ETF Fund Flows: July 7, 2023

July 9, 2023

July 2023 Returns and Asset Performance

August 2, 2023S&P 500 Earnings Update - 2Q.2023

Index Earnings

The S&P 500 earnings seasons for 2Q.2023 is well underway. Currently, 91 companies or 18% of the index has now reported actual results. In the upcoming week, a surge of 166 companies will report earnings, taking us to a total of 51% of index. The earnings growth estimate for the S&P 500 is now (-9.0%) and combines forecast and actual earnings. The blended result of (-9.0%) is down from (-7.0%) on June-30 and represents the largest earnings decline for the index since Q2.2020 (-31.6%). If realized, the estimate will mark the third quarter in a row to produce a decline in earnings growth.

Typically, the consensus estimate of analysts underestimates actual earnings. The average error is 6.1%. By way of comparison, earnings surprises to date have averaged 6.4% over estimates. As a result, it is still possible that a modest uplift in earnings growth may occur. However, its not likely that the increase will prevent a growth decline for the quarter.

Sector Earnings

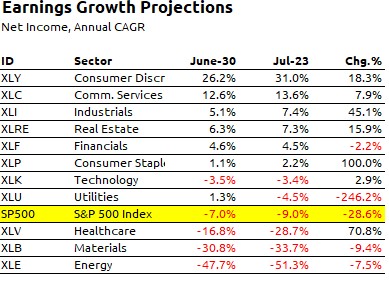

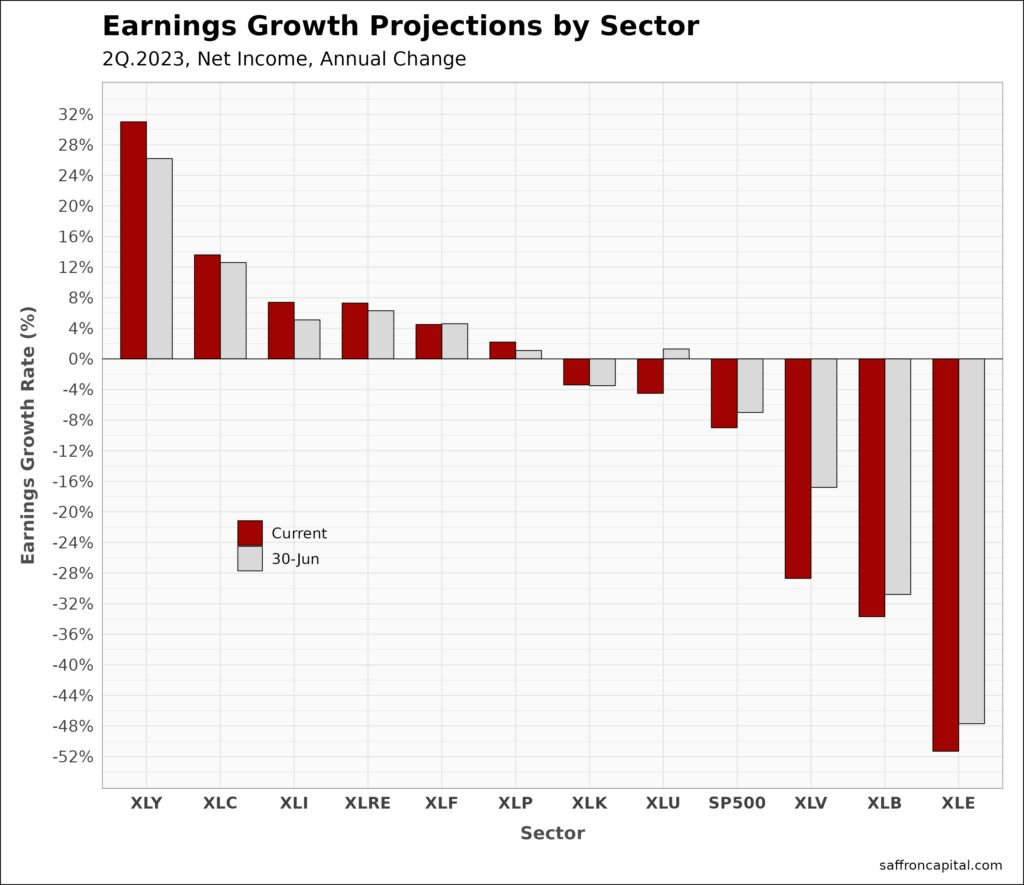

The sectors with the highest estimated earnings growth include the Consumer Discretionary (+31.0%), Communication Services (+13.6%), and Industrial (+7.4%) shares. In total, 6 of 11 sectors are projected to have positive growth. In contrast, 5 sectors have estimated declines in annual earnings growth. Laggards include the Energy (-51.3%), Materials (-33.7%), and Health Care (-28.7%) sectors.

The chart below shows changes in sector earnings estimates since June-30:

