Risk Disclosure

The Financial Market Outlook represents my personal views. At the time of this writing, I own the following portfolios or shares mentioned in the report: XLF, XLC, XLE, XLRE, XLB, IVE, IJR, IJW, PSCE, EZU, EDEN, INDA, MCHI, TMUS, JPM, GS, BLK, V, IBKR, CVX, COP, XOM, PVAC, BKR, ENPH, NEE, FCX, NUE, CLF, NET, BSX, ABT, VRTX, LHX, MSFT, NET, NFLX, GLW, WMT, BUD, TAP, SFM, CLX, CVS, LHA,. Prior to publication, this report was shared with private clients from whom I receive compensation. They too may own shares mentioned in this report.

Blog posts are not a solicitation to buy or to sell any securities. Solicitations are only made in person and subject to an advisory contract in place which takes into account the investor’s full spectrum goals, assets, investment policy and tax strategy.

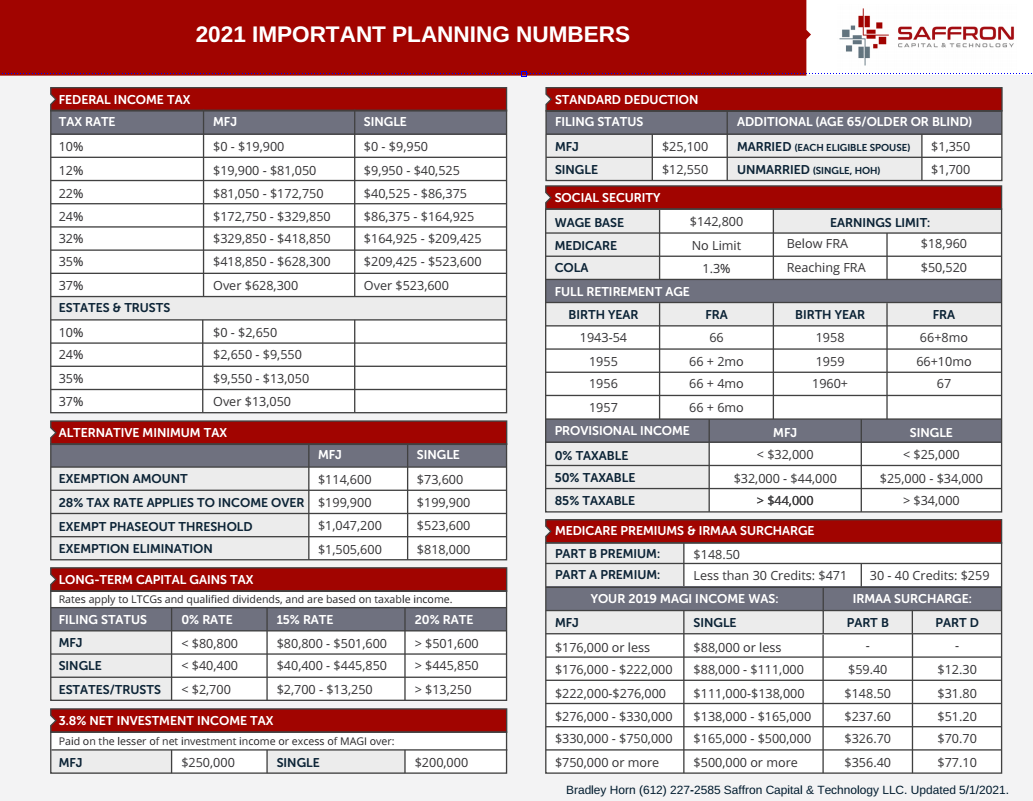

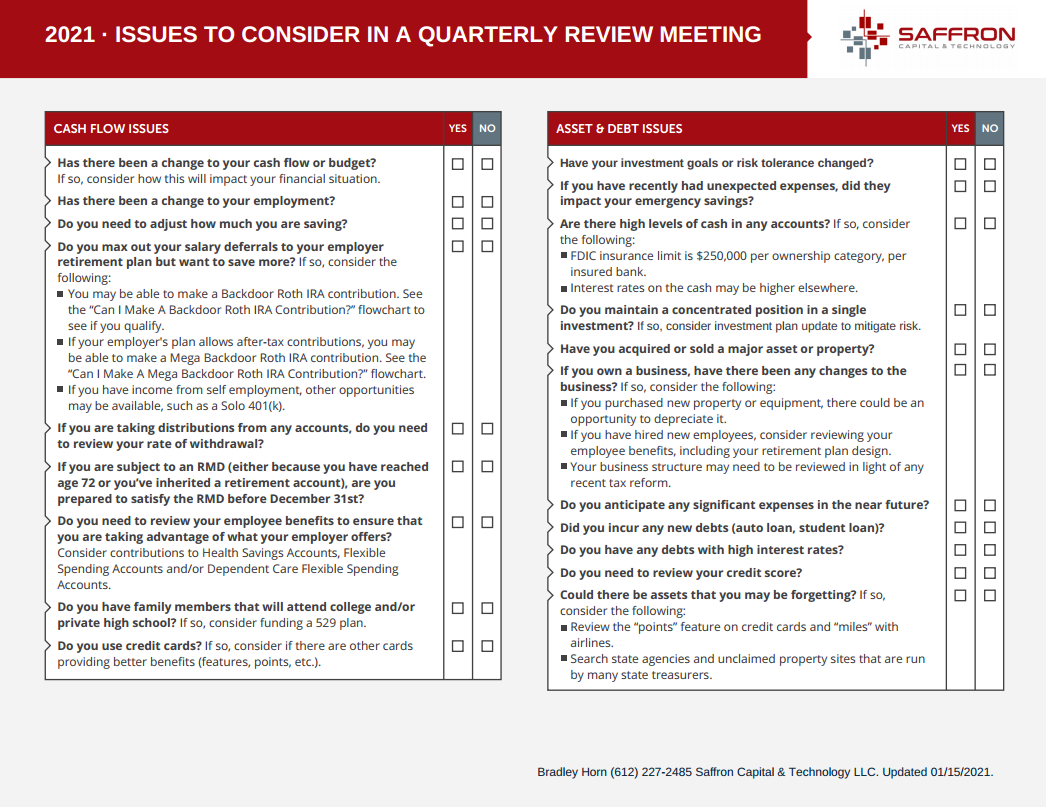

This report does not provide financial planning or tax advice. It is the reader’s responsibility to consult with a financial planner, investment advisor or tax professional before undertaking any investment.

Out of necessity, the report relies on economic surveys, forecasts or projections. Future projections are an important and valid tool for input into investment decisions. However, economic or market projections do not reflect actual knowledge of the future. Future projections, like past performance results, are no guarantee of future investment results or cash flows.

Investments in stocks, bonds, mutual funds, exchange traded funds and other securities may be risky and may be subject to loss of equity or principal.

Comments or questions regarding this report? You can contact me here.