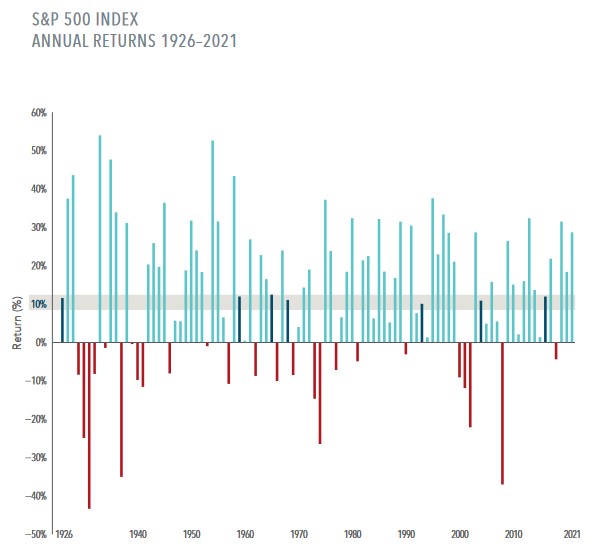

The Bumpy Road to Average Returns

May 19, 2022

Commitment of Traders Report 2022.06.28

June 29, 2022Major Asset Classes

May 2022

Performance Comparison

Introduction

May returns benefited from ‘spike lows’ in several asset markets, setting the stage for relief rallies over the second half of the month. Performance across US equity indexes was mixed with several sectors posting notable gains. Developed markets also posted positive gains and strength was also evident in emerging markets , notably South America. Government and corporate bonds also attracted sizable buying mid-month, pausing the rise in yields as traders shifted attention from inflation to the potential for recession. Meanwhile, the red hot commodity markets continued to inflate, while the the US Dollar traded off its highs.

The following analysis provides a visual record of returns for May 2022 across and within the major asset classes. The purpose is to help investors to benchmark their portfolio performance.

