August Returns – The Best and Worse Performing Assets

September 3, 2021

New Tax Law Proposed Will Kill IRA Conversions and Investments in Private Placements

September 17, 2021

Biden Tax law proposal Targets High Income Individuals, S-Corps and Trusts

Introduction

The new Biden tax law is on deck and in the books. Democrats released the tax proposal on September 13. After months of anticipation, the final product does not match expectations. The proposed measures may impact you in a huge way If you have::

- High income,

- Pass through income from an S-Corp or trust,

- Property used in farming or other trades and business.

Proposed Tax Law

The Responsibly Funding Our Priorities Act is the new tax law. As proposed, the Democrats will impose new taxes and surcharges on high income individuals. At the same time, new rules restrict S-Corps and target how business income or losses flow to your personal taxes. So lets hit the highlights. The changes listed below are the top 10:

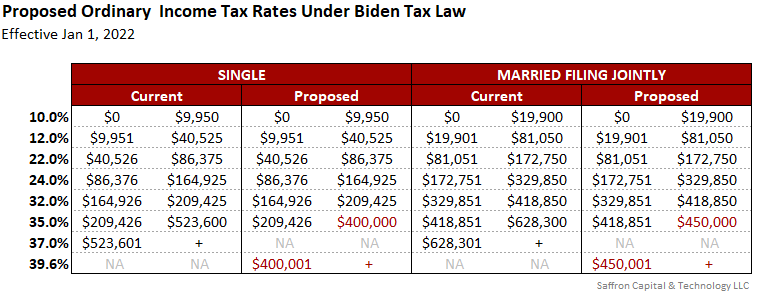

1 – Increase in Top Marginal Individual Income Tax Rate

The top marginal individual income tax rate will increase to 39.6% (formally 37% as defined by the 2017 Tax Cut & Jobs Act). The marginal rate applies to:

- Married individuals filing jointly with taxable income over $450,000,

- Heads of households with taxable income over $425,000,

- Unmarried individuals with taxable income over $400,000,

- Married individuals filing separate returns with taxable income over $225,000, and

- Estates and trusts with taxable income over $12,500.

The taxpayers who are most impacted by the new rates are those in the $400,000 to $500,000 income range. As a result, they move from the current 35% bracket to the new 39.6% bracket. The amendments made by this section apply to taxable years beginning after December 31, 2021.

The table confirms that the income range for the 35% tax rates becomes seriously compressed. The same compression squeezes married taxpayers even more. Over all, the highest tax rate increases over 7% (i.e., 2.6 / 37.0).

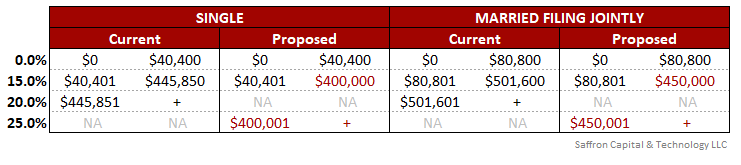

2 – Increase in Capital Gains Rate for Certain High Income Individuals

Next, the capital gains rate under the Biden tax law increases to 25% (from 20%). Meanwhile, the amount of income needed to enter the top rate is also dropped. The income thresholds proposed for the ordinary income tax (in point 1) also apply to the capital gains tax. Its worth noting that the capital gains law goes into effect immediately on September 13 2021. This will avoid incentives to liquidate appreciated assets prior to legal implementation. A transition rule further states the preexisting rate of 20% for the tax period prior to September 13. And the new rate applies after September 13. Thus, taxpayers with large unrealized capital gains would not be able to sell such assets before the end of the year in order to avoid the higher rate.

Historical note – The 25% rate would be the highest top rate imposed on long-term capital gains since 1997.

3 – Application of 3.8% Net Investment Income Tax to Trade or Business Income of Certain High Income Individuals

Under current law, profits of S-Corps are subject to neither employment taxes (e.g., FICA and SECA), nor the Net Investment Income Tax (NIIT). The ‘dual exemption’ puts profits from S-Corps in a narrow group of income sources, which are able to avoid both types of taxes.

Under the Biden tax law, NIIT expands to include new sources of income. If enacted, the proposal would include income for high-income S-Corp owners. Specifically, once an S-Corp owner’s Modified Adjusted Gross Income (MAGI) exceeds their applicable threshold, S-Corp profits will be added together with ‘regular’ investment income to produce “Specified Net Income.” And ultimately, the greater of a client’s net investment income or Specified Net Income will be subject to the 3.8% tax.