Click to enlarge

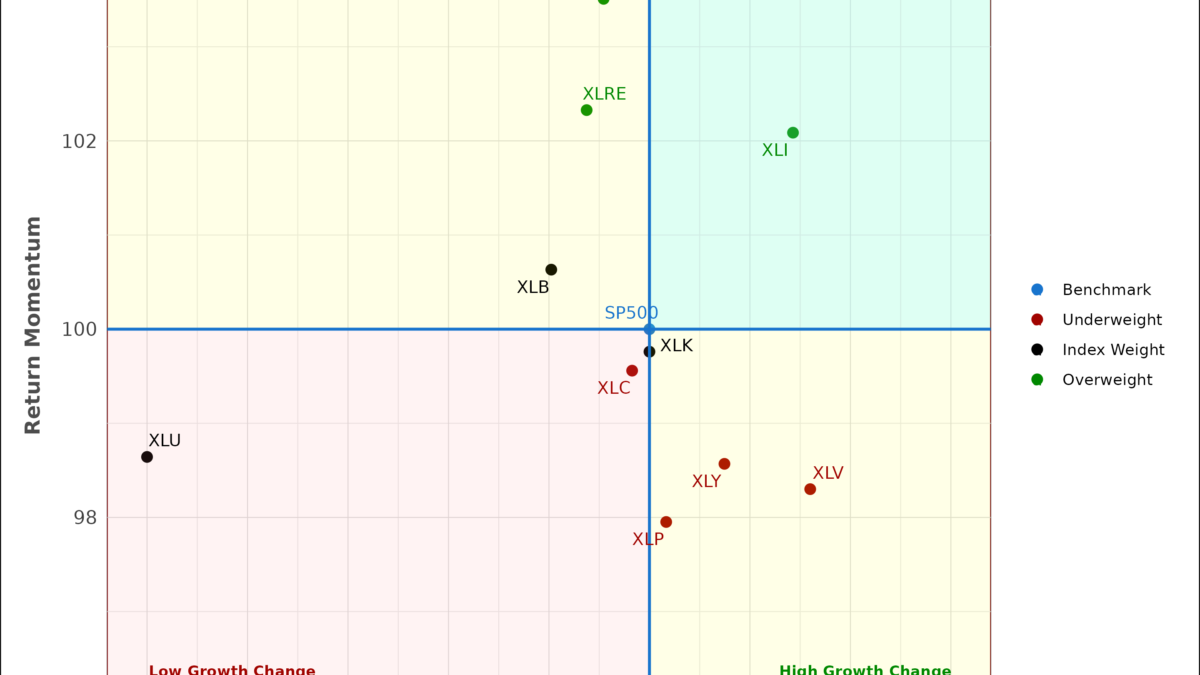

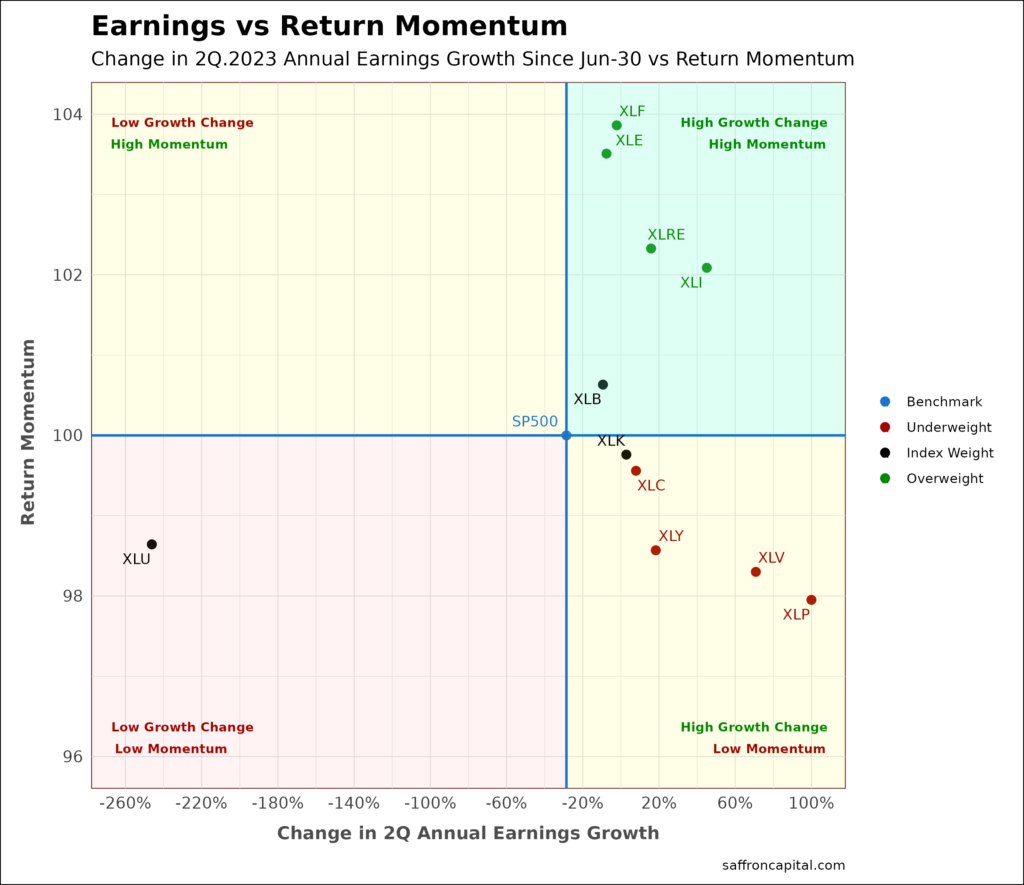

Sector Earnings vs Return Momentum

The next chart shows changes in earnings versus returns by sector over the same period. Normally we see high return momentum in sectors with positive changes in earnings outlooks. We also tend to see low return momentum for sectors with declining earnings growth. Currently, that is not the case. In particular, the market has not rewarded earnings changes equally. For example, we see solid return momentum for the Finance (XLF), Energy (XLE), Real Estate (XLRE) and Industrial (XLI) sectors, but some of these sectors have experienced declines in earnings. In contrast, the defensive Health Care (XLV) and Consumer Staples (XLP) sectors have had solid earnings growth revisions, but return momentum has been lackluster.

As a result, we are witnessing a market that is rewarding positive EPS surprises less than average. Typically, positive earnings releases generate a 1.0% return within two days of release. This quarter we are seeing an average return of only 0.6% for positive earnings surprises, combined with positive returns of 1.4% for companies with negative earnings surprises. This can be attributed in part to the rally underway. It is also evidence that current returns are not well supported by sector cash flows.

Click to enlarge

3Q and 4Q Outlooks

See the Signals

Contact us if you have questions about this report and how our model portfolios can help you. Looking to improve investment performance with real-time risk management? Contact us here.

Important Notice

Saffron Capital provides capital market research and insight reporting for informational and educational purposes only. The report does not constitute a solicitation to buy or sell securities. We only provide investment advice to people or entities subject to an investment advisory agreement and given client approved strategies for capital preservation.

Caution Regarding Forward-Looking Statements

Any opinion about future events (such as market and economic conditions, company performance, security returns, or future security offerings) are forward-looking statements. Forward-looking statements, by definition, involve risk or uncertainties and do not reflect actual knowledge about the future. Forward projections are valid inputs in any planning or investment process. However, they are not a guarantee of future returns or investment performance.