S&P 500 Earnings Forecasts – 4Q.2023

December 6, 2023

Download – Decrypting Crypto

February 1, 2024Major Asset Classes

December 2023

Performance Comparison

Introduction

Stocks

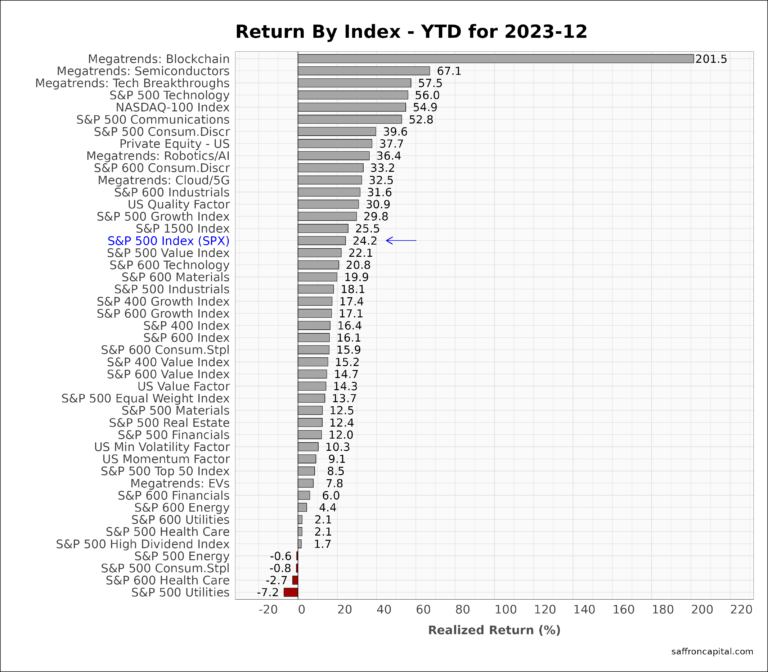

Investors have a lot to cheer given that December 2023 market returns made for a positive month, quarter, and year. The S&P 500 index rallied +4.4% in December, finishing the year up +24.2%. Key drivers include high US GDP growth, better-than-expected corporate earnings, and the potential end of central bank interest rate hikes.

Technology stocks, and the NASDAQ-100 index more broadly, jumped +5.6% in December and ended the year up +54.9%. Mega-trend growth stocks all benefited from emerging booms in cybersecurity and blockchain tech, artificial intelligence and robotics, cloud and data tech, semiconductors, batteries and EVs, and genomics for health care.

Bonds

Meanwhile, bond investors also fared well in the fourth quarter. After an unprecedented two year losing streak, the Aggregate Bond Index was up +3.7% in December and +5.7% for the year. The IBOXX Corporate Bond index was up +3.2% in December and ended the year with gains of +11.5%. As a result, a 60/40 portfolio that blends large-cap stocks and investment grade bonds end the year with gains of +19.2%, its best year since 2019 and the fourth best year since 2000.

Diversified Investment Results

For many investors, 2023 may well be remembered as the year where index returns passed them by. For example, many placed cash on the sidelines given dire and well accepted warnings of recession. Even worse, some made large leveraged bets the market would fall. Other investors were victim to rapid rises in equity in the first half of the year that melted away when the market dropped -11% in the third quarter. A more common outcome was the well diversified portfolio that just couldn’t compete with a concentrated index or equity portfolio of growth shares.

Regardless of how you came out in 2023, the following analysis should prove helpful. Scan the visual performance record of monthly and annual returns to understand recent performance and to identify opportunities for 2024.