The applicable thresholds are as follows:

- Single filers – $400,000

- Joint filers – $500,000

Further, the tax now includes investment income from trusts and estates. For clarity, NIIT excludes wage income. The amendments applies to tax years beginning after December 31, 2021.

4 – Limitation on Deduction of Qualified Business Income for Certain High

Income Individuals

The Tax Cuts and Jobs Act of 2017 allowed a deduction for qualified business income (QBI) on a personal tax return for up to 20%. The deduction of QBI applies to income from partnerships, limited liability companies (LLCs), S-Corps, trusts, estates, and sole proprietorships.

When President Biden ran for office, his tax platform included the goal of eliminating the QBI deduction for taxpayers with income in excess of $400,000. Fortunately, the Biden tax law does not eliminate the the deduction of QBI. Instead, it proposes to reset the maximum allowable deduction for QBI to:

- $500,000 in the case of a joint return,

- $400,000 for an individual return,

- $250,000 for a married individual filing a separate return, and

- $10,000 for a trust or estate.

The new proposal will impact S-Corp owners the most. The amendments made by this section apply to taxable years beginning after December 31, 2021.

5 – Limitations on Excess Business Losses of Non-corporate Taxpayers.

New rules will permanently disallow excess business losses (i.e., deductions in excess of business income) for non-corporate taxpayers. However, the provision allows taxpayers whose losses are disallowed to carry those losses forward to the next succeeding taxable year. Again, owners of S-Corp business are impacted. The amendments made by this section apply to taxable years beginning after December 31, 2021.

6 – Surcharge on High Income Individuals, Trusts, and Estates

A new tax is imposed equal to 3% of a taxpayer’s Modified Adjusted Gross Income in excess of $5,000,000 (or in excess of $2,500,000 for married filing separately). For this purpose, MAGI means adjusted gross income reduced by any deduction allowed for investment interest (as defined in section 163(d)). As a result, wealthy tax payers will confront a true top tax rate of 42.6% (39.6% + 3%). The amendments made by this section apply to taxable years beginning after December 31, 2021.

Notably, by making this a ‘surcharge’ on MAGI, as opposed to creating a 42.6% top ordinary income tax bracket, two things are possible. First, from a technical perspective, taxpayers will not be able to use below-the-line deductions to reduce their exposure to the surtax. Second, it gives a bit of political cover/wiggle room for more moderate Democrats.

Given the extraordinarily high threshold of $5 million, few individual taxpayers would ever be subject to the surtax. Nevertheless, taxpayers would want to pay close attention to once-(or few)-in-a-lifetime types of events, such as the sale of a large piece of property or business that could potentially (albeit temporarily) push them over the $5 million mark.

7 – Termination of Temporary Increase in Unified Credit

The proposed law terminates the temporary increase in the unified estate and gift tax exemption, reverting the exemption credit to its 2010 level of $5,000,000 per individual, indexed for inflation. If enacted, the change would create a ‘do or die’ (or perhaps a ‘do or be sorry when you die’?) situation for taxpayers with estates larger (or projected to be larger) at death than the reduced estate tax exemption. In such situations, from a tax planning perspective, using as much of the current exemption amount to gift assets before the end of the year makes a lot of sense.

8 – Increase in Limitation of Estate Tax Valuation Reduction for Certain Real Property Used in Farming or Other Trades or Businesses

A new provision amends section 2032A to increase the special valuation reduction available for qualified real property used in a family farm or family business. This reduction allows decedents or beneficiaries who own real property used in a farm or business to value the property for estate tax purposes based on its actual use rather than fair market value. This provision increases the allowable reduction from $750,000 to $11,700,000.

9 – Certain Tax Rules Applicable to Grantor Trusts

A new law will pull ‘grantor trusts’ into a decedent’s taxable estate when the decedent is the deemed owner of the trusts. Prior to this provision, taxpayers were able to use grantor trusts to push assets out of their estate while controlling the trust closely. The provision also adds a new section, which treats sales between grantor trusts and their deemed owner as equivalent to sales between the owner and a third party. The amendments made by this section apply only to future trusts and future transfers.

10 -Valuation Rules for Certain Transfers of Non-business Assets

A proposed law clarifies that when a taxpayer transfers non-business assets, those assets should not be afforded a valuation discount for transfer tax purposes. Non-business assets are passive assets that are held for the production of income and not used in the active conduct of a trade or business. Exceptions are provided for assets used in hedging transactions or as working capital of a business. A look-through rule provides that when a passive asset consists of a 10-percent interest in some other entity, the rule is applied by treating the holder as holding its ratable share of the assets of that other entity directly. The amendments made by this section apply to transfers after the date of the enactment of this Act.

Have questions? Contact me here