Capital Preservation

Risk Control is at the

Heart of Our Approach

Saffron Capital applies a systematic approach for adaptive investing. The approach combines low-cost index investing with rules-based technology for the active management of market risk. This lets our clients benefit from the upside potential that markets offer, while mitigating the painful losses that impact wealth and planning confidence in market downturns.

When managing accounts, we use several risk controls, including:

- Client risk appetite profiles and customized risk control plans

- Portfolio re-balancing given changes in the market risk regime

- Saffron WealthLock and real-time risk response

Build a Safety Net

As part of the investment planning process, you benefit from structured dialogue on risk to benchmark your risk appetite and to better inform your investment plans.

We use a simple survey to profile client risk preferences. The result helps us to determine what kind of investor you are and the level of portfolio risk we need to manage to.

Risk profiling also allows us to propose risk control plans. Client-advisor alignment on risk response ensures clear expectations and is key to building an effective safety net. In general, investors who are better prepared tend to be more risk aware and, as a result, are more confident when making portfolio decisions.

Market Risk Assessment

Market risk assessment plays a critical role in portfolio construction and re-balancing. Every day starts with a simple question: “Is it a healthy market to invest into?”

We study and integrate a wide range of economic, market and technical indicators to characterize the market risk regime and to guide “risk on/risk off” investment decisions.

- Risk On — In the “risk-on” state, your managed accounts are overweight with risky assets that align to client investment and risk goals.

- Risk Off – In the risk-off state, your portfolio is overweight with cash, money market accounts, and short-term bonds to mitigate client exposure to market losses and long duration drawdowns.

Our assessment of the market risk regime does not rely on a market forecast. Nor is it based on the belief we can ‘beat the market’ and time market price reversals. Instead, regime classification uses leading economic indicators and observed value, momentum and volatility data to guide portfolio re-balancing and risk response.

Saffron WealthLock

Saffron WealthLock is a personalized wealth protection system for defensive risk response.

WealthLock enables capital preservation by helping you to set risk limits in advance for ‘stop-loss’ protection. The system monitors activity in each of your financial accounts to provide you with total visibility to changes in your overall net worth.

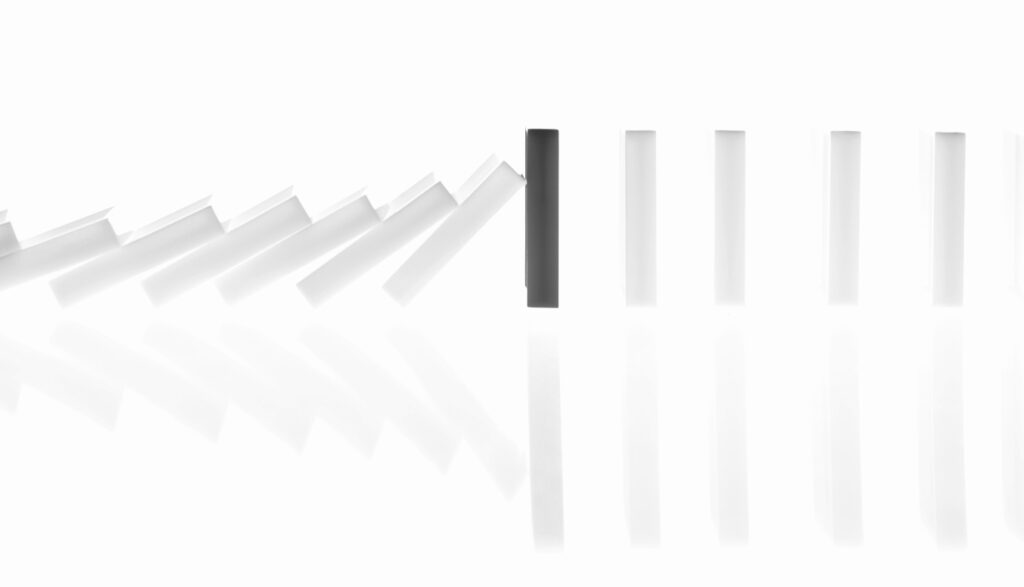

The system is reactive because it works to alert you and your advisors to market conditions when your total net worth hits your WealthLock limit. WealthLock integrated with Saffron risk response aims to function like a ‘barrier control’ which triggers action to protect your assets and portfolio.

While market risk can never be eliminated, it can be managed and mitigated. WealthLock and risk response is one of several layers of defense we provide for improved planning confidence.