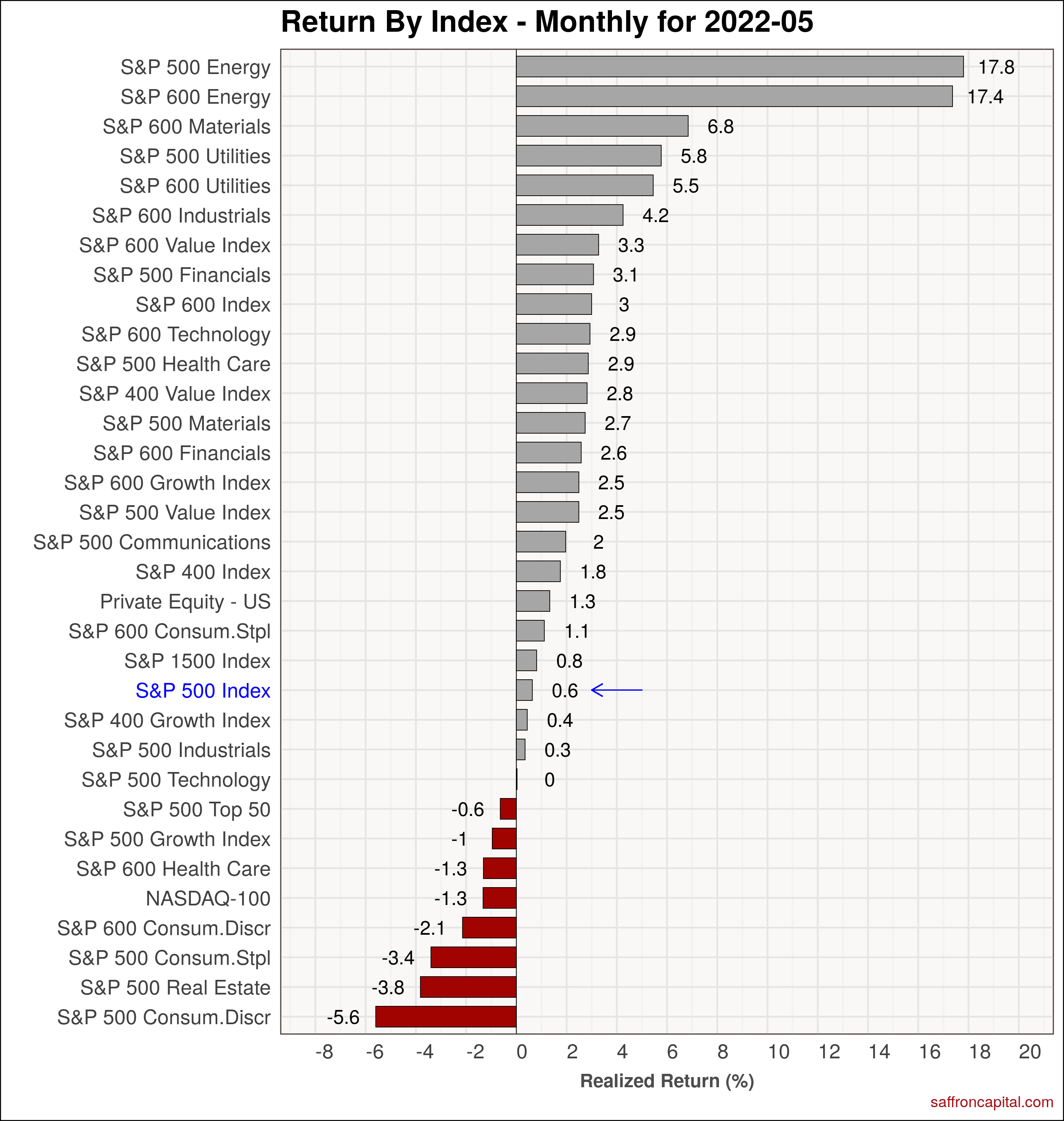

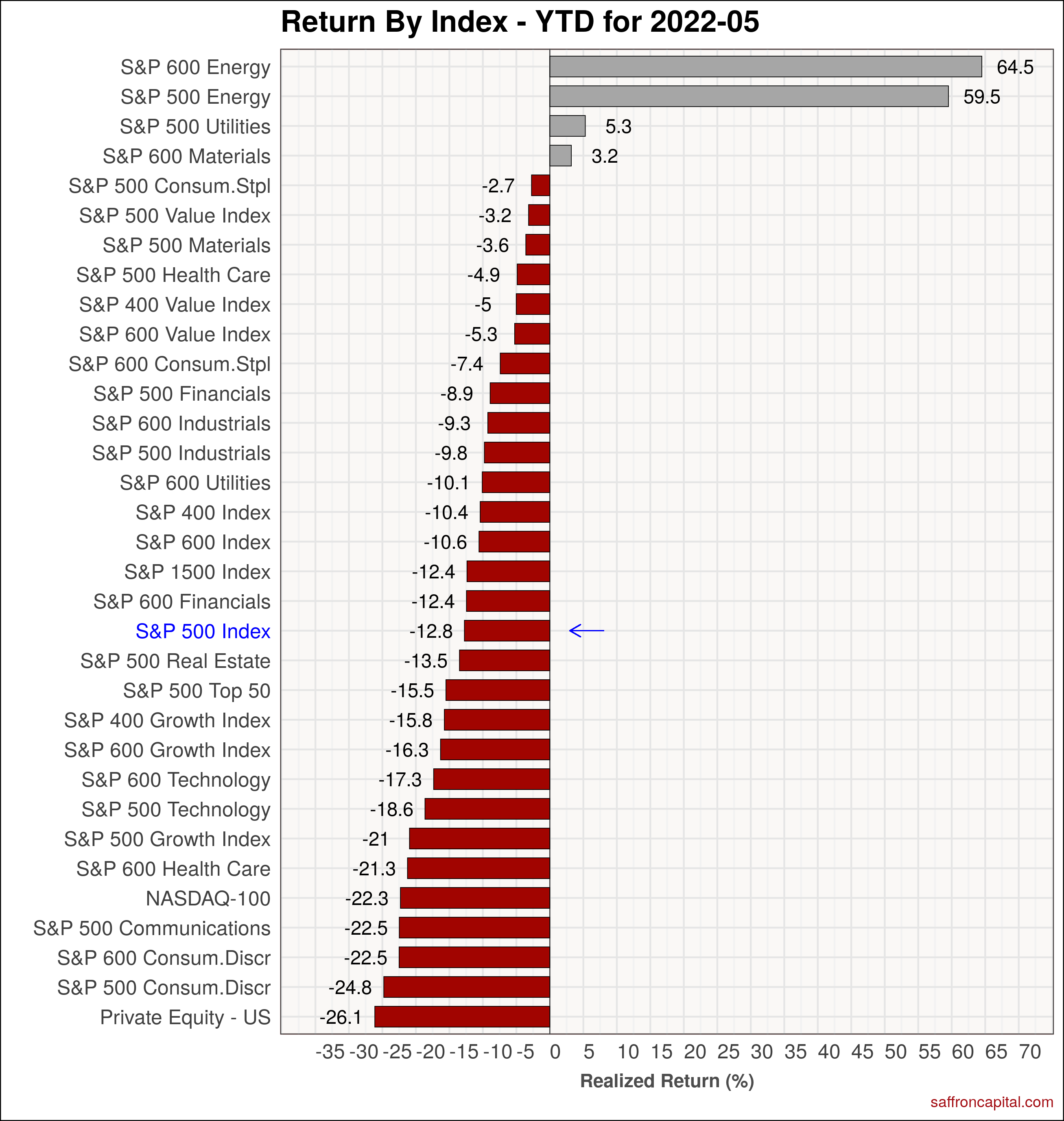

US Equities

May returns for the benchmark S&P 500 index (+0.6) were modest, but easily outperformed the NASDAQ index (-1.3%). The small cap S&P 600 Index (+3.0%) had solid gains, as did the S&P 500 value index (+2.5%). At the sector level, both large and small cap energy stocks (+17.8% and 17.4%) topped the charts. Sector weakness was evident in Consumer Discretionary stocks (-5.6%), Real Estate (-3.8% and Consumer Staples (-3.4%). Year-to-date (YTD), the S&P 500 index (-12.8%) continues to outperform the NASDAQ (-22.3%) and growth stocks (-21.0%). Among large cap stocks, the best safe havens have proven to be Energy (+64.5%), Utilities (+5.3%) and Consumer Staples (-2.7%).

