February 2023 Returns and Asset Performance

March 1, 2023

April 2023 Returns and Asset Performance

May 1, 2023Major Asset Classes

March 2023

Performance Comparison

Introduction

March 2023 returns capped a quarter of broad gains, but with considerable volatility along the way. Total returns for the S&P 500 Index (3.5%) lagged behind the NASDAQ index (+9.5%), which had its best March since 2010. Thanks to the melt-up in tech shares, US equity returns easily beat international developed (+2.5) and emerging (+3.0%) market equities. However, positive returns masked severe weakness in the financial sector, which dropped (-5.5%). Liquidity injections by the Fed caused the dollar to fall (-2.5%) for the second quarter in a row. Meanwhile, flight to quality funds sent the 20-year bond up (+4.8%), gold up (+7.7%) and bitcoin up (+23.0%).

The following analysis provides a visual record of March 2023 returns across and within the major asset classes. The report is provided to facilitate portfolio performance benchmarking.

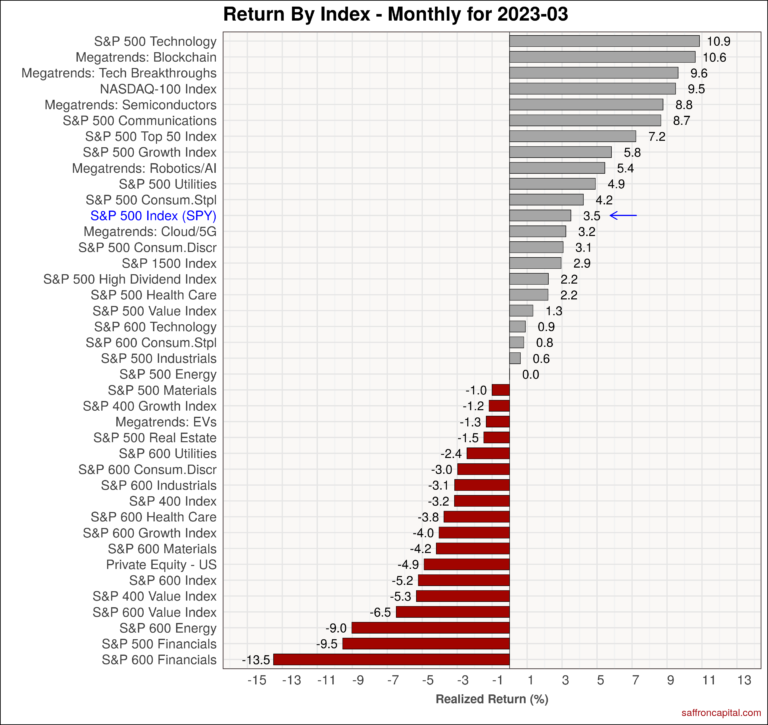

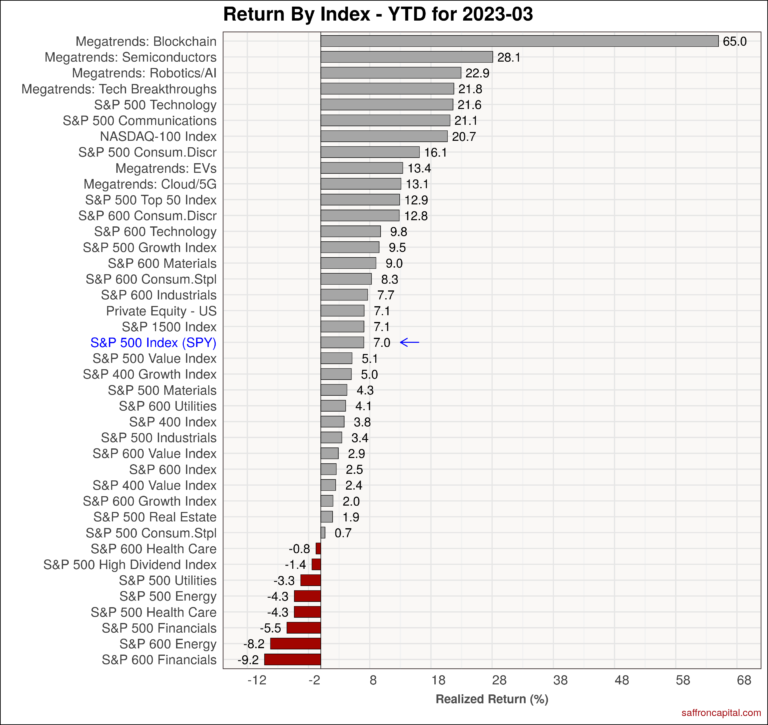

US Equities

