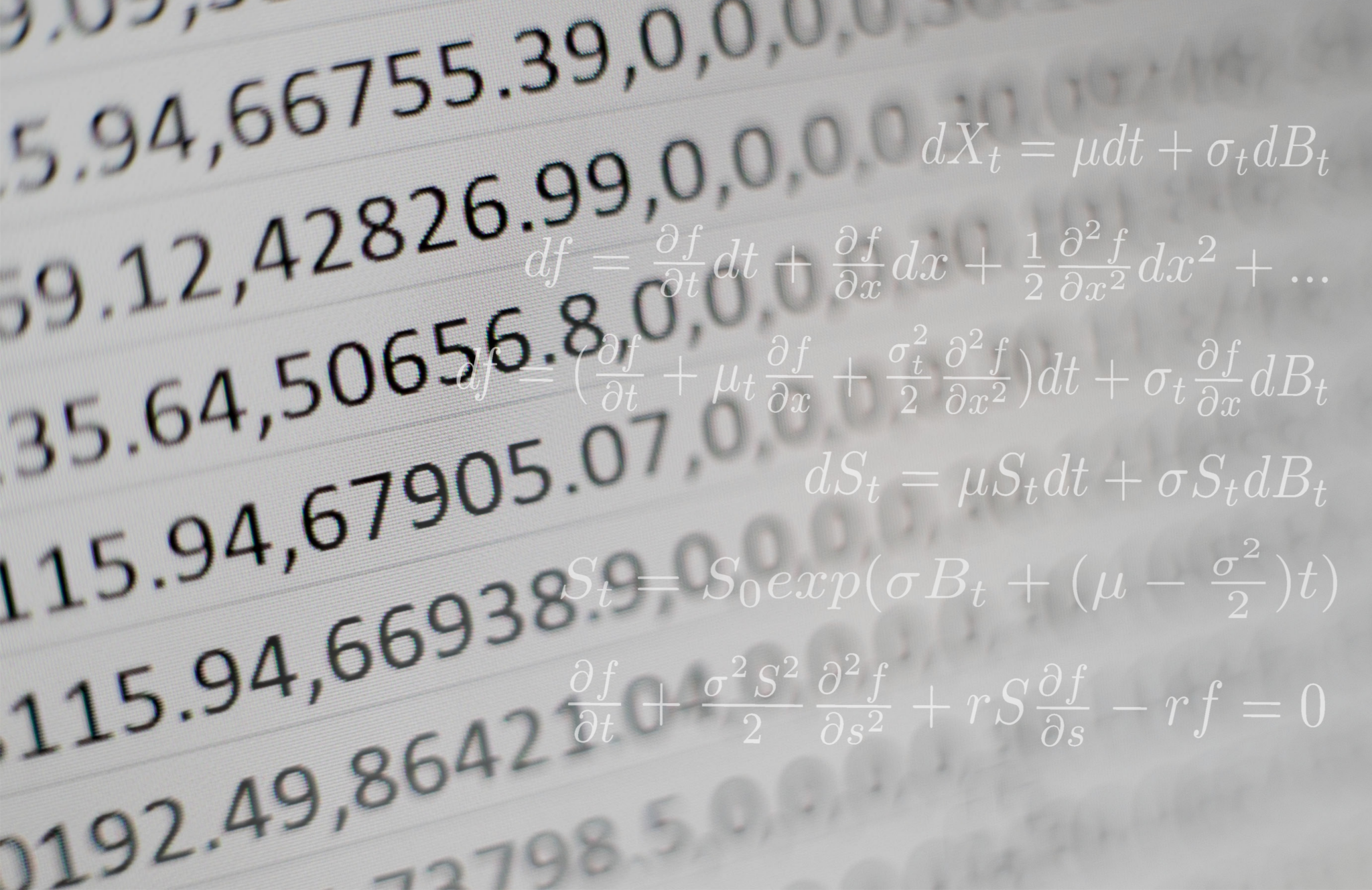

A Science-Based Approach to Wealth Management

We specialize in working with science, engineering, and technology professionals who are ready to explore how they want their retirement, investment, and estate plans to unfold.

A Science-based Approach to Wealth Management

We specialize in working with engineering, technology and science professionals who are ready to explore how they want their retirement, investment, and estate plans to unfold.

More Clarity, Less Stress

Saffron Capital offers financial planning and investment advisory services:

Comprehensive and scenario-based planning models are provided to support our clients and their strategic tax partners.

Portfolio management is based on custom formulations that take into consideration your investment objectives and risk tolerance.

A Focus to Bank on

We spend time where we believe we have the greatest advantage, namely on client’s strategic planning and investment needs:

Vision

To be a trusted advisor for our clients and a respected leader in the areas of tactical asset allocations and risk managed portfolios.

Mission

To help investors to achieve their financial goals by delivering superior performance at a reasonable cost through a systematic and repeatable planning and investment process.

Bradley Horn

Brad Horn is the founding principal and sole shareholder of Saffron Capital. For over 30 years, Brad has led strategic portfolio and investment initiatives, specializing in energy trading and infrastructure investing.

Brad’s career started at Lehman Brothers and his skills have been tested at the New York Mercantile Exchange and in leadership roles with top energy companies in North America, Europe, and the Middle East.

From 1993 to 2005, Brad managed energy infrastructure portfolios for the delivery of natural gas and electricity to retail end-users, including the city of New Orleans, eight cities in the U.S. Northeast, and over five million end-users in Northwest Europe. Employers included Koch Industries, Consolidated Natural Gas, and NV Nuon.

From 2006 to 2020, Brad managed investment due diligence and engineering design initiatives for the delivery of electric power plants based on renewable wind and solar resources. In total, his investment and M&A experience includes over fifty utility-scale power projects. Contract clients included NextEra Energy Resources and Qatar Petroleum.

Brad started Saffron Capital to devote his energy and attention full time to client investing and risk management. He believes he can deliver the most value to clients by providing a science-based approach to markets and wealth management combined with personal advisory to reduce the stress of active financial management.

Brad holds an MS degree in Economics and Operations Research from the Colorado School of Mines and a BA degree in Economics from Bates College.

Professional qualifications include a Series 65 license and conduct in good standing with the Financial Industry Regulatory Authority (FINRA) and the Minnesota Department of Commerce, where Saffron Capital is a Registered Investment Advisor (RIA). Brad also has a Series 3 license administered by the National Futures Association (NFA), where Saffron Capital is registered in good standing as a Commodity Trading Advisor (CTA). Finally, Brad is a member of the CFA Institute.