7 Signs It’s Time To Hire a Financial Advisor

September 8, 2023

3Q.2023 Earnings Update – S&P 500

September 11, 2023Roth 401K vs. Traditional 401K

The Roth 401K was built on a simple idea: Save today and get a tax break tomorrow. This is the inverse of the traditional 401K, where workers set aside money to save for tomorrow and they get a tax break today.

The Roth 401K is a relatively new retirement tool and it is closely related to the traditional 401K. The Roth version is funded with after-tax money that grow tax-free in the years after. In many ways, it is like the Roth IRA, but with the potential of allowing workers to save significantly more and to still get a company match while they are employed.

Thousands of companies now offer the Roth 401K in their retirement plans. The objective: Give workers more flexibility in retirement saving. in order to have more spending money and lighter tax burdens in old age.

Roth accounts aren’t the best choice for everyone. For example, its not always clear cut to decide how much money should go into a Roth 401K versus a traditional 401K. Good planning requires knowing your expense budget, future taxable income, life expectancy. and other factors, some of which are not known with certainty. The decisions can leave even savvy investors a bit overwhelmed.

Benefits of the Roth 401K

First, the Roth 401K creates the opportunity to reduce lifetime tax bills and to leave more money for retirement or heirs. For example, the money coming out of Roth accounts is tax-free. Hence, it can be used to supplement taxable income during later years when retirees might otherwise be pushed into a higher tax bracket.

Second, starting in 2024, the Roth 401K will be exempt from the required minimum distributions. this is a clear advantage compared to traditional 401Ks and other individual retirement accounts (IRAs). That means the Roth accounts can be left intact for your heirs, who don’t have to pay tax on the distributions either. However, beneficiaries must drain the account within 10 years of inheritance.

Eligibility

Roth 401Ks are open to all employees across the income spectrum, including high earners who are barred from contributing to Roth IRAs. But not everyone should contribute to a Roth.

The classic Roth candidates are those who are convinced their tax rates will be higher in retirement than they are now. This profile fits many younger workers with decades of pay raises ahead of them.

For mid-career workers, it can be harder to predict whether their tax rates will be higher or lower in retirement. Some sources of retirement income provide estimates of future

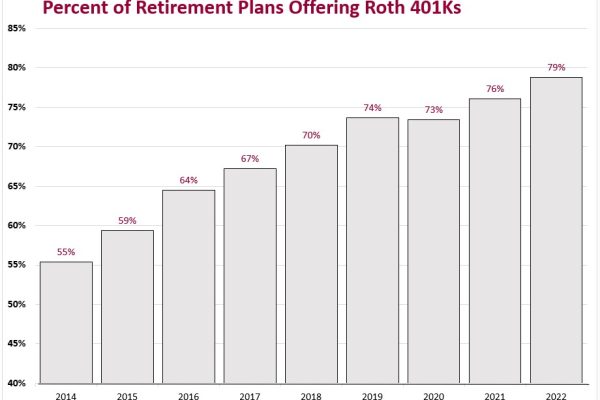

benefits, such as Social Security. However, it is still impossible to predict future income from retirement accounts since returns on savings are highly uncertain. Moreover, some people will work in retirement or move to an income tax-free state which could change the justification for investing in a Roth 401K today. For these reasons, only 17% of workers made made contributions to a Roth 401K last year, even though 79% of Retirement plans offer Roth 401Ks, according to Vanguard Group.

When to do a Roth 401K

To decide whether to contribute to a traditional or Roth 401K (or both), compare your current tax rate and the rate you expect to pay in retirement.

The math favors the Roth for many younger workers, because future tax rates will be higher as they climb to new tax brackets over time.

For example, take the hypothetical couple Jane and Jack Flash. Jack, age 32, and his wife contribute to Roth 401Ks. They are paying a 22% tax on the money before it goes into their Roth accounts, but Jack and Jane both figure that that their incomes will rise in coming decades, subjecting them to higher tax rates in retirement.

Furthermore, Jack confirms that chose to have his employer funnels his matching contributions into a traditional 401K. His thinking is sound: As the couple’s tax bracket rises, he plans to shift more of his Roth 401K contributions into his traditional 401K account since it will make sense to secure upfront tax breaks today, rather than tomorrow. For now, “the more we can get into a Roth after paying a low tax rate, the better off we’ll be in the future,” he said.

David Brown, associate finance professor at the University of Arizona, said that once a person moves out of the 12% tax bracket, his research indicates it is best to start dividing savings between a Roth and a traditional account.

The rule of thumb that he recommends is to add 20 to your age and put that percentage of the money you are saving for retirement into a traditional 401K, with the rest in a Roth.

When to stick with traditional 401K

A traditional 401K is often the better choice for workers in their peak earning years.

For example, I recently met with a client in the top 37% tax bracket and he was considering Roth 401K contributions. While the client currently earns more than $400,000 this year, his income is likely to drop to $125,000 in retirement, leaving him in a much lower tax bracket late in life. Asa result, it made sense to take the tax break now by contributing as much as possible to a traditional 401K.

Peak-earning workers should also look for other ways to get money into traditional IRAs before they move into a lower tax rate.

When to divide your contributions

Given the planning uncertainties regarding future tax rates, it makes sense to put a portion of 401K savings into a Roth. This will help savers to hedge their bets if they aren’t sure what their future tax rates will be. For example, it helps even to have 10% of your annual savings go into a Roth. Roth money can supplement taxable income in years in which retirees would otherwise be pushed into a higher tax bracket or face higher Medicare premiums.

Finally, Congress will soon require older, higher-earning workers to put at least some money into a Roth 401(k). A law that goes into effect in 2026 means people ages 50 and older with salaries above $145,000 have to funnel any extra savings above the the 401K contribution limit of $22,500 into a Roth. So soon, high-earners who want to maximize savings will be relying on the Roth 401K even more.

Do you more questions on how to maximize savings or how to enjoy and afford retirement? For a free consultation, you can schedule time with me here.