July 2025 Returns and Asset Performance

August 2, 2025

August 2025 Returns and Asset Performance

September 1, 2025Tactical Positions for Fed Rate Cuts

Introduction

Signs of economic slowing and a softer labor market are starting to shift the market yield outlook after a prolonged period of high interest rates. Falling rates tend to favor growth stocks, bonds, gold, real estate, and infrastructure development projects. Portfolio rebalancing toward increased rate sensitivity is ideally accomplished before a new Fed policy cycle.

Interest Rate Update

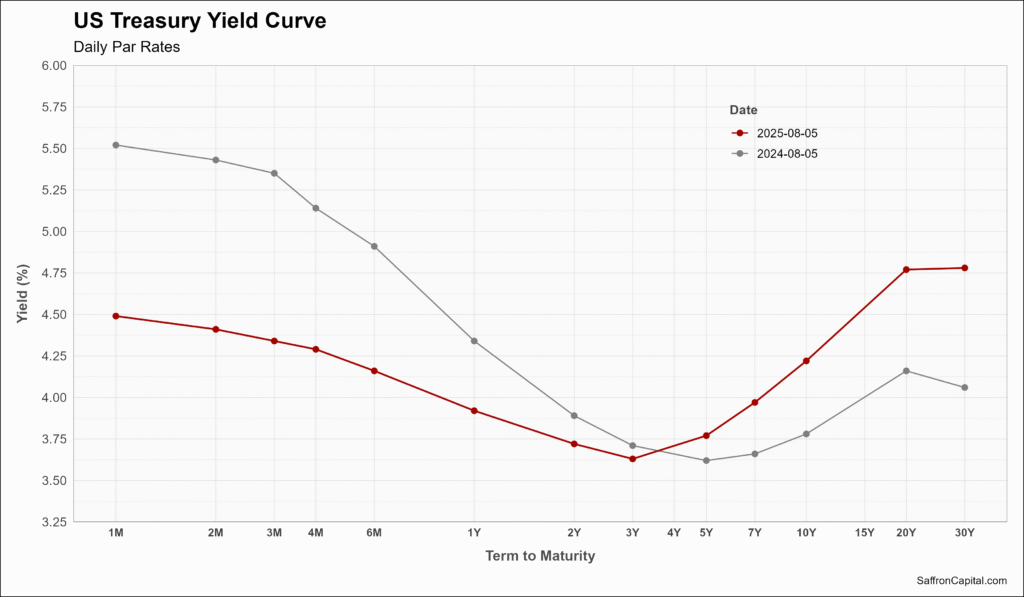

Yield curve discussion now center on when, not whether the Fed will begin easing. Federal funds futures imply a 90% chance of a 25-basis-point (bp) cut at the Fed’s 17-September FOMC meeting and greater than 50% odds of a second cut by year-end. Skeptics still argue inflation is too sticky for 2025 cuts, but futures are giving policy-doves the benefit of the doubt.

The shift in implied probabilities has already begun to impact Treasury prices. The 10-year yield slipped to 4.23 % (1 August close) while the 2-year sits at 3.69 %, down 25 bps, leaving the 10Y-2Y spread at +0.53%, the steepest since 2022. Traders see the steepening of the yield curve as the first sign of a cycle in which short rates fall more quickly than the long end, a view echoed by the view “the Fed always follows the two-year yield.”

Equities: Reallocate as Rates Fall

Lower yields benefit cash flow valuations, including equities, but the impact is not consistent across all stocks. Sector, style, and quality all matter when interest rate policy shifts. Here are several tactics for equity allocations:

- Tilt toward growth stocks selectively: Software, AI infrastructure, and associated power supply projects will all benefit from lower discount rates, boosting the contributions from long-term cash flows.

- Rotate into cyclicals and small caps: Cheaper financing and a steeper curve will benefit banks, industrials, and the S&P SmallCap 600 index. Confirmation that the macro data is stabilizing is key, especially for small-caps, and it’s important to avoid over-leveraged balance sheets.

- Prioritize dividend compounders: As Treasury yields retreat, dividend yields of 4% or higher look very attractive. Screen for payout ratios <70%, along with consistent free-cash-flow growth.

- Emphasize quality: Tariffs, supply-chain constraints, and inflation will cause investors over time to seek stocks with strong balance sheets, pricing power, and operational discipline.