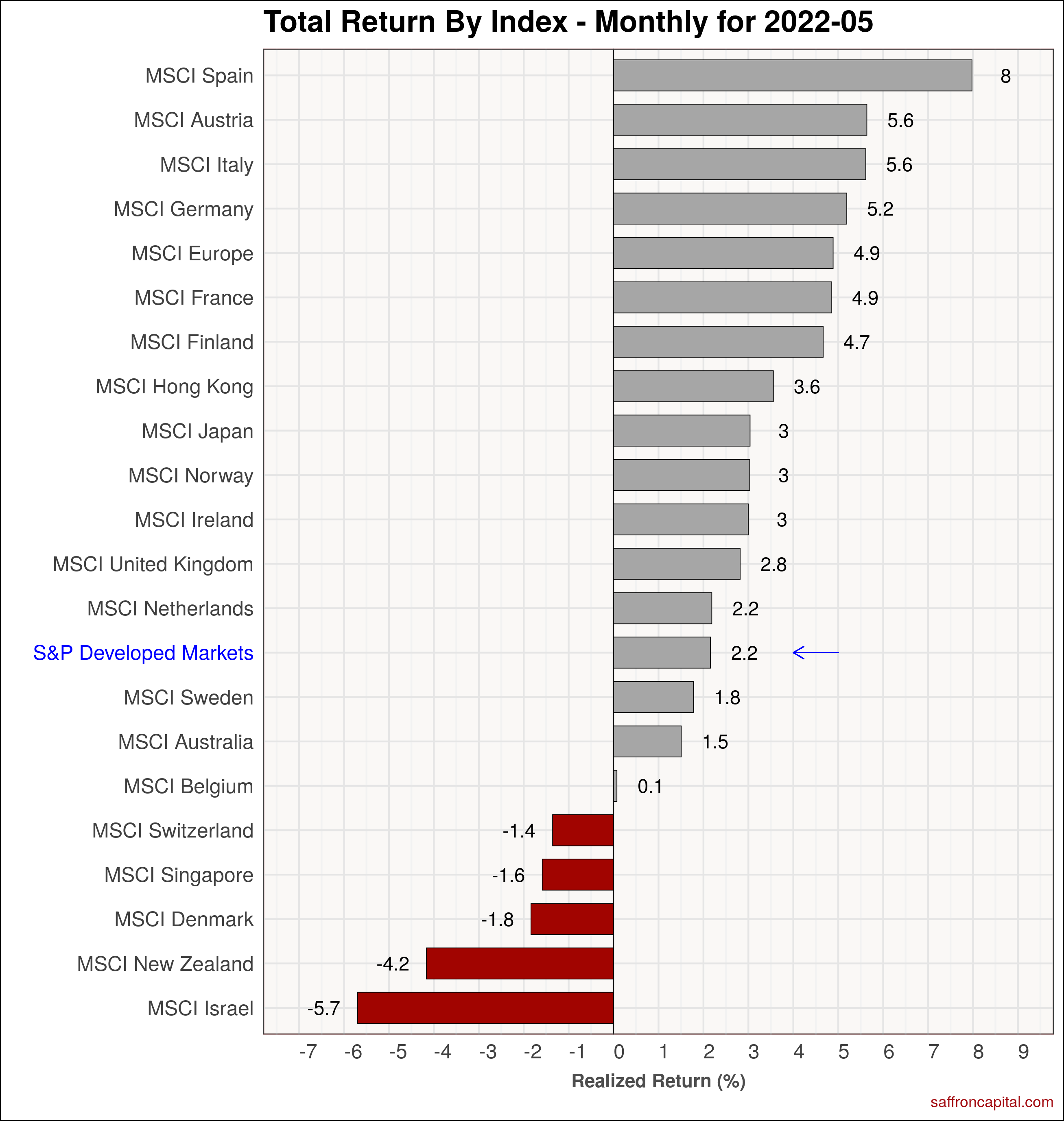

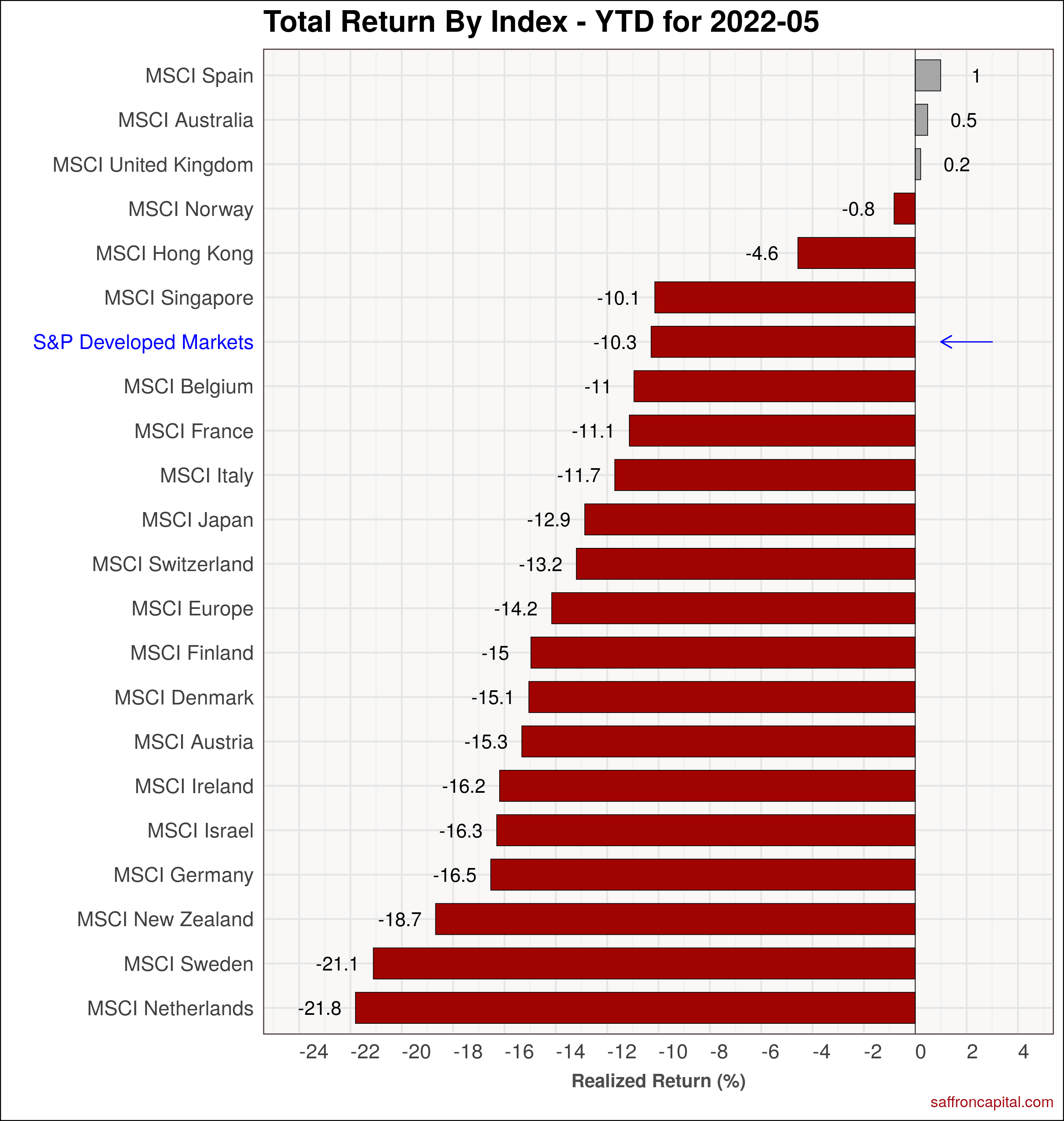

Developed Market Equities

Elsewhere, equity markets for the developed economies were positive. The S&P Developed Markets index (+2.2%) outperformed the S&P 500 index by 160 basis points (bps), the second month in a row. European markets topped the chart, with Spain (+8.0%), Austria (+5.6%) and Italy (+5.6) all showing strong gains. Meanwhile, on a year-to-date basis, the Developed Market index (-10.3%) is beating the S&P 500 index by 250 basis points. The best markets in the category include Spain (+1%), Australia (+0.5%), and the United Kingdom (+0.2%).