Top sector performers in March were large cap Technology (+10.9%), followed by megatrend equities including Blockchain shares (+10.6%), Tech Breakthrough companies (+9.6%), and semiconductors (+8.8%). The defensive large cap Utility sector also performed well (+4.2%). Small cap Financials (-13.5%), large cap Financials, and large cap Energy (-9.0%) were the weakest sectors in March. Year-to-date, the S&P 500 index (+7.0%) has put in solid gains, but trails many growth and megatrend shares. Blockchain shares (+65.0%), Semiconductors (+28.1%) and AI/Robotics (+22.9%) lead in quarterly returns.

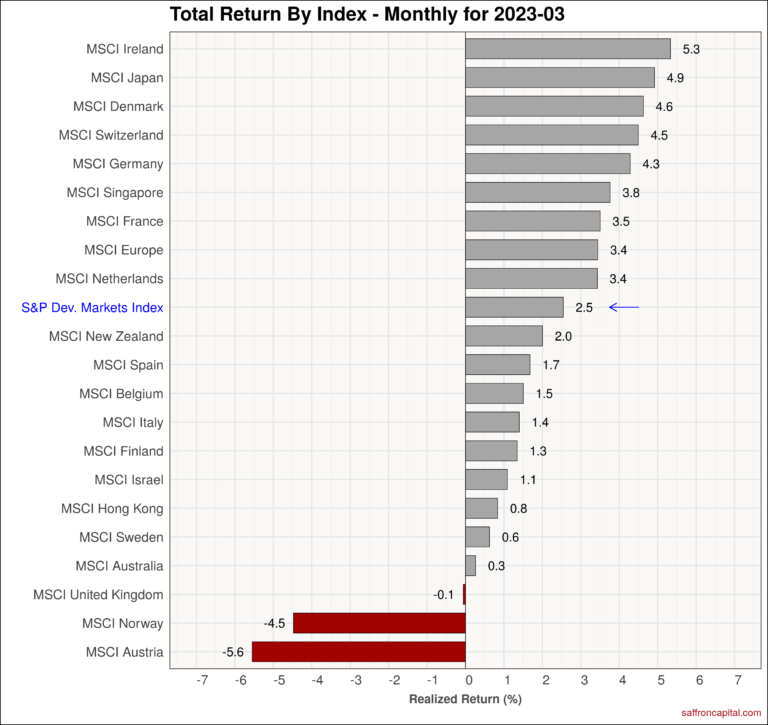

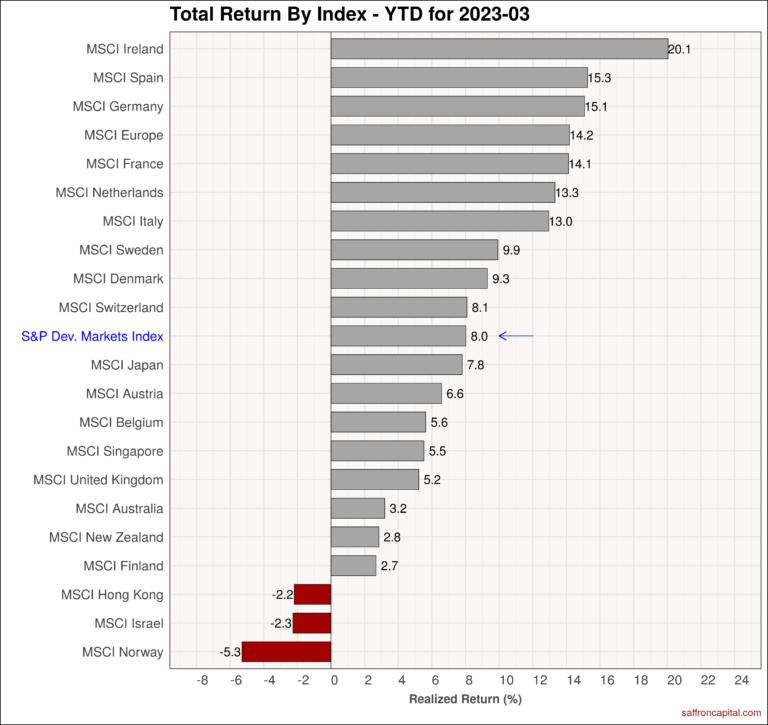

Developed Market Equities

international developed markets (+2.5%) lagged the US for the second month straight. However, a number of foreign stock markets outperformed the S&P 500 including Ireland (+5.3%), Japan (+4.9%), and Denmark among others. The weakest markets were in Austria (-5.6% and Norway (-4.5%). Year-to-date, the devloped markets (+8.0) continue to outperform the US, the MSCI Europe (+14.2%) index doubling the US performance for Q1.