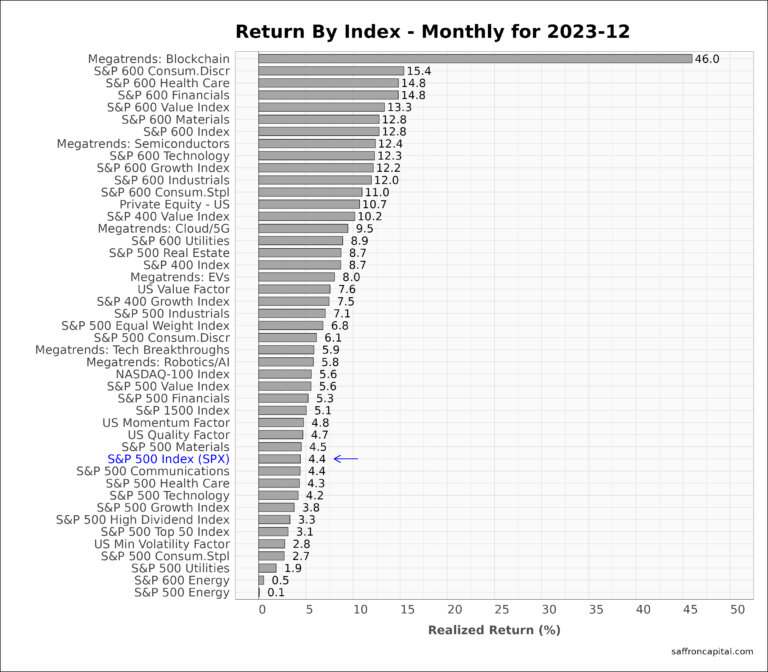

US Equities

in December, US equity returns were not dominated by mega-trend equities. The exception was Blockchain shares (+46.0%), which once again outperformed all other benchmarks. However, the real performers were small cap shares. For example, small cap Consumer Discretionary (+15.4%), small cap Health Care (+14.8%) and small cap Financials (+14.8%) topped the monthly performance. A close look at the December return chart also confirms that 10 small cap sectors dominated December market returns.

For large cap stocks, the top sectors in December were Real Estate (+8.7%), Industrials (+7.1%), and Consumer Discretionary (+6.1%) shares. The laggards were Consumer Staples (+2.7%), Utilities (+1.9%), and Energy (0.1%) shares.

The top factor portfolios in December were Value (+7.6%), Momentum (+4.8%), and Quality (+4.7%).

Moving to the annual data, the top performers in 2023 were the mega-trend equity portfolios for Blockchain technology (+201.5%), Semiconductors (+67.1%), and multi-sector tech breakthroughs (+.57.5%). These sectors are likely to enjoy strong growth again in 2024. In comparison, annual returns for the S&P 500 large cap index (+24.4%) lagged technology shares, but easily outperformed the S&P 500 equal weight index (+13.7%). Large cap shares also outperformed the S&P 400 Mid Cap index (+16.4%) and the S&P 600 Small Cap index (+16.1%) index. Finally, the large cap Growth (+29.8%) portfolio beat the large cap Value (+22.1%) portfolio.