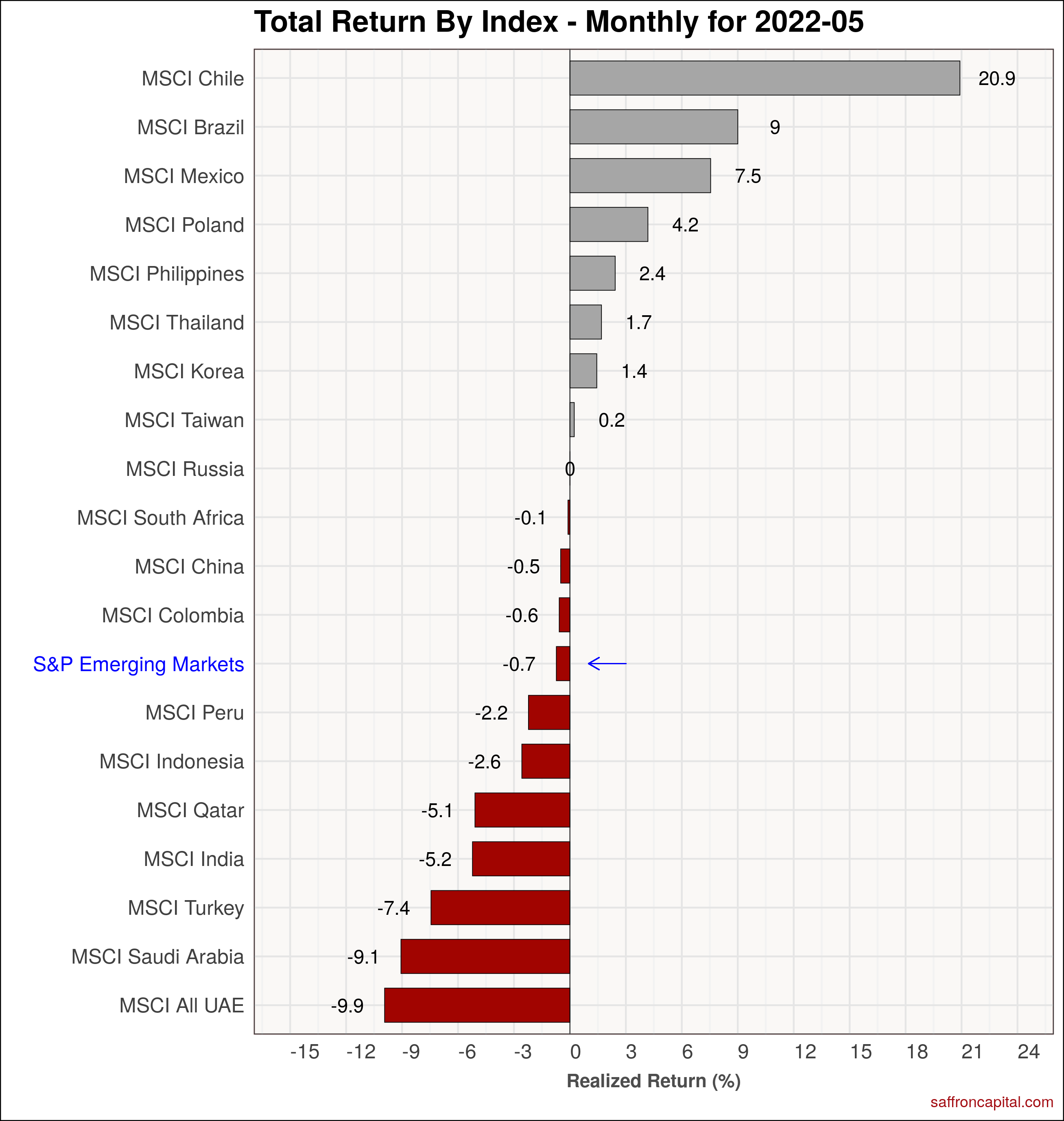

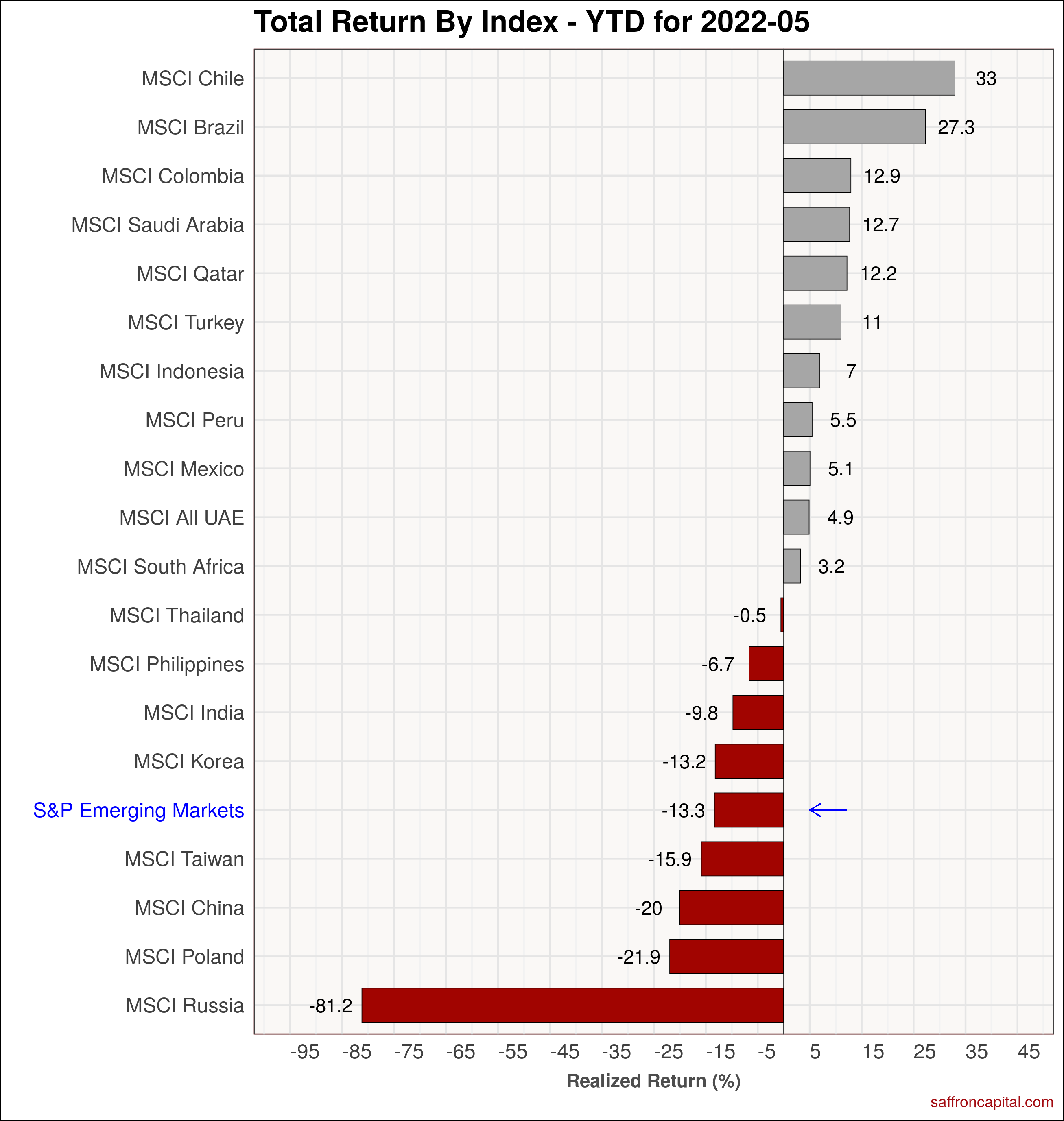

Emerging Market Equities

Emerging market were mixed in May and the S&P Emerging Markets Index (-0.7%) was down slightly. Chile (+20.9%), Brazil (+9.0%) and Mexico (+7.5%) all had strong gains. Resource rich economies lagged the EM index, notably the UAE (-9.9%) and Saudi Arabia (9.1%), both of which ended a multi-month up trend. On a year to date basis, The S&P Emerging Market index (-13.3%) is now lagging the US market thanks to sharp declines in Russia and Eastern Europe. Notwithstanding, several markets have had stellar years, notably the South American and resource rich economies. NOTE: values for the Russian stock market have not been updated since March 2022 when the market closed.