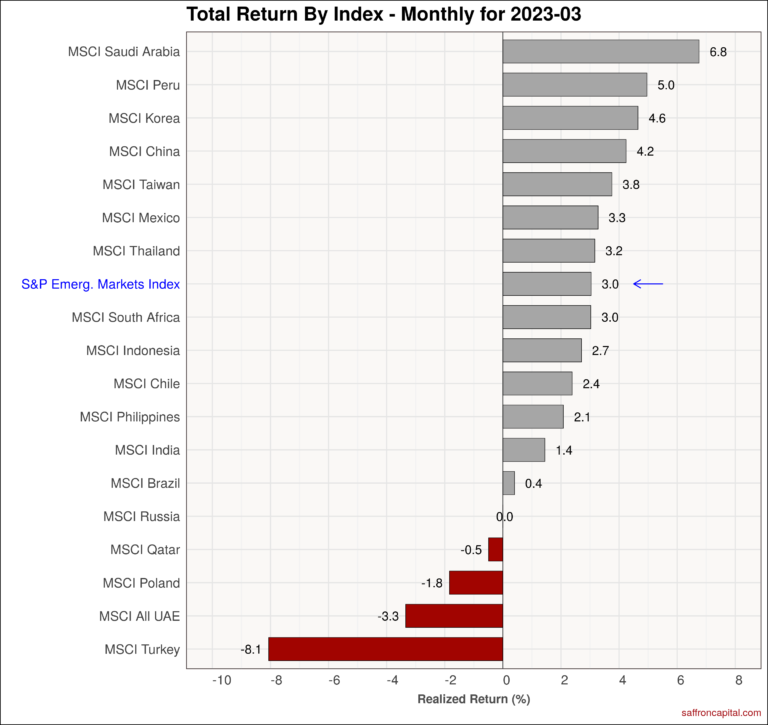

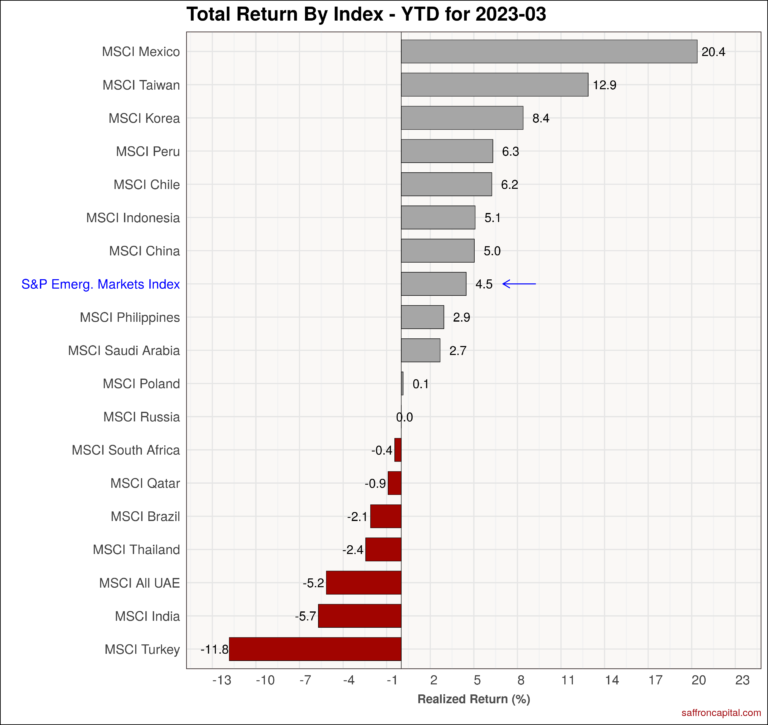

Emerging Market Equities

March 2023 returns for the S&P Emerging Markets Index (+3.0%) trailed the US and other developed markets. Saudi Arabia (+6.8%), Peru (+5.0%) and Korea (+4.6%) topped the list, while the laggards included Turkey (-8.1%), the UAE (-3.3%), and Poland (-1.8%). China (+4.5%) returns were solid, while those in India (+1.4%) trailed, but remained positive. Year-to-date performance for emerging markets (+4.5%) reflects broadly divergent results. Mexico continues to lead (+20.4%), followed by Taiwan (+12.9%) and Korea (+6.4%). Indian shares for the year (-5.2%) are still vulnerable.

