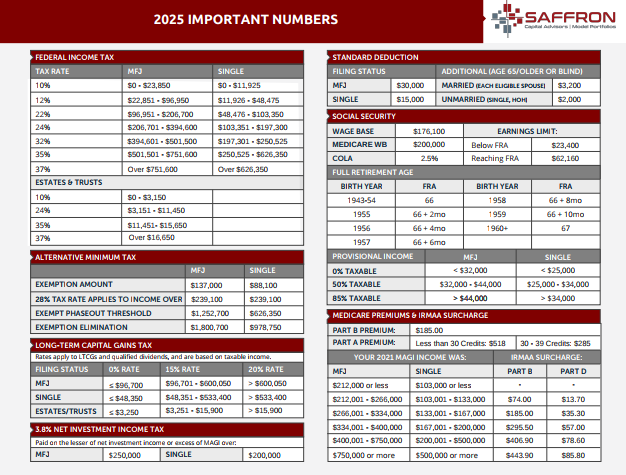

Download – Important Numbers 2025

December 3, 2024

December 2024 Returns and Asset Performance

January 6, 2025Roth IRA Conversions

Introduction

Roth IRA conversions are a powerful tool for tax and retirement planning. A Roth IRA conversion is a financial strategy that allows individuals to move funds from a standard retirement account, such as a Traditional IRA or 401(k), into a Roth IRA. The conversion can have immediate benefits but requires a solid understanding of process, drawbacks, and tax implications.

What is a Roth IRA?

A Roth IRA is a type of retirement account where contributions are made with after-tax dollars, meaning you pay taxes upfront if funds are being transferred from a traditional IRA. The primary advantage is that:

- Investment funds grow tax-free.

- Qualified withdrawals in retirement are tax-free.

- No required minimum distributions (or RMDs) during the account holder’s lifetime.

- Minimize exposure to higher taxes in the future.

- Budget funding is enhanced any time taxes on retirement savings are reduced.

Why Bother?

The sustainability of retirement savings is enhanced when lifecycle taxes are reduced. Meanwhile, traditional tax-deferred retirement accounts have RMDs that increase over time. Frequently, RMDs drive individuals into higher tax brackets late in retirement. The result: Increased taxes reduce the sustainability of savings.

Roth IRA conversions mitigate future taxes when applied properly. They also help to enhance retirement budget funding. Potential beneficiaries include individuals with

pensions, high ordinary income, and tax-deferred retirement accounts. Measurable lifetime savings can be estimated in advance and may be significant. Moreover, the tax advantages can be passed on to heirs.

Funding a Roth IRA

There are two ways to fund a Roth IRA:

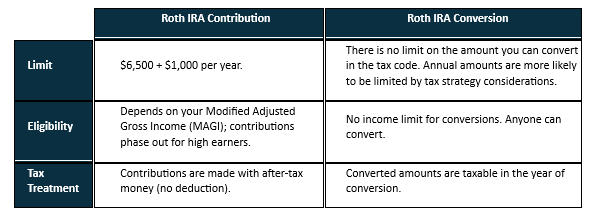

- Roth IRA Contribution: A Roth IRA contribution is the amount of after-tax money that an individual deposits into a Roth IRA during a given tax year. Contributions are subject to annual contribution limits and eligibility requirements. For 2025, each individual investor over the age of 50 is allowed to contribute $6,500 as a base contribution + $1,000 as a catch-up contribution for a total of $7,500 per person.

- Roth IRA Conversions: A Roth conversion is the process of transferring funds from a traditional IRA, 401(k), or a similar tax-deferred account into a Roth IRA. The process involves a withdrawal of funds from the tax deferred account (e.g., a traditional IRA) and then paying taxes now on the distribution amount in exchange for the benefit of tax-free growth and tax-free withdrawals in the future. Conversions are often significant in size and have no limit in the tax code.

The differences between Roth IRA contributions and conversions are summarized below:

Benefit Analysis

Roth IRA conversions will be profitable as long as today’s tax rate is lower than your projected tax rate in the future. An example will make this clear.

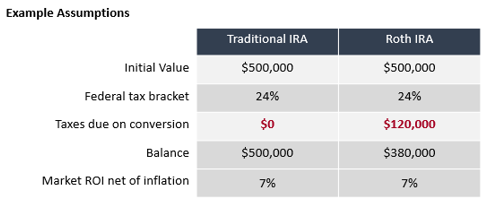

The table below compares a Traditional IRA with $500,000 versus a Roth IRA funded with $500,000. Initially, the Traditionally IRA will have the full $500,000 available for investment. In contrast, the Roth IRA will have only $380,000 available for investment net of taxes, assuming a 24% tax rate.

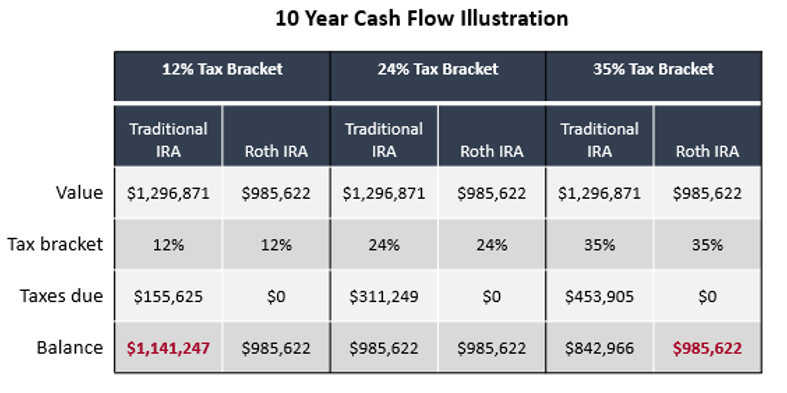

The next table compares after tax results assuming a 10-year real return on investment of 7% and given 3 different tax brackets in the future:

In the first case, the future tax rate is 12% given a drop in the investor’s tax brackets over time. Over 10 years, the traditional IRA grows to a pre-tax value of $1.3 million. Taxes due at 12% equal $155,625. The net result is an after-tax balance of $1.1 million. The Roth IRA has no taxes due but has grown at 7% to $986K. The Roth IRA underperforms the Traditional IRA given reduced taxes over time.