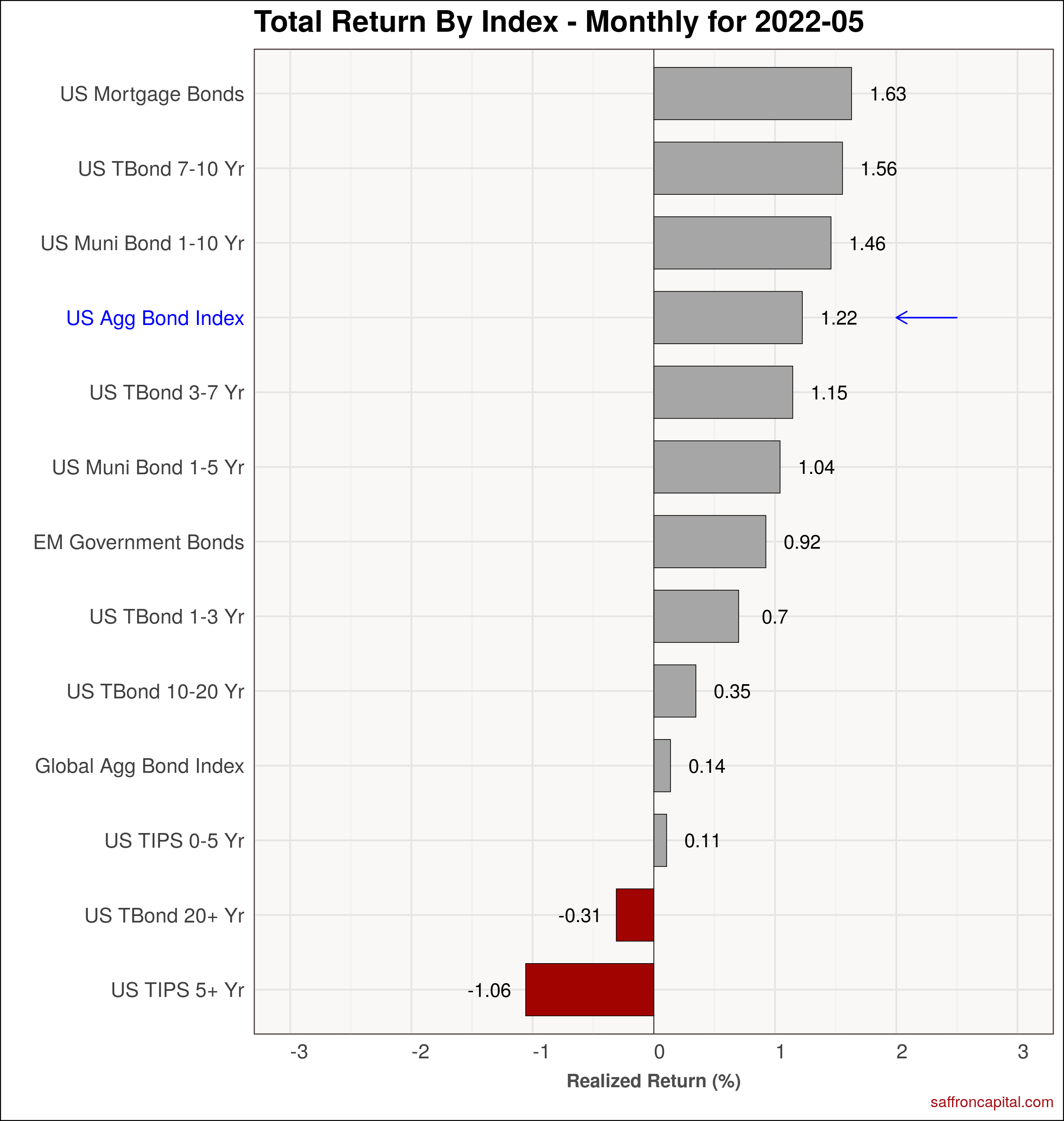

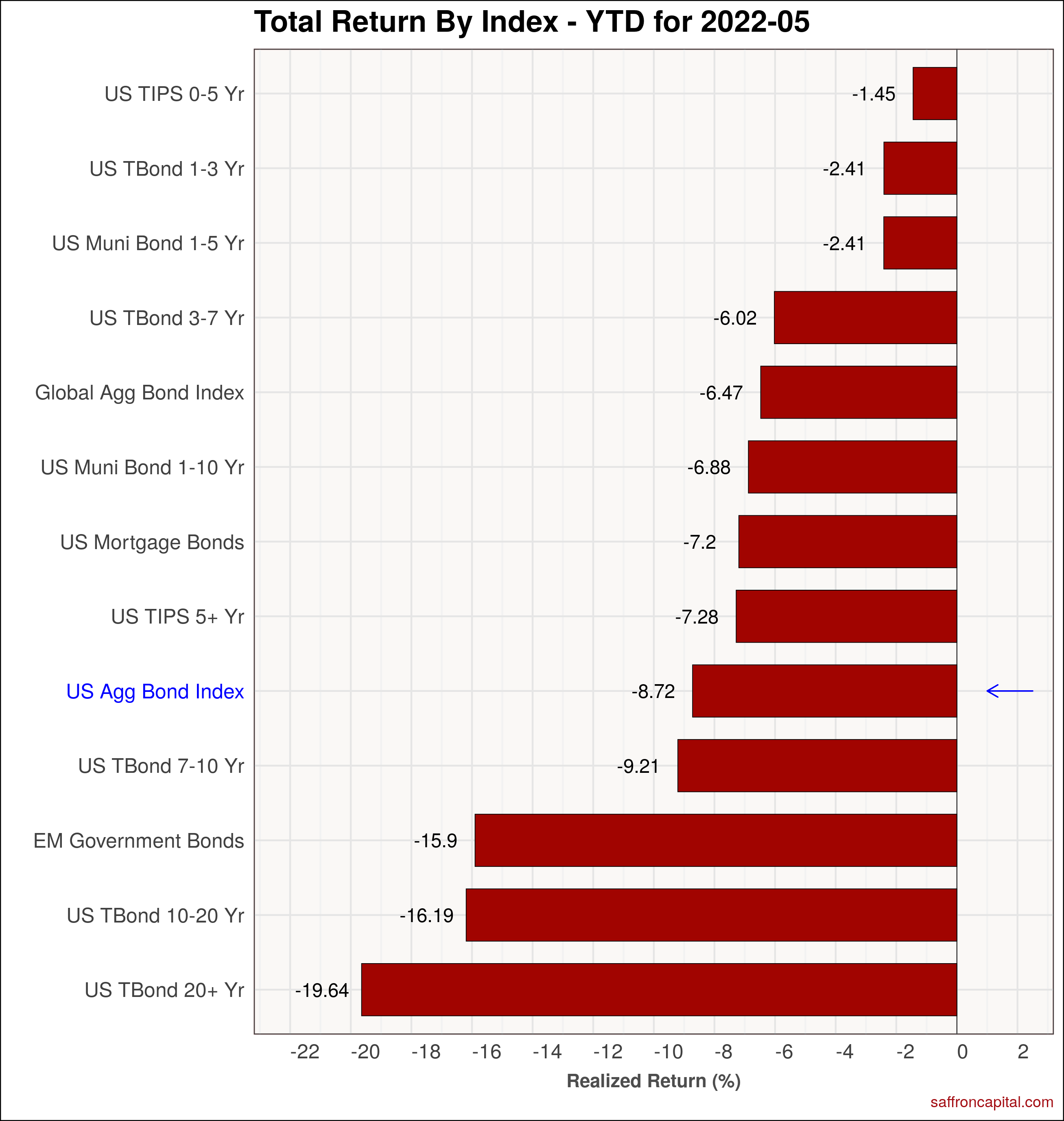

Government Bonds

Government bonds rallied in May as ‘peak Fed, peak inflation’ sentiment helped to divert attention from inflation to the potential for recession. The short-covering bounce in US bonds lifted the US Agg Bond Index (+1.22%), while the Global Aggregate Bond Index (+0.14) lagged US markets, owing to delayed efforts to raise interest rates in many countries. On a year-to-date basis, US treasury bonds maturing in 20+ years (-19.64%) and 10-20 years (-20.52%) are down significantly. CFTC Commitments of Traders data confirms that leveraged funds are rebuilding their short bond positions.