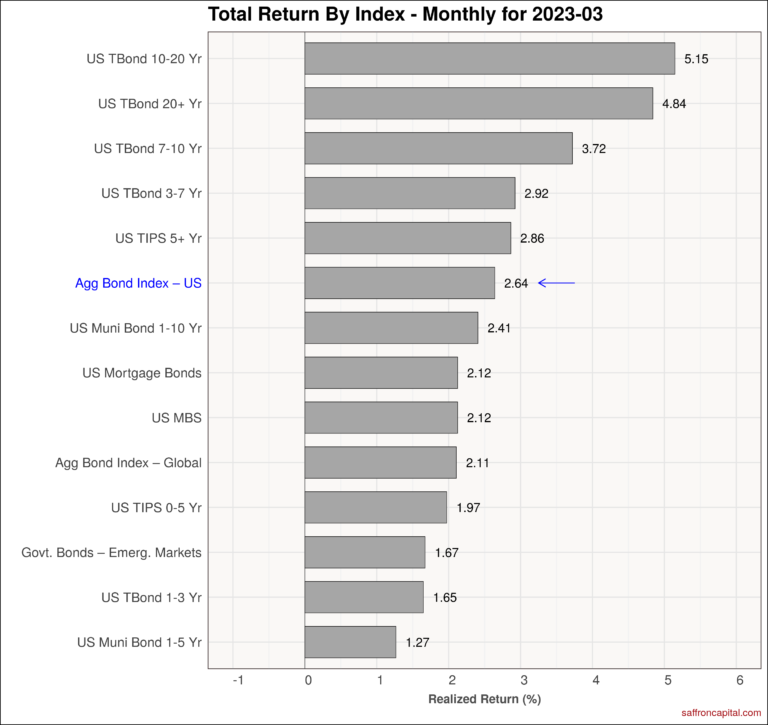

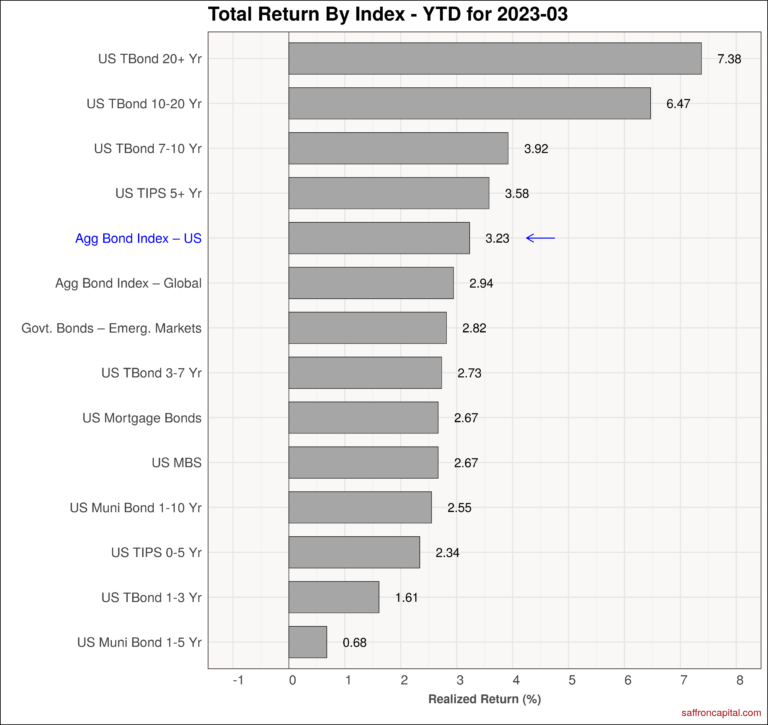

Government Bonds

March returns for government bonds reflected broad based recovery given flight to quality buying. The U.S. Aggregate Bond Index (+2.64%) had solid total returns, with the long dated bonds (+5.15%) outperforming equities. The international aggregate bond index (+2.11%) proved durable as well. Since the start of the year, the US aggregate index (+3.23%) has lagged equities, but long-duration bonds (7.38%) have proven to have higher total returns and lower risk in Q1.