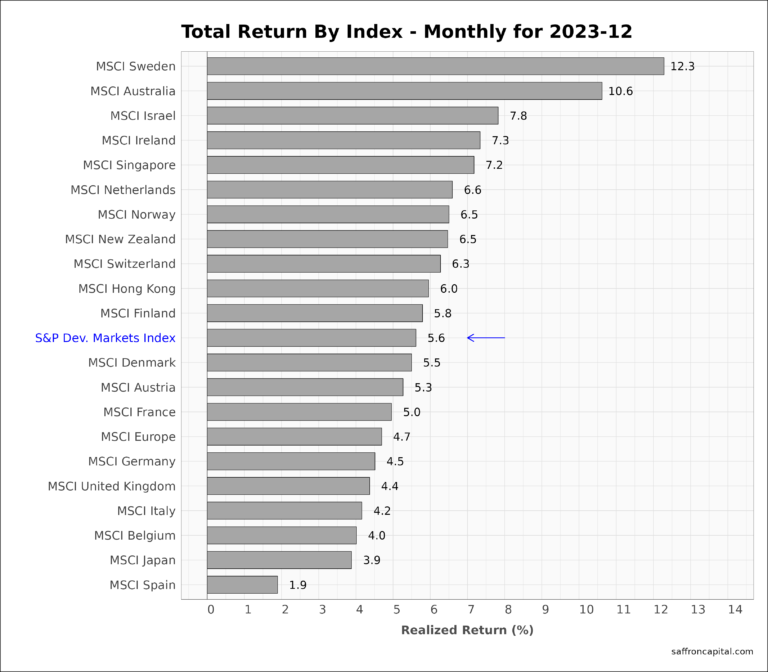

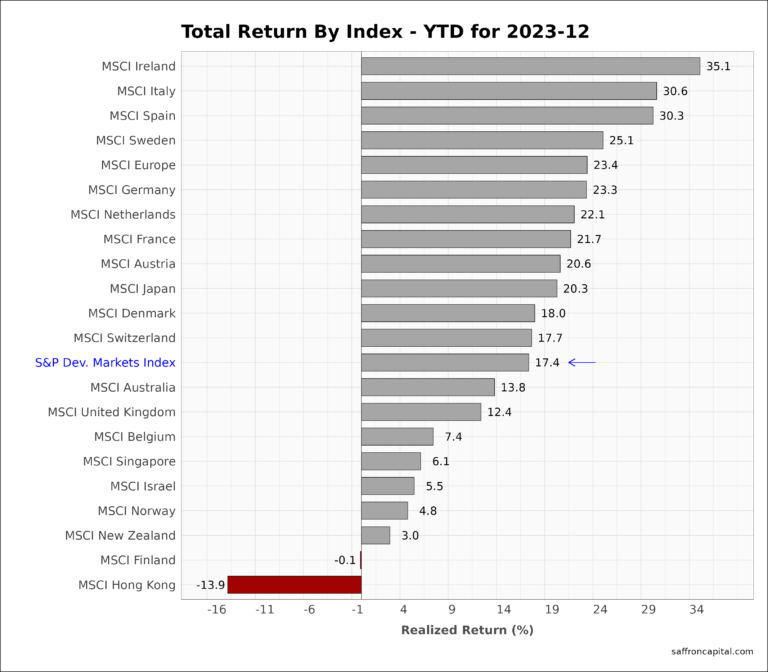

Developed Market Equities

International developed markets (+5.6%) outperformed US shares in December. Top markets included Sweden (+12.3%), Australia (+10.6%), and Israel (+7.8%). Results for the largest developed markets varied, as seen by Germany (+4.5%), Japan (+3.9%) and the UK (+4.4%). Since the start of the year, Developed Markets (+17.4%) have lagged the S&P 500 index. However, the MSCI Europe index (+23.4%) had annual results on par with the US large cap benchmark. The best market results were achieved in Ireland (+35.1%), Italy (+30.6%), and Spain (+30.3%). Hong Kong (-13.9%) was the only developed market to end the year with red ink.

