European Gas Prices Down 20%

December 23, 2021

December Returns and Asset Performance

January 3, 2022Long Bond Yield Surges, Omicron Drawdown Over

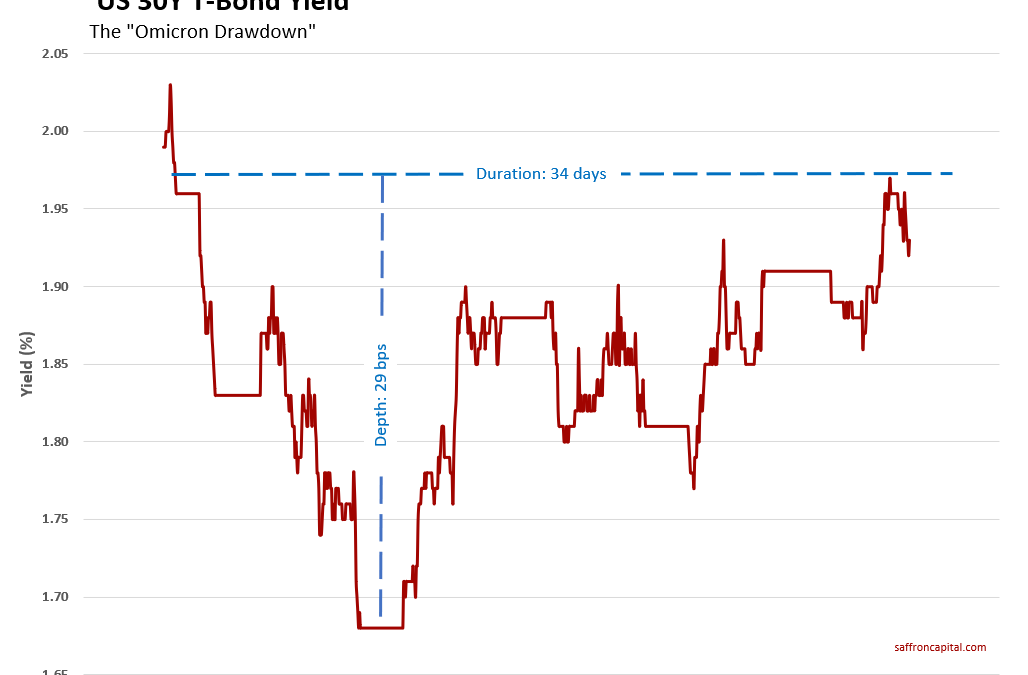

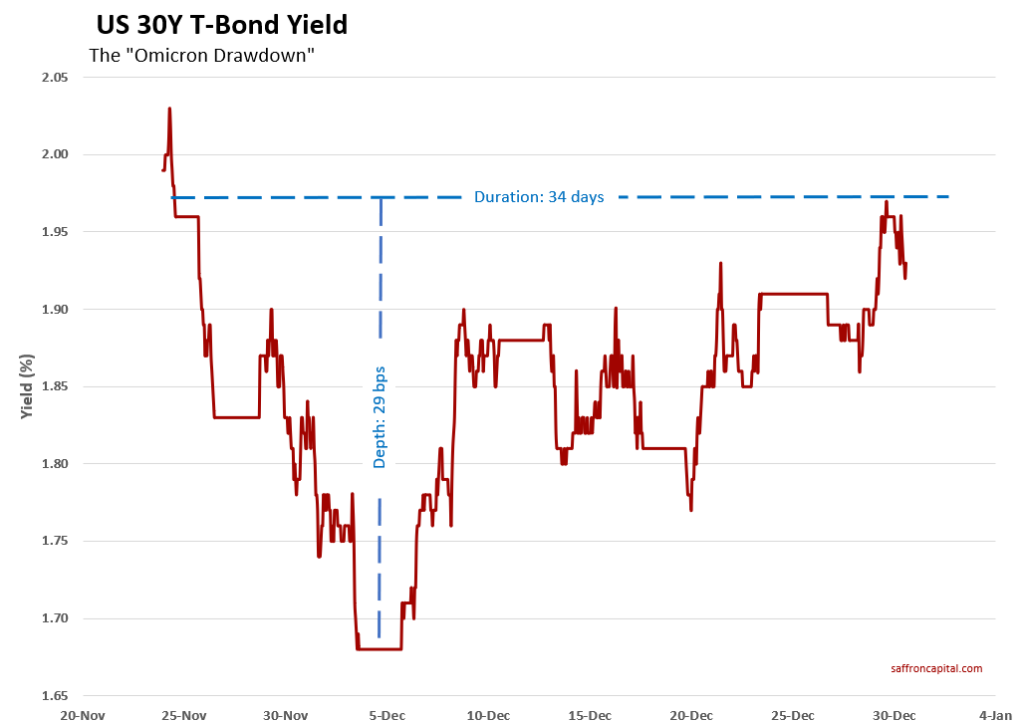

The 30-year bond yield collapsed 29 basis points (bps) during the Thanksgiving holiday. The week of Nov-24 was also the first week of the Omicron endemic. Yields