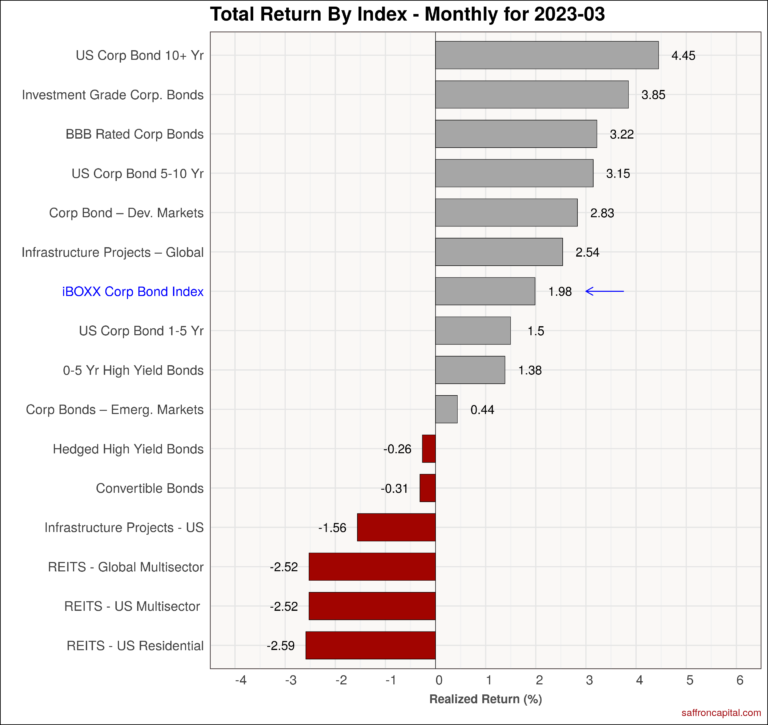

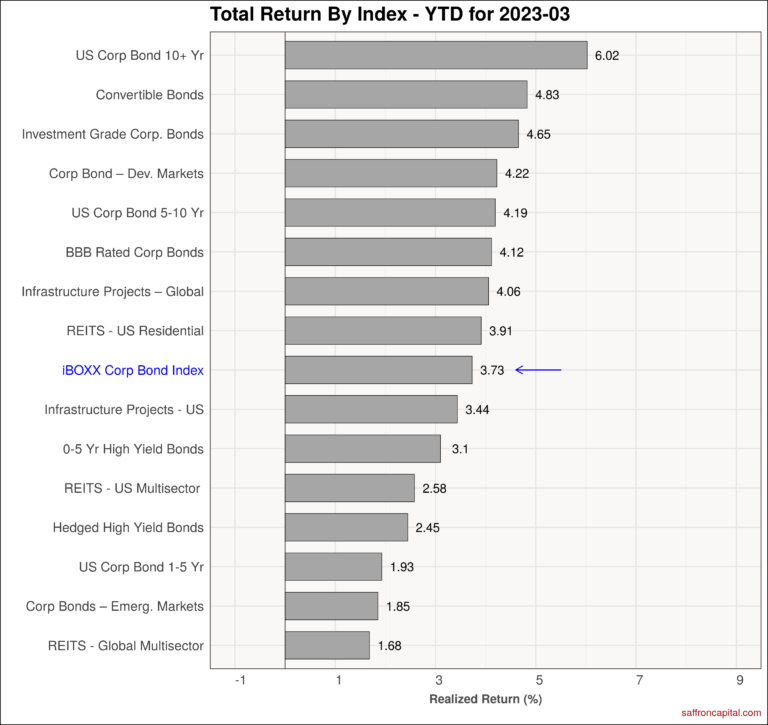

Corporate & Infrastructure Bonds

The iBoxx Corporate Bond Index (+1.96%) was pulled up by a solid recovery in long duration 10+ year bonds (+4.45%). Real estate was a notable loser, with all sectors suffering by more than (-2.5%). US infrastructure project bonds (-1.56%) also saw more sellers than buyers. On a year to date basis, the best home among the corporate bond assets have been long-duration bonds (+6.02%), Convertible Bonds (+4.83%) and Investment Grade +4.65%. High-yield bonds are lagging the group benchmark for Q1, prone to yield spread expansion when credit default events hit the headlines.

