Download – REIT Masterclass

October 10, 2024

November 2024 Returns and Asset Performance

December 3, 2024Medicare 2025 – Key Changes and Demographics

Today is the beginning of the 2025 open enrollment for Medicare.

In response, I share a recent article from the Wall Street Journal. The article is noteworthy as it reveals new challenges tied to the annual contracting process for Medicare Advantage (MA) programs. The simple summary:

- In 2025, MA programs will give with one hand (e.g., lower premiums), but they will take with the other (e.g. new and higher out-of-pocket costs). The net result is an increase in overall costs.

- It is also notable that more hospitals are beginning to leave MA provider networks given increased conflicts with the insurance providers over cost compensation and care strategies.

Prior Growth Trends

After reading the article, I wanted to confirm a personal hypothesis that change is being shaped by demographics. Sure enough, the past marketing success of MA programs is now starting to hurt the private insurance providers. Let’s look at the data.

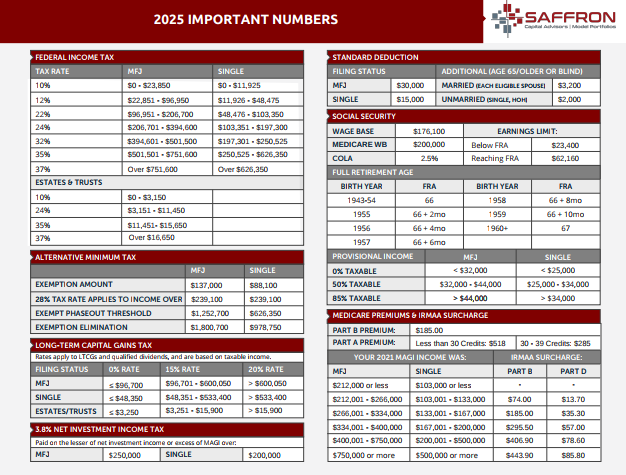

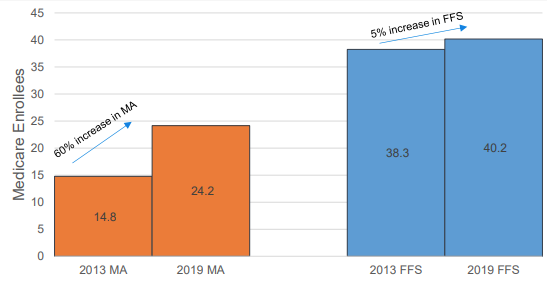

The first chart shows that MA programs were the preferred choice over Fee-For-Service (FFS) MediGap plans over the last 10 years. Fast growth in MA programs (60%) was a function of having a smaller base of customers, but also due to aggressive marketing campaigns and broker incentives that the government refused to match. As a result, the fee-for-service Medigap plans grew more slowly (5%)

Demographics of Medicare Advantage vs Fee-For-Service MediGap

10 years later, the rapid growth of Medicare Advantage programs has skewed the demographics and is now proving costly for the insurance companies.

For example, the chart below shows that the oldest and the most vulnerable now dominate Medicare Advantage. In response, the private insurers are getting more aggressive about reducing their exposure in the annual contracting process. Also note that younger new enrollees are now favoring the more traditional Fee-for-Service programs of Medigap as provided by the government. The traditional Fee-For-Service plans are proving more popular given more flexibility in doctor selection and cost management.

Final Word

To be fair, not all Medicare Advantage programs are the same and the urgency to manage the cost and demographic risks will differ by provider. In particular, Medicare Advantage programs in Minnesota may not be under the same stress as the national data suggests.

However, you should still read the fine print in your provider’s annual Medicare contract to better understand how your out-of-pocket costs may be changing. Also, your best (or most unbiased) source of information on Medicare is the US government, not the private insurers or their brokers.

Are you concerned how long-term medical costs might impact your retirement savings? Saffron Capital provides comprehensive retirement plans that model out-of-pocket medical costs as a function of age. The goal is to test the sustainability of savings in order to better afford and enjoy retirement.