Benchmark Selection for Investment Portfolios

August 14, 2021

August Returns – The Best and Worse Performing Assets

September 3, 2021The Sustainability of Social Security

The Social Security Administration (SSA) just issued its annual report and projects a fiscal cliff in 2034. Let’s discuss what’s happening, what’s being done about it and how you might be affected.

Social Security Trust Funds

The SSA administers two large trust funds. The first is the Old Age and Survivors Insurance (OASI) program, which makes monthly income available to insured workers and their families at retirement. The second is the Disability Insurance (DI) program, which supports disabled workers and their survivors. The two programs are jointly referred to as OASDI, and their combined trust funds have asset reserves of $2,908 billion.

On August 31, the Board of Trustees for the OASDI trust funds released their 2021 Annual Report. The report confirms the scope of the activities covered by the SSA trusts in 2020:

- An estimated 175 million people had some portion of their earnings covered by Social Security.

- The total annual cost of the program was $1,107 billion.

- The total annual income of the programs was $1,118 billion, of which $1,042 billion was non-interest income (mostly payroll taxes) and $76 billion was interest income.

- The total cost of Social Security programs has exceeded non-interest income since 2010.

Fiscal Cliff 2034

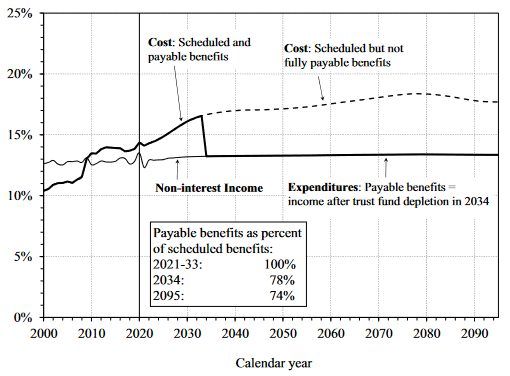

The trustees report also states that the total cost of Social Security is projected to be higher than total income in 2021. Cost over-runs are projected to continue indefinitely, eroding the SSA trust funds until they are depleted in 2034. Absent ongoing reserve funding, program benefits and scheduled expenditures must collapse to stay in line with program income. The resulting fiscal cliff in 2034 is shown in this chart:

SSA Costs vs. Non-Interest Income (Short-Range)

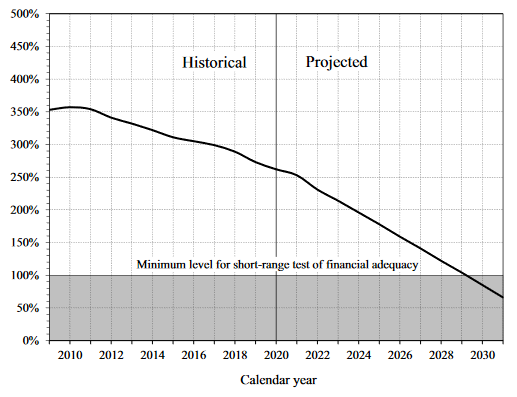

The 2021 Annual Report is based on assumptions for fertility, mortality, productivity, inflation, tax receipts, etc. Taken together, the short-range outlook supports the sustainability of Social Security, but at great cost:

- Total reserves for the combined OASDI trust funds are sufficient to cover scheduled program costs over the next 10 years. However, the asset reserves are projected to decline to $1,336 billion at the end of 2030.

- The ratio of reserves to annual costs is projected to decline from 253% in 2021 to 85% at the start of 2030.

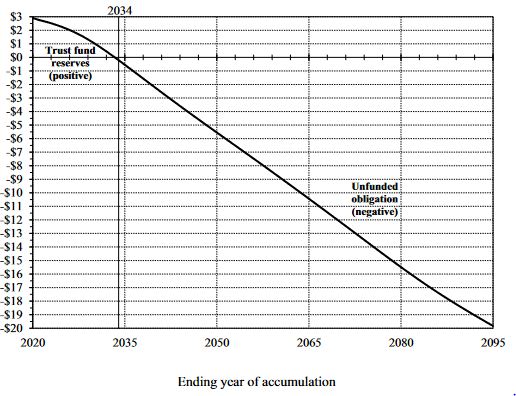

Magnitude of the 75-Year Deficit (Long-Range)

After 2034, Social Security is projected to operate in the red. The chart below shows the magnitude of the 75-year actuarial deficit that the fund trustees project.

What’s to be Done?

There are solutions for the long-term actuarial deficit in the trustee’s report. The combined OASI and DI trust funds can remain fully solvent throughout the long-range projection if the following actions are taken:

- Revenue would have to increase by an amount equivalent to an immediate and permanent payroll tax rate increase from 3.36% to 15.76% … close to a 5-fold increase!

- Scheduled benefits would have to be reduced by 21% immediately if applied to both existing and new beneficiaries.

- The reduction would be as high as 25% if applied to new beneficiaries only and starting in 2021.

Some combination of these solutions could be adopted. However, nothing in the current political discourse supports these actions. If substantial action is deferred, then the changes required to maintain Social Security solvency could be worse.

Your Personal Benefit Elections

Long-term retirement planning should take into consideration a potential cut in Social Security benefits of 25-35% starting in 2034. Typically, it pays for most retirees to defer Social Security Benefits until 72. Decisions to defer benefits when reserve resources are finite may be challenged going forward. In practice, there is no single answer to guide decisions on Social Security benefit deferral. Each person’s decision will be different since optima deferral depends on the level of your early vs deferred benefits, your working status, and your other sources of income. For additional insight, give us a call at

612-227-2485.