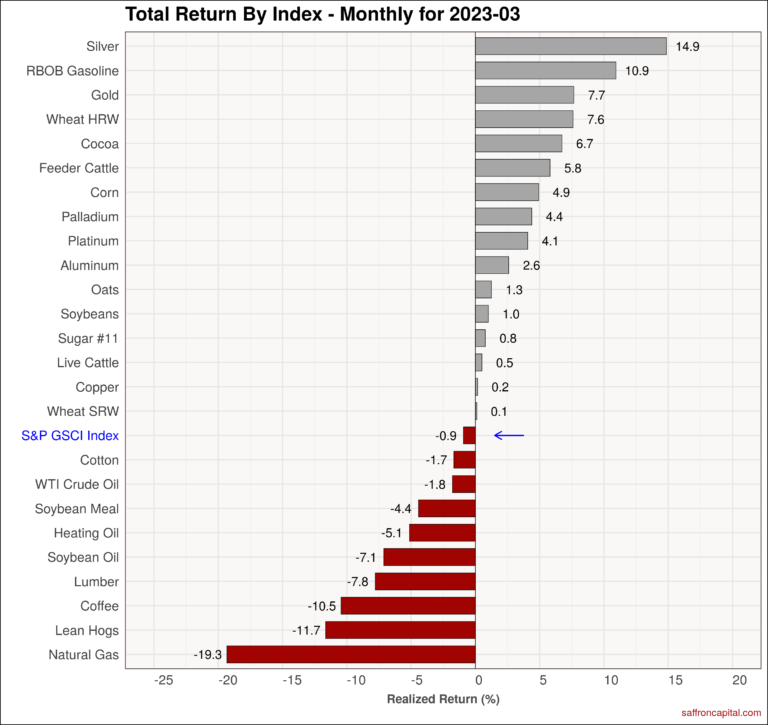

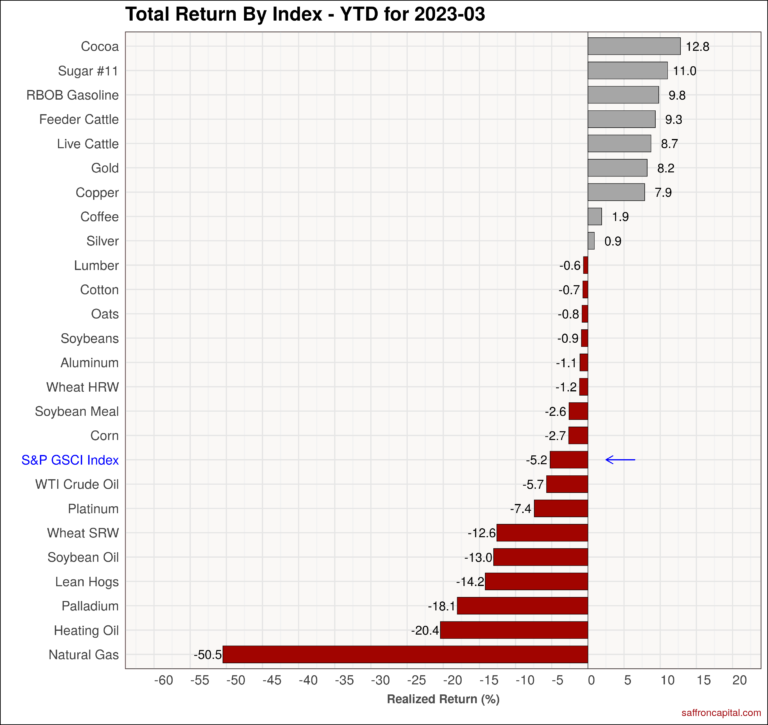

Commodities

March 2023 returns for the S&P GSCI index (-0.9%) masked the wide range of results across the commodity complex. For example, Silver (+14.9%), Gasoline (+10.9%) and Gold (+7.7%) all benefited from strong consumer spending. The weakest commodities in March included Natural Gas (-19.3%), Lean Hogs (-11.7%), and Coffee (-10.5%). Year to date, scarcity trade dominated Cocoa (12.6%), while strong demand benefited Sugar (+11.0%) and Gasoline (+9.8%). Energy prices, notably heating fuels, significant price drops in the first quarter.