In the second case, taxes remain fixed at 24% over time. The Traditional IRA and the Roth IRA perform exactly the same on an after-tax basis.

In the final case, the investor’s taxes rise from 24% to 35%. As a result, the Traditional IRA confronts a larger tax bill, underperforming the Roth IRA. Hence, the Roth IRA is preferred on an after-tax basis when expected taxes increase with time. In this case, the measurable benefit exceeds $142,000 due to tax-free compounding.

How Does the Conversion Work

The steps involved in a Roth IRA conversion are simple:

- Identify the Amount to Convert: Decide how much you want to transfer from your traditional IRA (or other tax deferred account) to your Roth IRA

- Pay Taxes: The amount converted is treated as taxable income in the year of the conversion. If you convert $100,000, that amount is added to your taxable income.

- Move the Funds: Transfer the funds directly from your tax-differed account to the Roth IRA

Key Considerations

1. Timing

Roth contributions are most advantageous when the investment time horizon exceeds 10 years. Conversions are typically more attractive in the early years of retirement when income tax brackets are the lowest (due to a loss of salary and prior to the start of large RMDs from tax deferred accounts.

2. Amount

The amount to be converted in any one year will depend on the person’s current tax rate versus projected tax rate. Individuals will typically convert as much as possible as long as the current tax bracket remains below the expected tax bracket.

3. Evaluate Future Investment Returns and Taxes:

It is essential validate that the upfront tax cost of the Roth conversion is offset by future tax savings. To do this, consult a financial advisor to model future investment and tax scenarios. It may also be necessary to consult a CPA to validate planned benefits.

4. Plan for Current Year Taxes:

The converted amount is subject to ordinary income tax in the conversion year. Ensure you have adequate cash available to pay the current tax bill. You can use funds from the Traditional IRA for the tax payment if your age is greater than 59.5 years. Withdrawals made prior to 59.5 will be subject to an early distribution penalty and justify using other funds for the tax payment.

5. Contact Your IRA Bank Custodian or Broker:

Prior to year-end, inform your financial institution of your intent to convert funds from your Traditional IRA to a Roth IRA. Make sure to understand transfer logistics so the transfer can be completed prior to year-end. You can initiate the transfer online, via phone, or via a paper form provided by your custodian.

6. Initiate the Conversion Transfer:

Specify the amount to convert the and the Roth IRA account to receive the funds. Roth IRAs will differ by owner and some investors may have different Roth IRAs that vary by investment plan. You will need to establish a Roth IRA first if you don’t already have one. Remember: Creating new accounts may have delays, which you want to avoid at year-end.

7. Pay Taxes:

Work with your CPA or direct with the IRS and make quarterly or year-end tax payments. When filing taxes, report the conversion on IRS form 8606, which calculates the taxable portion of the conversion. Make sure to avoid underpayment penalties.

8. Keep Records:

Keep records of your account transfers (e.g., your transfer request and the custodian’s confirmation of transfer). The IRA custodian will also provide you form 1099-R showing the amount converted, which is typical of any year-end tax reporting. Finally, keep form 8606 and proof of tax payments.

Distributions from Roth IRAs

Roth IRA withdrawals are ‘qualified distributions’ under the tax code. This means the withdrawals are tax-free and are not included in your Adjusted Gross Income (AGI). Tax free status is justified since account funding used after-tax dollars. Meanwhile, all gains or earnings within the Roth grow tax-free and can also be withdrawn tax-free.

Qualified or tax-free status is allowed only if:

- The account has been open for at least 5 years,

- The account holder is at least 59½ or older.

- Distributions are for a first-time home purchase (up to $10,000)

- The account owner is disabled or deceased.

Roth IRA withdrawals are ‘non-qualified distributions’ if the withdrawals do not meet the conditions above. In this case, earnings (not contributions) are included in AGI and are subject to taxes (and potential penalties).

Order of Withdrawals

Roth IRA withdrawals should follow a specific order

- Contributions are withdrawn first (always tax- and penalty-free),

- Earnings, which are subject to taxes/penalties if the distribution is non-qualified or made within 5 years,

- After 5 years, both contributions and earnings can both be distributed tax-free.

Of course, there is a risk that the tax code could change in the future, potentially affecting the tax treatment of Roth IRA earnings. However, such changes would require congressional legislation and would be subject to significant political debate. As of year-end 2023, Roth IRA accounts in the US held over $2 trillion.

Conclusion

Roth IRA conversions are a retirement planning tool for those who plan strategically. The goal of the conversion is to enhance the sustainability of savings. A Roth IRA conversion will make sense when you understand the tax implications of paying taxes today versus tomorrow. To this end, advisors at Saffron Capital can assess your retirement cash flows, future investment returns, and expected tax exposure. Your advisor can also help to facilitate execution with account management, investment strategy, and tax compliance. The potential benefits are worth exploring and can be significant.

Have questions regarding your integrated retirement, investment, and tax plan? Contact us here.