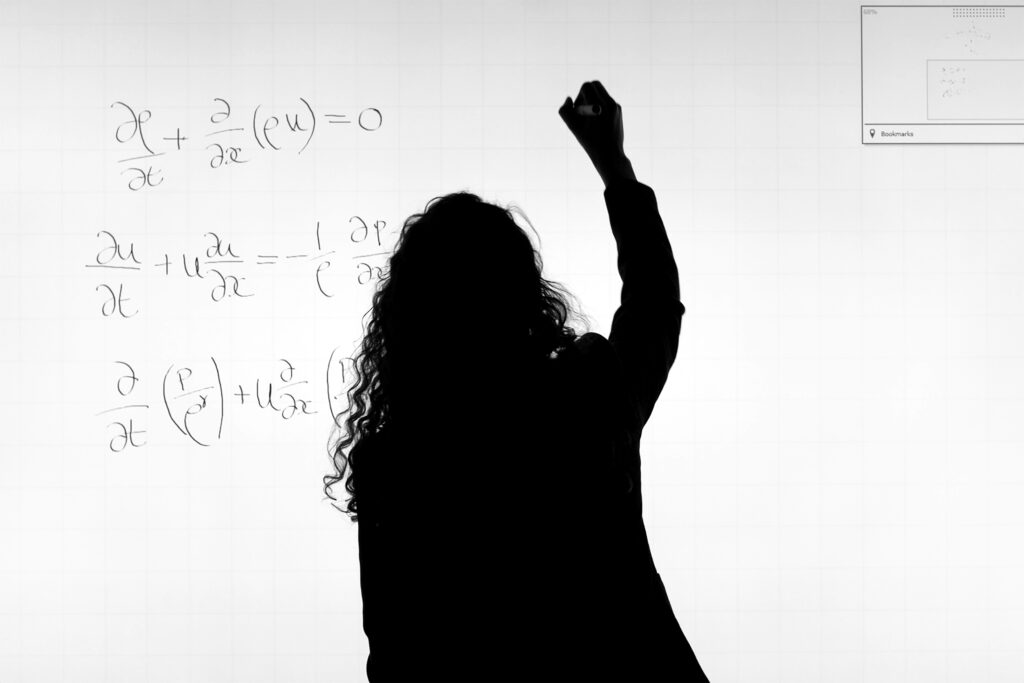

Wealth Management Guided by a Scientific Mindset

Saffron Capital was founded on the belief that data science combined with active risk management constitutes unique capabilities for investor value creation

Wealth Management Guided by a Scientific Mindset

Saffron Capital was founded on the belief that data science combined with active risk management constitute unique capabilities for investor value creation.

Bond Market Masterclass

Sponsored by Osher Lifelong Learning Institute / University of Minnesota

A class for people that seek a sound foundation in fixed income investing and analysis. Learn how to construct low-risk, fixed-maturity bond ladders for guaranteed income, while comparing ladders for different bond types. Go beyond corporate generated charts to define strategies so your income and capital are better protected.

Rigorous Planning, Opportunity and Risk Evaluations

As a fiduciary, we always keep top-of-mind that by investing in stocks, bonds, and index funds, you run the risk of losing money or losing buyer power if your investments do not keep pace with inflation. Count on us for risk-aware financial advisory.

Custom detailed cash flow models and planning tools let you run scenarios on the key drivers of your business, retirement, and estate plans.

Proprietary tailored planning products help your strategic tax and legal advisors to better support you and your beneficiaries.

Portfolios formulations match your specific return objectives, risk tolerance, and investment mandate for improved control.

Top-notch concierge services simplify your retirement and estate plan administration, account management, and compliance.

Model Portfolios for Adaptive ETF Trading

Saffron Capital offers innovative solutions in the areas of tactical asset allocations and risk management.

Our model portfolios seek to outperform market benchmarks in favorable market environments while providing systematic and real-time risk response in unfavorable market conditions.

The adaptive approach to investing responds to changes in the market risk regime. Our portfolios combine low-cost index investing with systematic and rules-based strategies for capital preservation.

Tactical Index Portfolio

Strategic Factor Portfolio

All Country Index Portfolio

An Invitation

It’s normal to feel hesitant when it comes to changing advisors or getting investment management advice and support.

Whatever is motivating you to reach out, we’re here to listen and help.

An enduring belief in data science and risk management

Brad Horn is the founder of Saffron Capital. His 30-year background in energy trading and infrastructure project investing sharpened his approach to portfolio management and risk control. Quantitative planning and investing are combined with personal advisory to reduce the stress of active wealth management.

An enduring belief in data science and risk management

Brad Horn is the founder of Saffron Capital. His 30-year background in energy trading and infrastructure project investing sharpened his approach to portfolio management and risk control. Quantitative planning and investing are combined with personal advisory to reduce the stress of active wealth management.