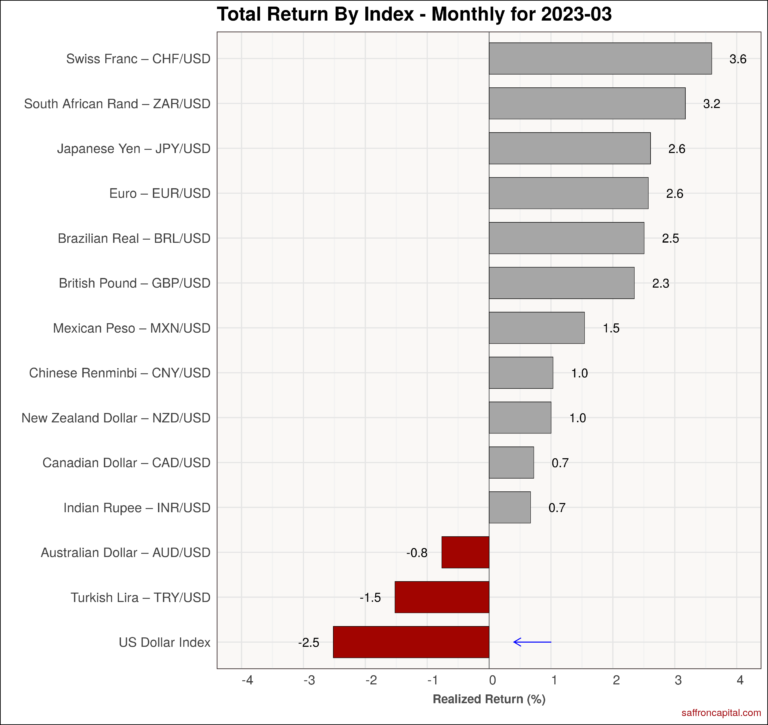

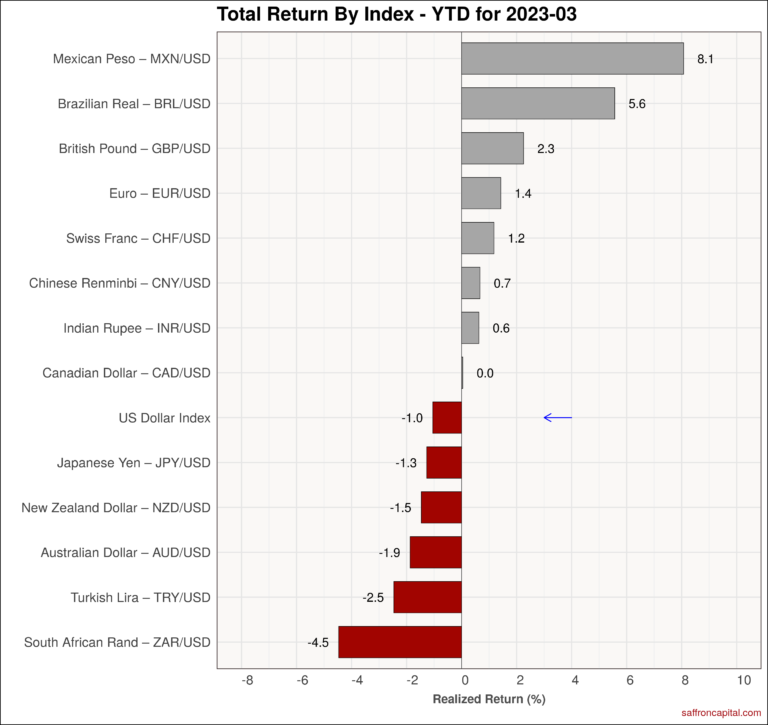

Currencies

US Dollar (-2.5%) weakness resumed in parallel with declining US interest rates. Currency gains were strongest for the Swiss Franc (+3.6%). The Turkish Lira (-1.5%) Turkey was again the weakest currency of the month. The year-to-date leader board includes the Mexican Peso (+8.1%), Brazilian Real (+5.6%) and British Pound (+2.3%).

Have questions or concerns about the performance of your portfolio? Looking for a risk-optimized portfolio strategy to grow and protect your savings? Whatever your needs are, we are here to help. Schedule a meeting here.