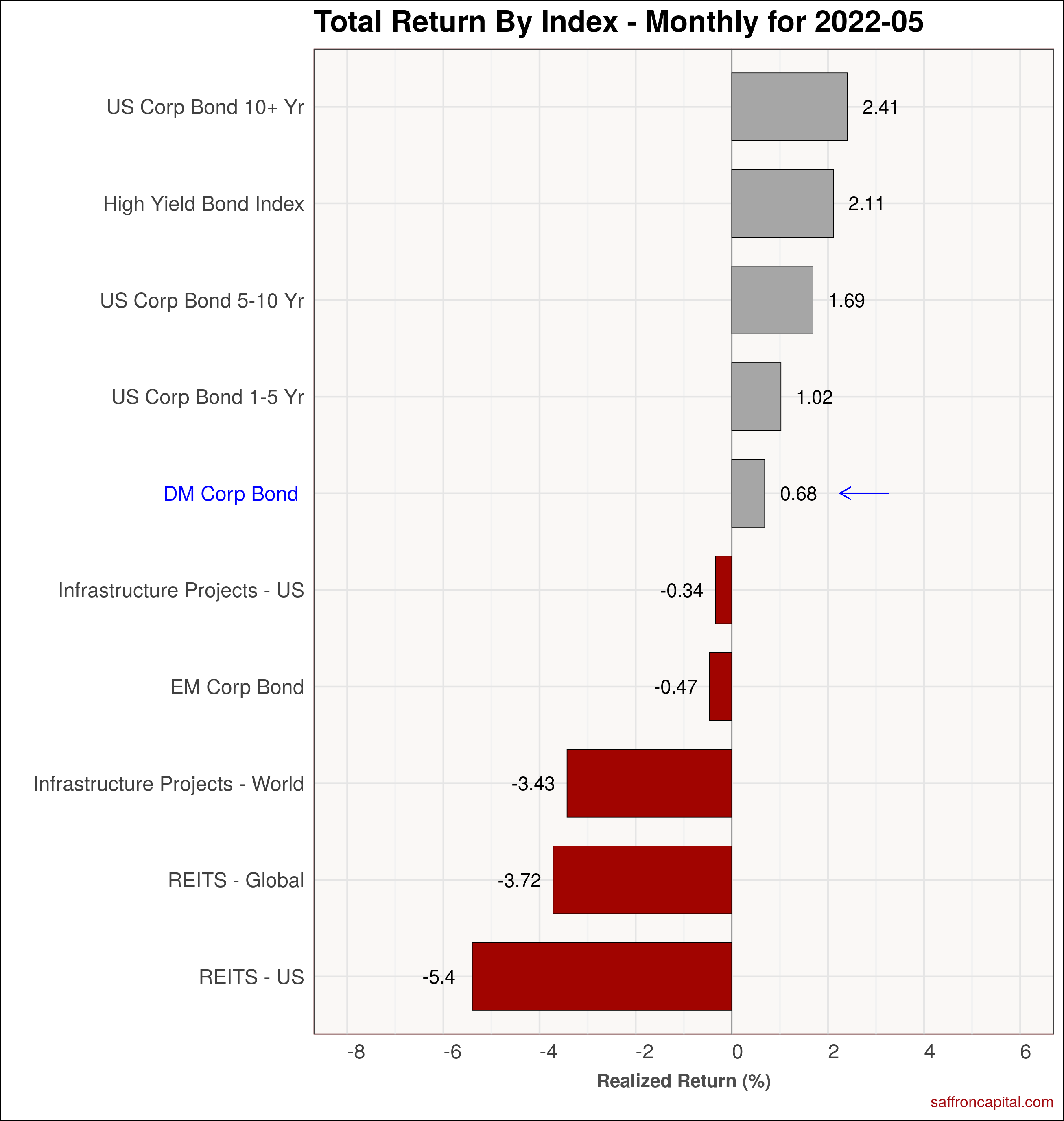

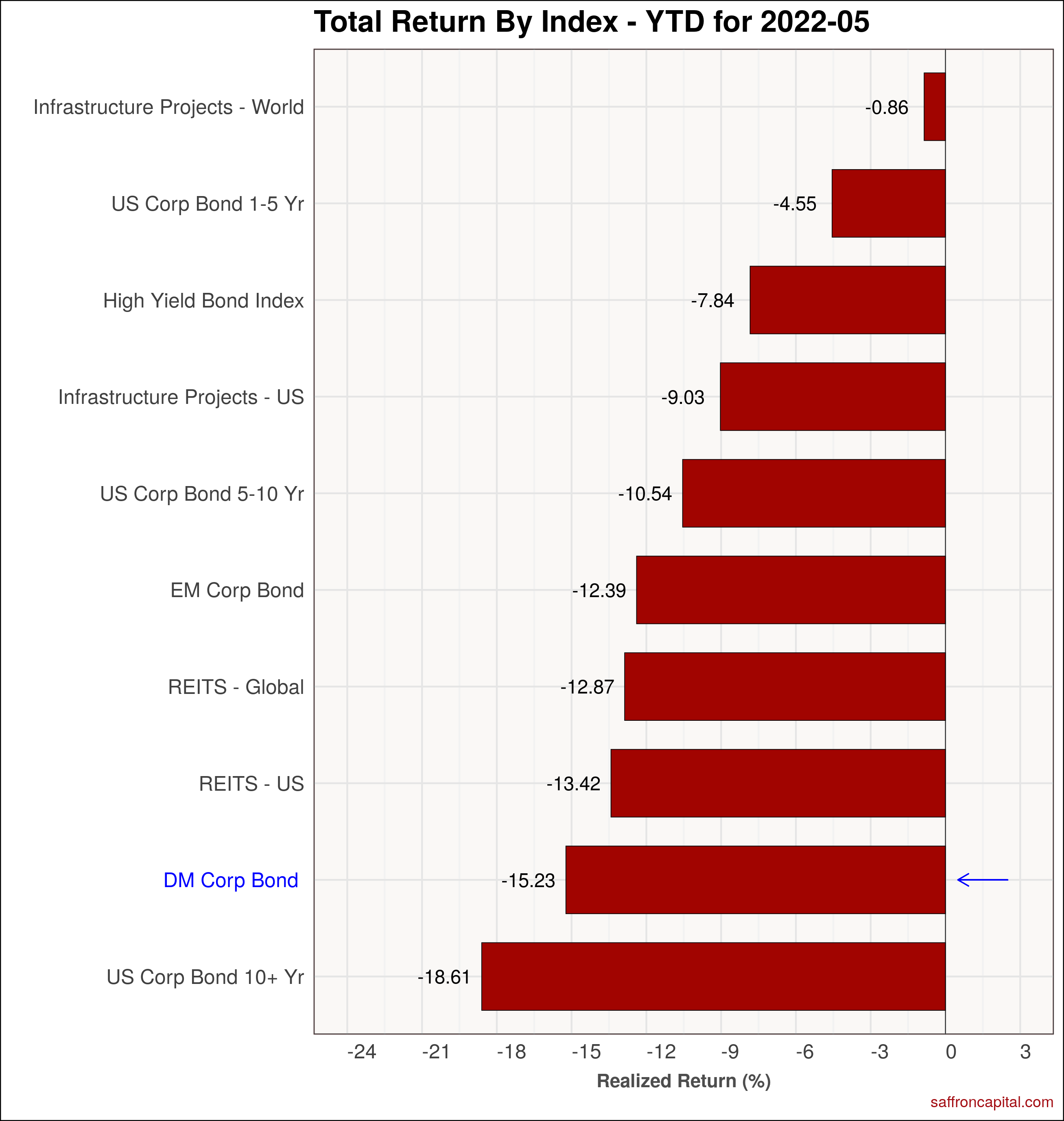

Corporate & Infrastructure Bonds

Corporate and high-yield junk bonds also rose in value in May. In the middle of the yield curve, the benchmark US Corp Bond 5 -10 Year index (+1.69%) outperformed the S&P 500 index and US treasuries of the same maturity. US and global infrastructure project bonds (-0.34% and -3.43%) had negative returns, but rallied at month end. May returns for real-estate investment trusts (-5.4%) were hard hit on news that consumer staples firms will be liquidating properties. YTD returns all remain negative with he Developed Market Corporate Bond Index (-15.23%) outperforming long dated US corporate bonds (-18.61%).