Click to enlarge

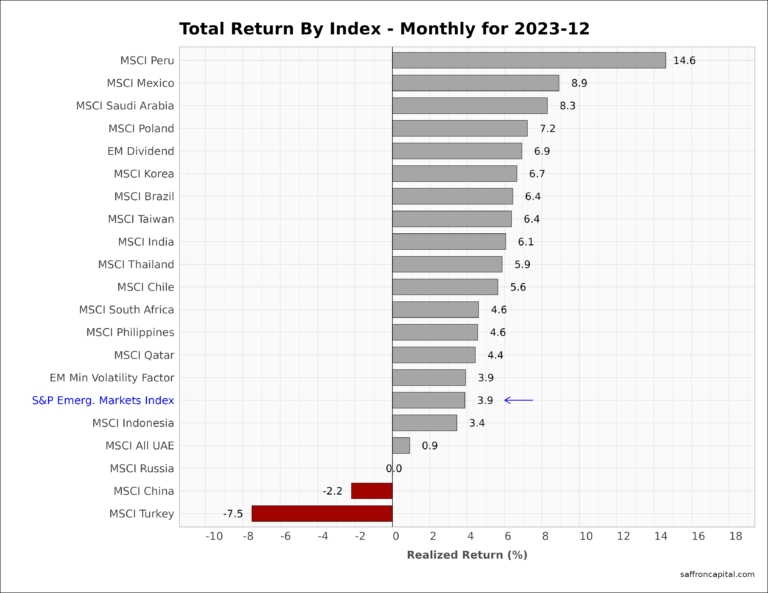

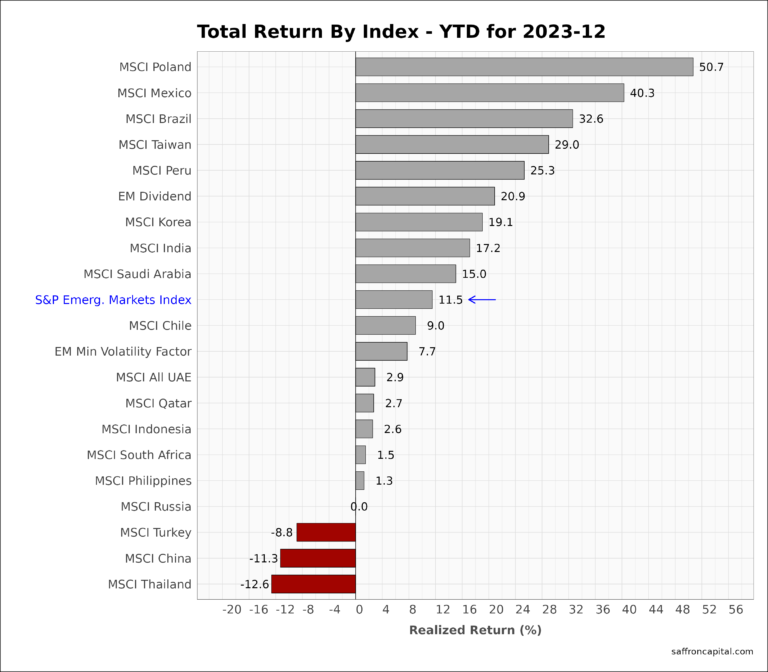

Emerging Market Equities

December 2023 market returns for the S&P Emerging Markets Index (+3.9%) had a wide range of results. Peru (+14.6%), Mexico (+8.9%), and Saudi Arabia (+8.3%) lead the group. Taiwan (+6.4%) and India (+6.1%) both outperformed China (-2.2%) and the group benchmark.

The YTD performance of the group (+11.5%) was solid, but trailed developed markets. As a result, valuations are also lower as we enter 2024. Top performers in 2023 includes Poland (+50.7%), Mexico (+40.3%), and Brazil (+32.6). Asian markets have been consistently weak in 2023 as seen by Thailand (-12.6%) and China (-11.3%) in the East and by Turkey (-8.8%) in the West.