- Rebalance toward international stocks: Rate cuts, new trade policies, and economic softening have weakened the US Dollar. Dollar softness now appears to be structural. This will negatively impact foreign investors in the US, while magnifying small stock market gains abroad for US-domiciled investors.

Bonds: A Better Total Return

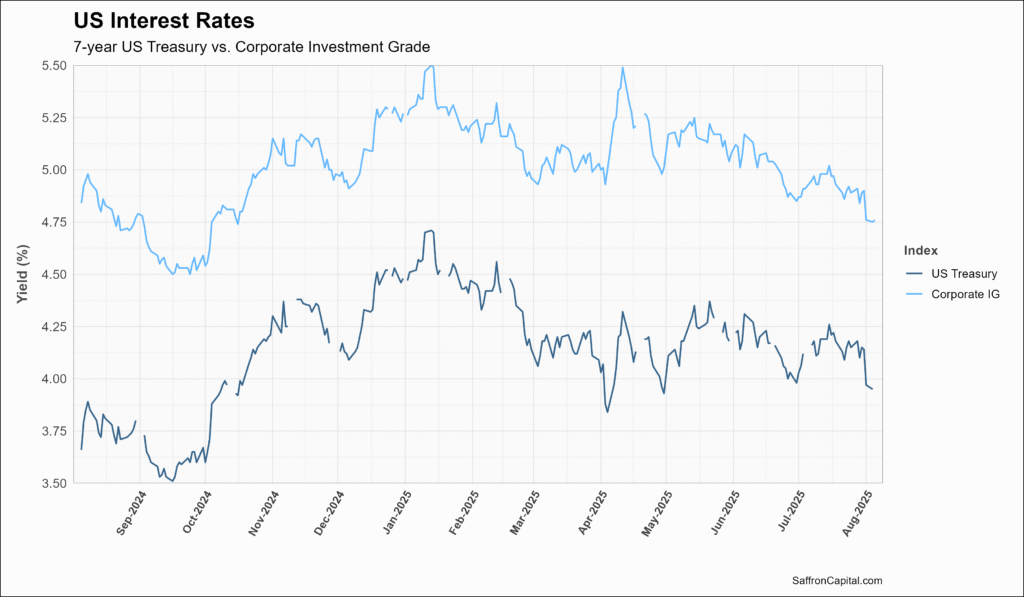

For the past five years, bonds prices have trended down with limited opportunity for long-term capital gains. Rate cuts have historically been a positive catalyst for bonds, especially for intermediate- and long-duration government debt. For example, the first 50 bps of Fed rate cuts have typically benefited the 5- to 10-year part of the yield curve the most. The “belly” of the curve offers a modest monthly coupon yield with a much lower price sensitivity for a better risk-adjusted return, as shown below:

- 7Y Treasury Note: yields 3.96% with a price sensitivity of +/- 3% to a 50 bp move.

- 10Y Treasury Note: yields 3.70% with a price sensitivity of +/- 6% to a 50 bp move.

Investment-grade corporate bonds also offer attractive return potential given a yield-to-maturity of 4.47% and relatively low credit risk if rates fall. Finally, a two-year high-yield bond offers a yield-to-maturity of 7.47% without the price risk of longer maturities.

Real Assets: Improved Diversification

The investment playbook for rate sensitivity is also expanded with real assets which act as inflation and volatility buffers as the cycle turns.

- Gold performs well when rates fall and the dollar is weak. Gold also serves as a store of value given policy uncertainty, inflation surprises, or geopolitical events.

- Silver and platinum-group metals are more volatile than gold but also will benefit from lower rates if global growth holds as the Fed eases.

- Infrastructure project equity and bonds, notably for utility-scale power projects, benefit significantly from lower rates and now enjoy supply chain demand from tech companies, which are fueling a surge in project opportunities.

- REITS and stocks of real estate developers can also benefit as yields fall even though many are still trading at a discount.

Summary

The Fed hasn’t started to cut rates yet, but yield curve steepening is underway, the 2Y bond has started to turn, and mortgage rates have also dipped. The interest rate paybook is simple: seek to harvest the price upside in intermediate Treasuries and corporate bonds, while keeping credit quality high; add measured exposure to growth and small-cap stocks that benefit from falling capital costs; and hold real assets to diversify and hedge a traditional portfolio. Still have questions about your portfolio or the proportion of funds to allocate across the asset groups? Contact us here to optimize allocations for your risk tolerance.