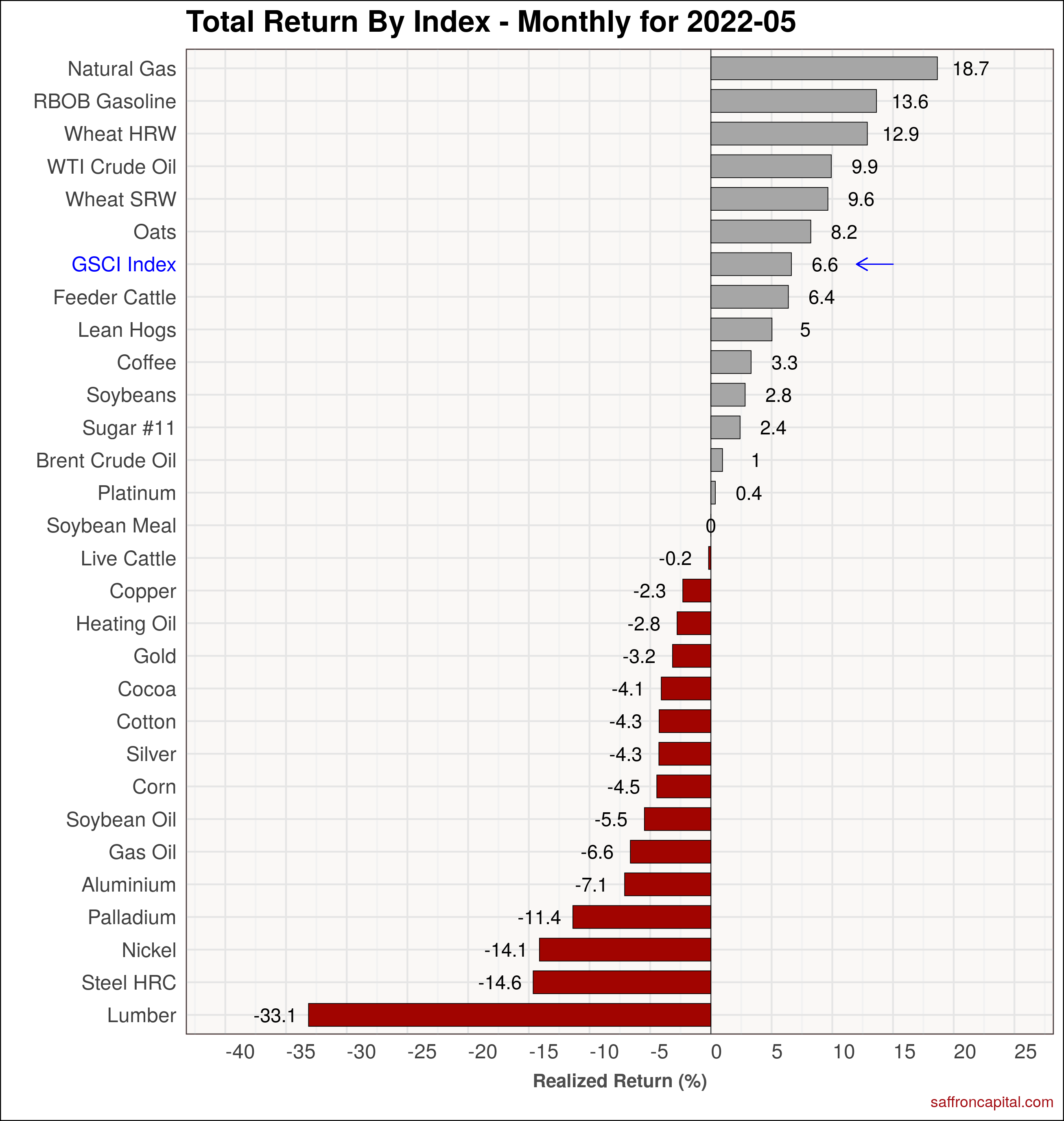

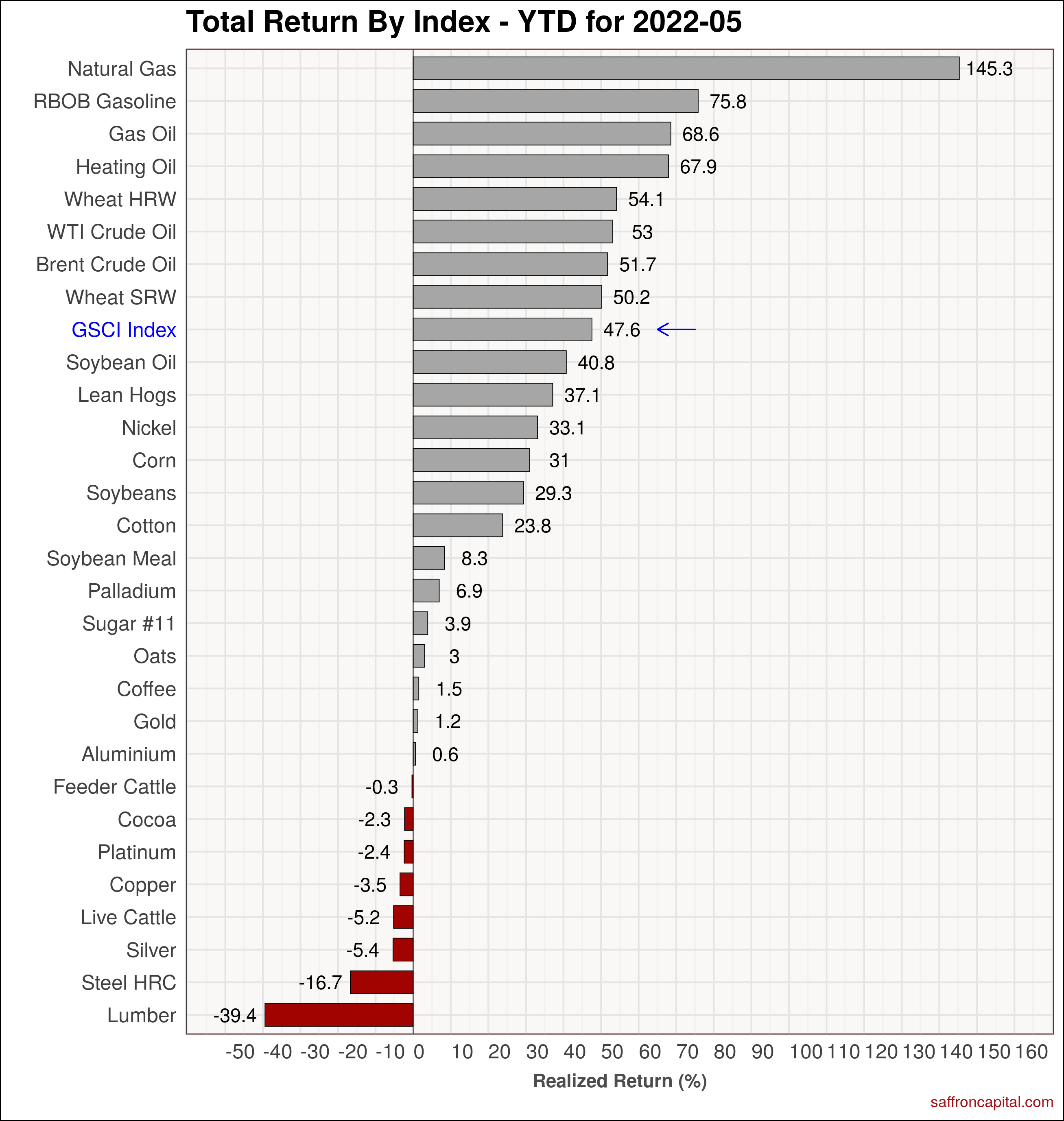

Commodities

May commodity market returns were again dominated by energy and food. Top performers included Natural Gas (+18.7%) Gasoline (+13.6%) and Hard Red Winter Wheat (12.9%). Market laggards included lumber (-33.1%), Hot Rolled Coil Steel (-14.6%), and Nickel (-14.1%). The diversified commodity funds linked to the GSCI Index (+6.6%) easily outperformed US equities. This is also true on a year-to-date basis where the index is up 47.6%