have since bottomed out in early December and surged back to unchanged, erasing the Omicron drawdown by year-end.

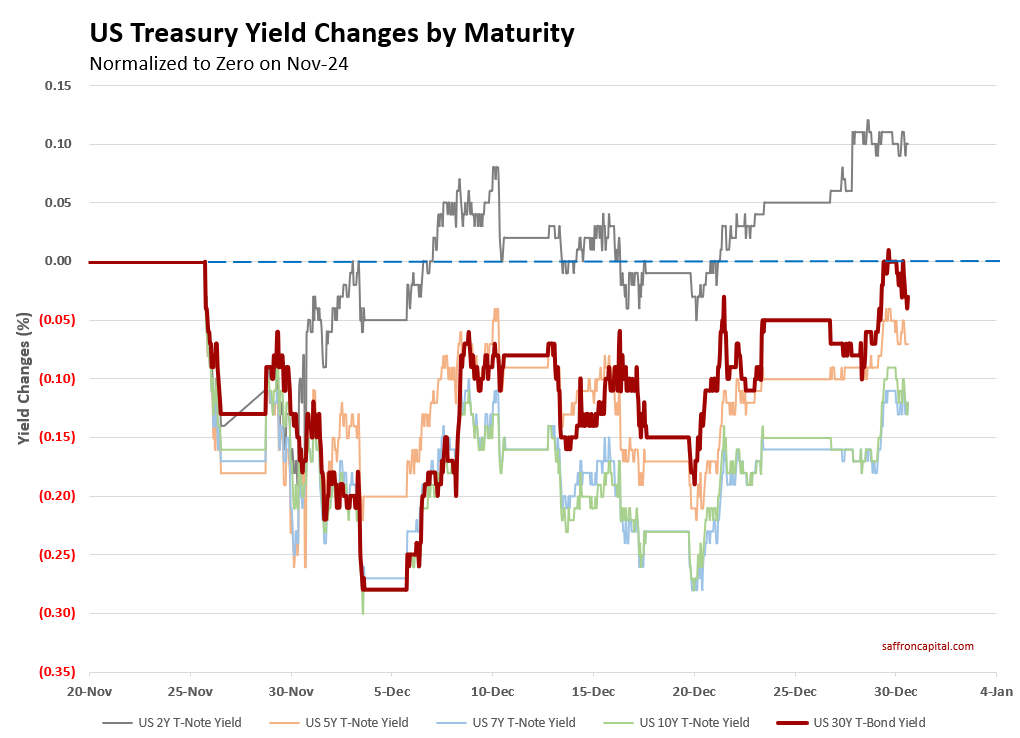

Meanwhile, the 2-year bond yield is up 10 bps since 24-Nov, thanks mainly to the hawkish pivot of the Federal Reserve. In response, the belly of the yield curve (.i.e 7-year duration) has outperformed with yields down 12 bps.