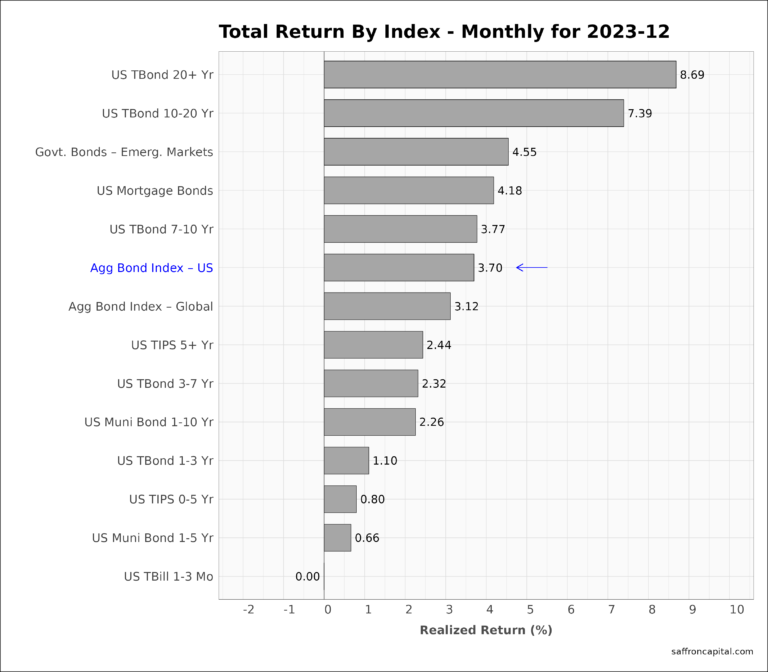

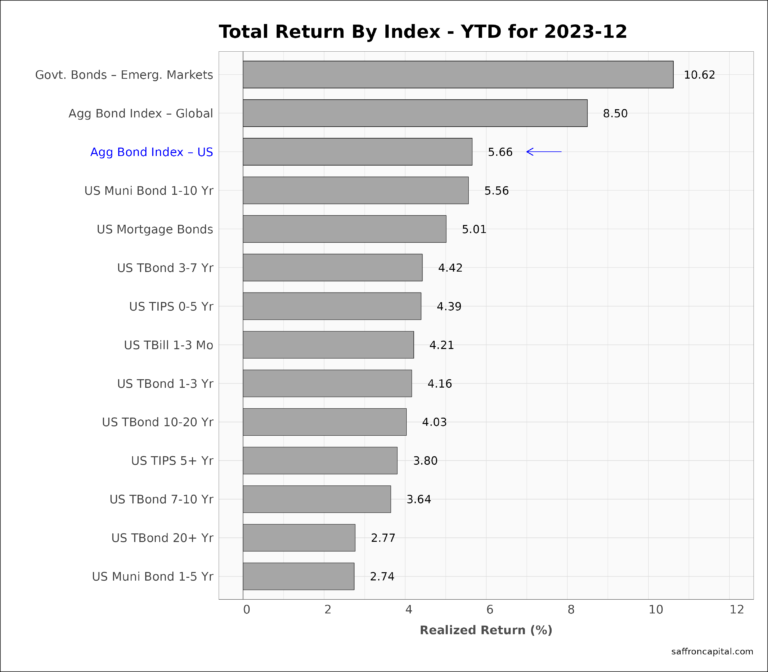

Government Bonds

Returns for the Aggregate US Government Bonds Index (+3.7%) have again been solid, breaking the chain of losses seen earlier in the year. The long-end of the yield curve has the lead the group with the 20-Year bond (+8.69%) topping the chart. Maturities in the 10- to 20-year time frame (+7.39%) also gained. Finally, Emerging Market sovereign bonds (+4.55%) were also been pulled higher in December. YTD returns for US government bonds (+5.66%) are positive, but trailed Emerging Market bonds (+10.62%) in 2023, as well as developed market bonds in the Global Aggregate Bond index (+8.5%).