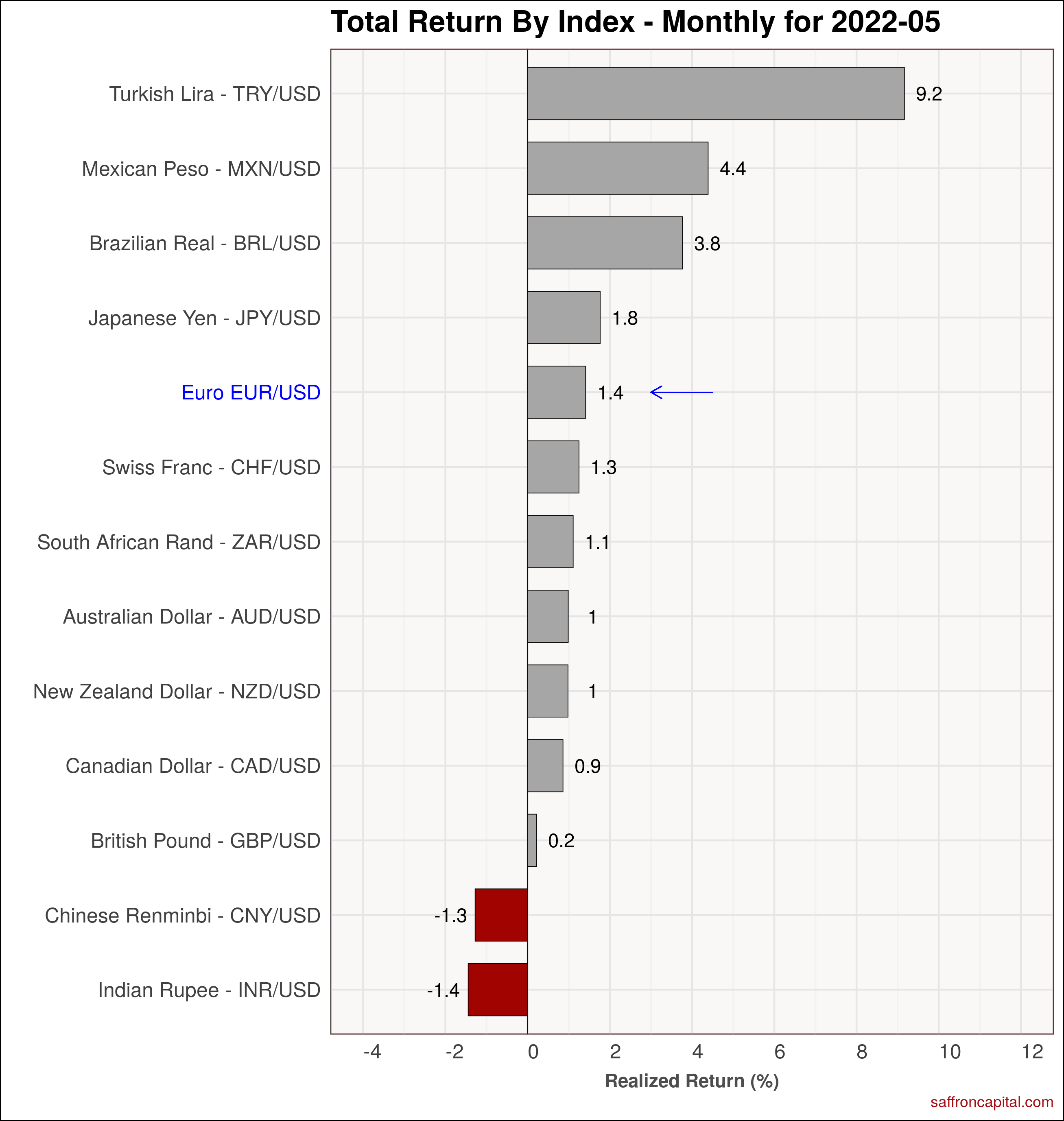

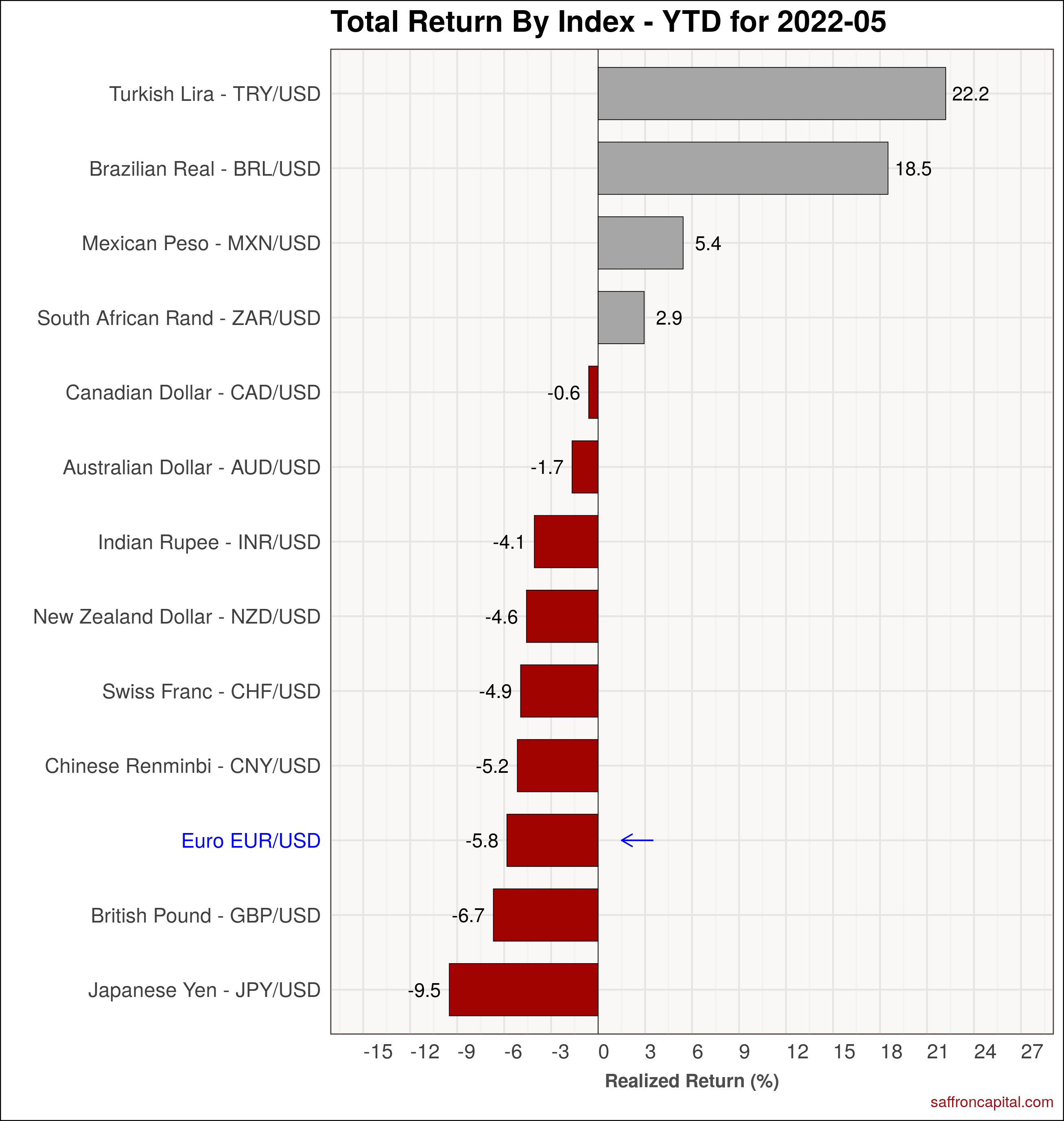

Currencies

The US Dollar declined in May, positively impacting most currencies, with the exception of the Indian Rupee (-1.4%) and the Chinese Renminbi (-1.3%). Since January, the Yen (-9.5%) has fallen the most, followed by Pound Sterling (-6.7%) and the Yuan (-5.8%).

Have questions about your portfolio? Looking for active risk management to secure your financial future? Contact us here.