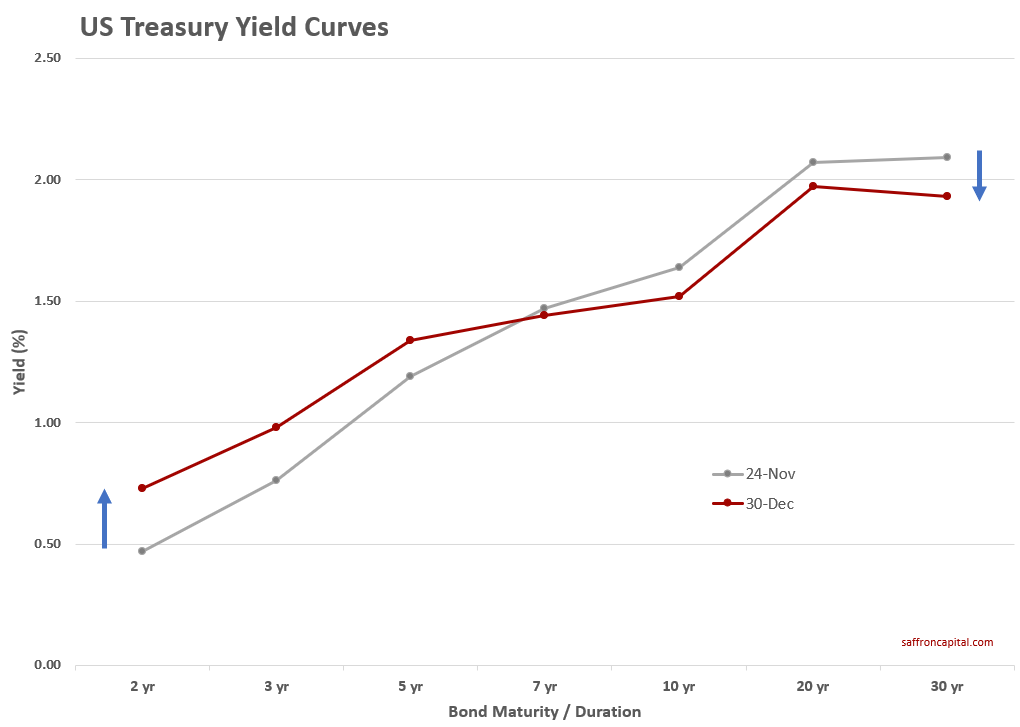

The rapid flattening of the yield curve implied by these changes is noteworthy. It makes clear which durations are the least affected by short-term inflation and supply chain issues.

These changes are also noteworthy as the short end of the curve has priced in the full rate hike expected by May 2022. However, observed changes are yet to price the potential for three full rate hikes.

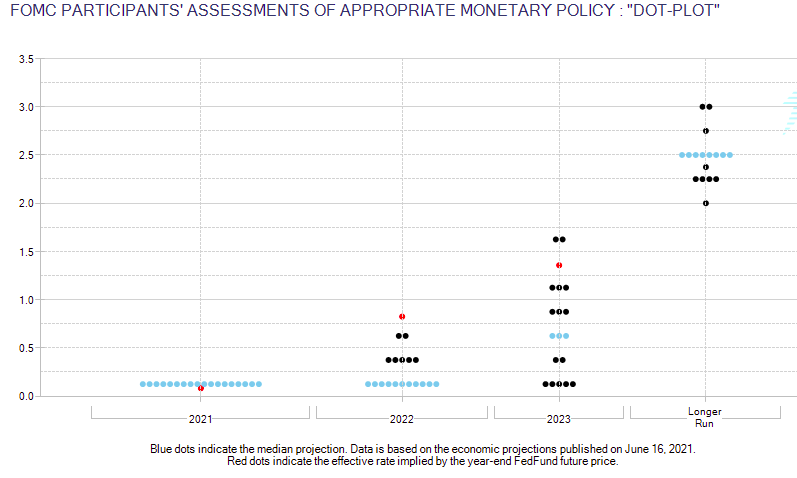

The final chart compares yield outlooks. For example, CME futures data on expected yield changes (red dots) are compared to the median expectations of the board of governors of the Federal Reserve system (blue dots). The black dots represent the individual views of each voting member of the committee responsible for Fed rate setting.

Bottom line: The recent bond yield drawdown was short-lived. Also, the collective wisdom of the market is seen to be much more hawkish than the published views of the Fed. Have comments? You can contact me here.