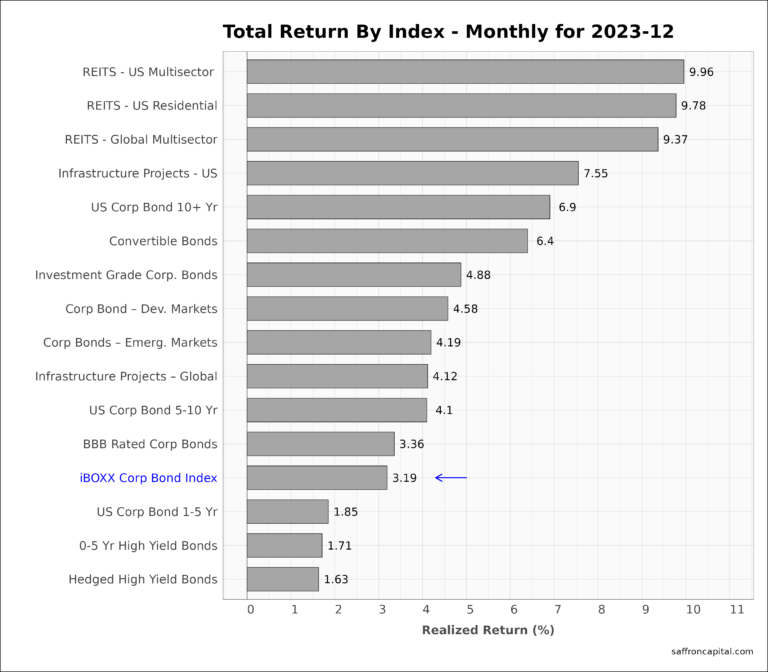

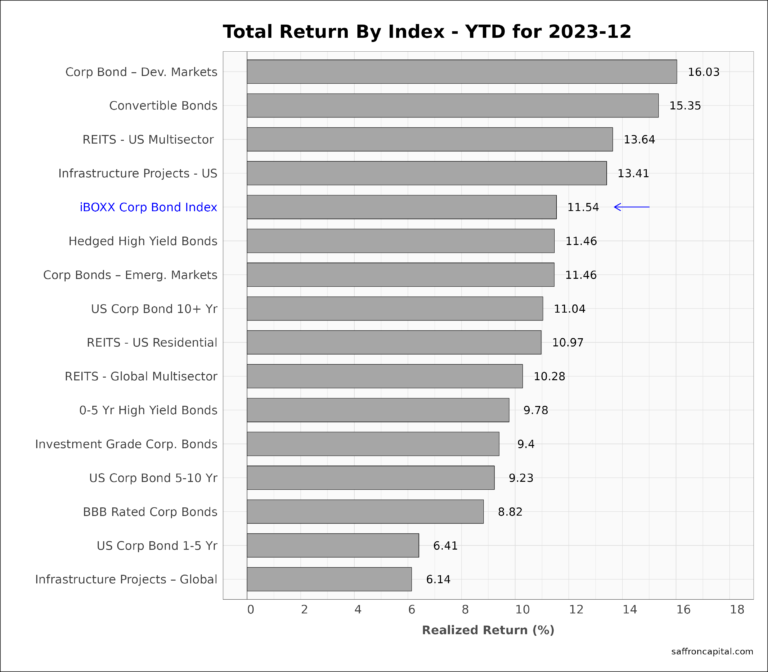

Corporate & Infrastructure Bonds

The iBoxx Corporate Bond Index (+3.19%) trailed the Aggregate US Treasury index in December. Top performance was taken by Real Estate Investment Trusts (REITS), with the US Multi-sector portfolio (+9.96%) topping the charts, followed by US residential REITS (+9.78%) and the Global Multi-sector REITS (+9.37%). US Infrastructure project bonds (+7.55%) also beat the group benchmark, as did Investment Grade bonds (+4.88%) that are A-rated. High yield bonds turned in positve price gains in December, but trailed the corporate index for the first time in months.

Year-to-date performance for the iBOXX index (+11.54%) has solidly beat the total return on US Treasuries. Group performance is led by Developed Market Corporate issues (+16.03%), Convertible Bonds (+15.35%) and US Multi-sector REITS (+13.64).

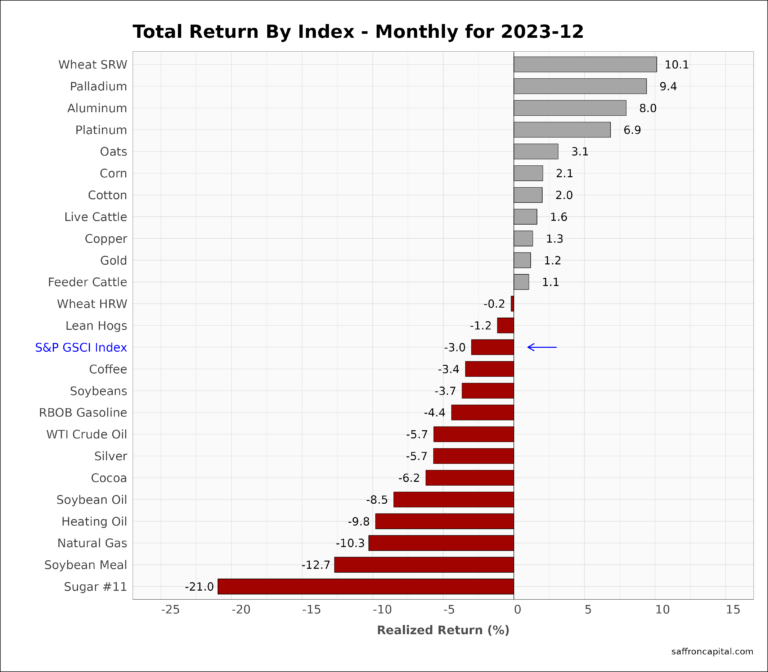

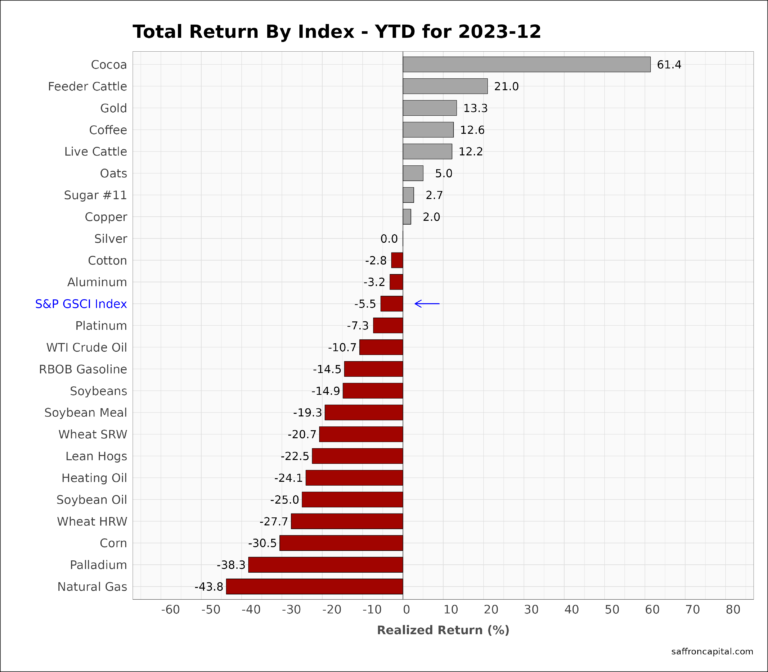

Commodities

Commodities were the only asset group to post negative benchmark returns. December 2023 results for the S&P GS Commodity Index (-3.0%) confirmed falling raw material prices, but with highly variable results within the commodities basket. For example, Spring Red Wheat (+10.1%) lead the group, followed by Palladium (+9.4%) and Aluminium (+8.0%). Commodities under the most pressure in December included Sugar (-21.0%), Soybean Meal (-12.7%), and Natural Gas (-10.3%).

The top performers for 2023 include Cocoa (+63.4%), Feeder Cattle (+21.0%) and Gold (+13.3%). The S&P GS Commodity index was down (-5.5%) for the year, pulled down by energy, metals, and grains.

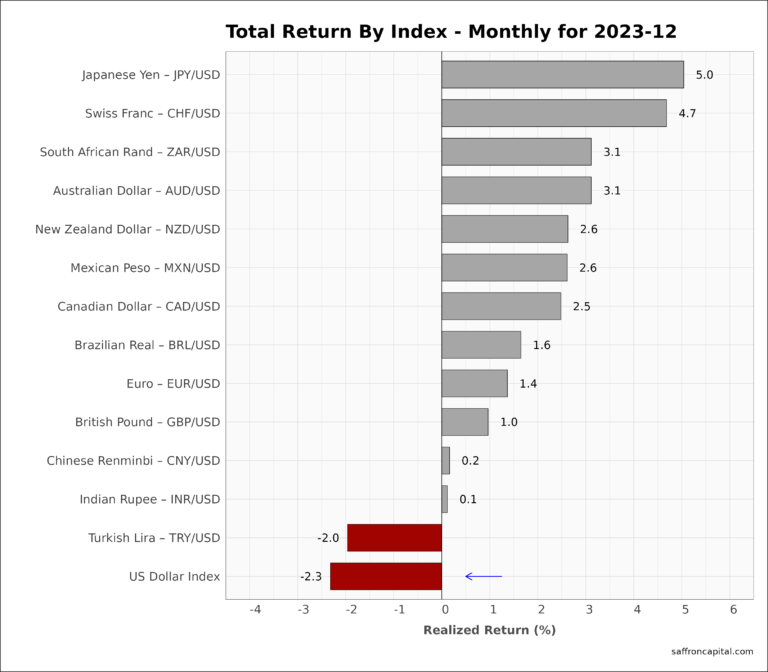

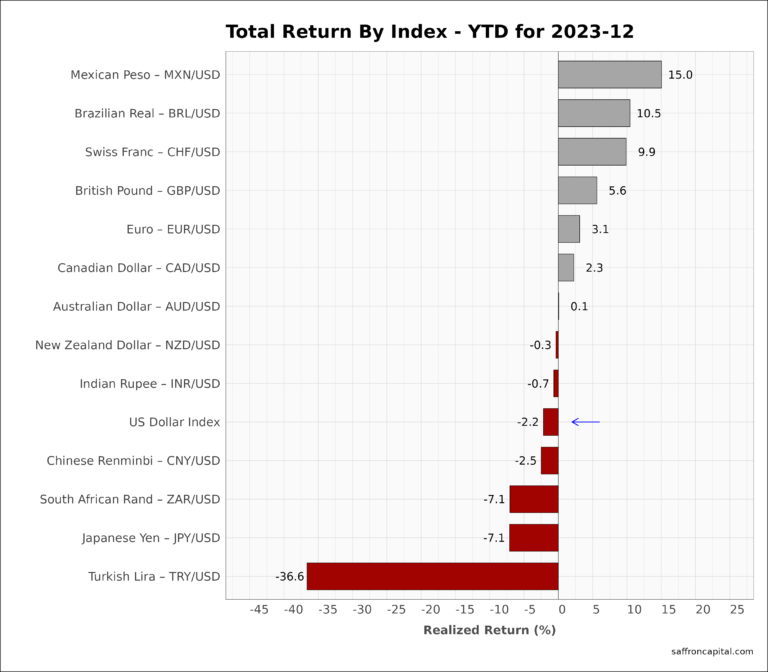

Currencies

Finally, for December, the US Dollar (-2.3%) added to declines seen last month, ending the year down (-2.2%). The top performer in 2023 was the Mexican Peso (+15.0%) followed by the Brazilian Real (+10.5%). The Euro ended the year up (+3.1%), while the Indian Rupee was flat (-0.7%), and leading Asian currencies were down.

To our clients, we look forward to serving you in 2024. For others, if you have questions or concerns about the performance of your portfolio, we provide free portfolio assessments and solve custom formulations for each client’s portfolio goals and risk tolerance. Whatever your needs are, we are here to listen and to help with structured income, capital growth, or preservation strategies. To schedule a call with us, please contact us here.