Download – Decrypting Crypto

February 1, 2024

February 2024 Returns and Asset Performance

March 3, 2024Major Asset Classes

January 2024

Performance Comparison

Introduction

January 2024 market returns saw the return of Commodities as the top asset group. In other markets, US stocks beat international markets, corporate bonds marginally outperformed Treasuries, and the US Dollar outpaced all other currencies. January was also unique as the SEC approved Exchange Traded Funds (ETFs) for cryptocurrencies, increasing market access. In response, I expand the benchmark performance report to include cryptocurrencies for the first time. The following brief provides a visual summary of performance returns across and within the major asset classes.

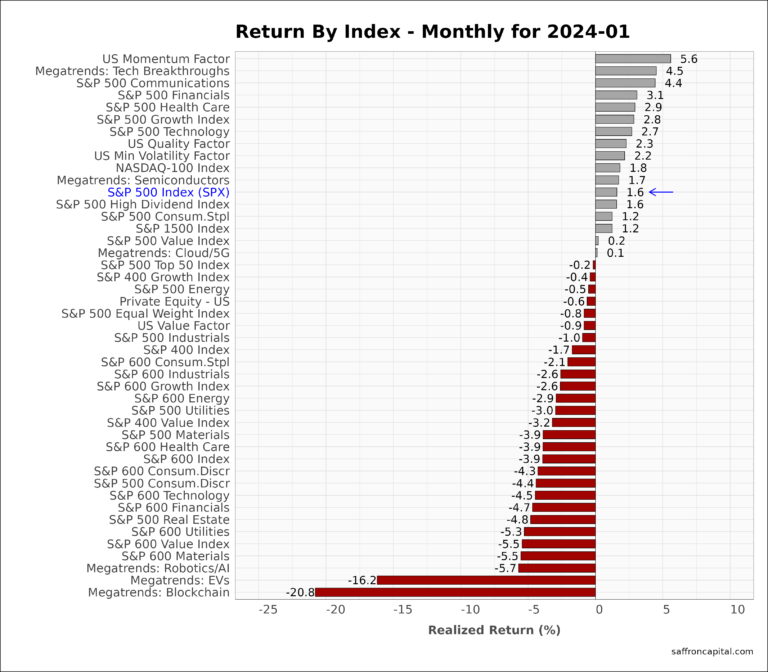

US Equities

The NASDAQ-100 index (+1.8%) only marginally beat the S&P 500 Index (+1.6%) in January. Top performing large-cap sectors included Communications (+4.4%), Financials (+3.1%), and Healthcare (+2.9%).

The top factor portfolios included Momentum (+5.6%), Quality (+2.3%), and Minimum Volatility (+2.2%). Meanwhile, Growth (+2.8%) easily outperformed Value (+0.2%).

After 12 straight weeks of positive returns, it is amazing that market breadth is still so weak. Specifically, the S&P 400 Mid-Cap Index (-1.7%) and the S&P 600 Small-Cap Index (-3.9%) continue to lag the overall market and large-cap shares in particular. At the same time, we are starting to see performance for megatrend equities begin to fracture. Heavy losses were registered in January for companies in Robotics/AI (-5.7%), EVs (-16.2%) and Blockchain (-20.8%).

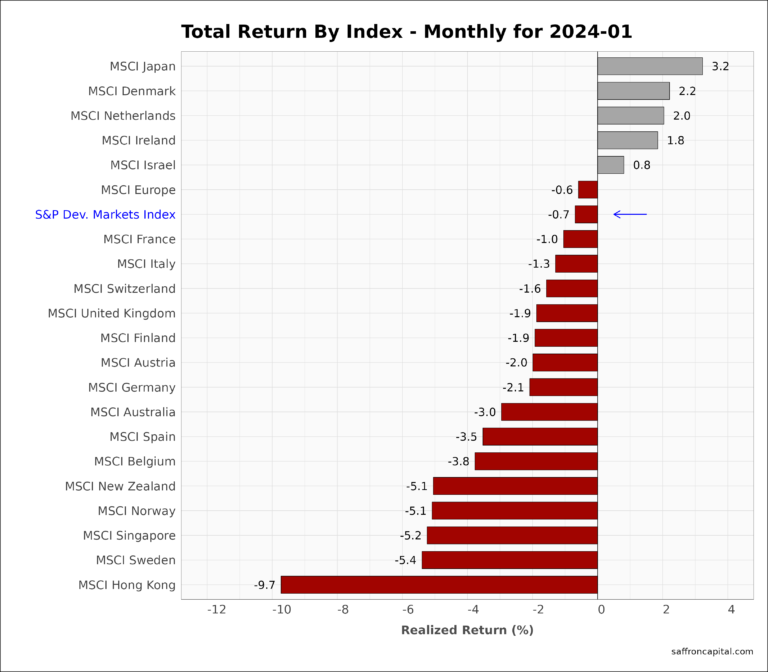

Developed Market Equities

International developed markets (-0.7%) underperformed US shares in January. Top markets included Japan (+3.2%), Denmark (+2.2%), and the Netherlands (+2.2%), all of which beat US large-caps. Results for the biggest developed markets varied, as seen by the UK (+-1.9%), Germany (-2.1%), and Australia (-3.0%). Meanwhile, Asian bourses fared among the worse with Singapore (-5.2%) and Hong Kong (-9.7%) starting the year poorly.

Click to enlarge

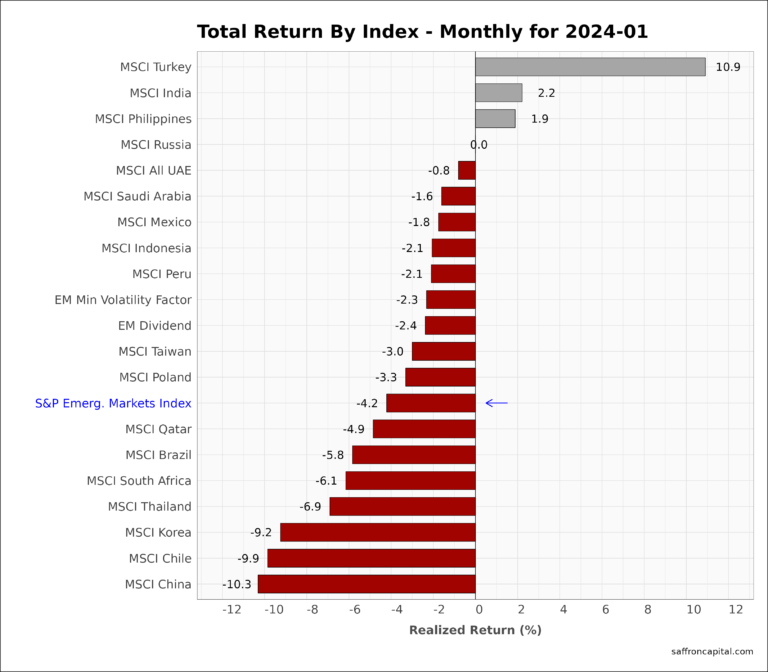

Emerging Market Equities

January 2024 market returns for the S&P Emerging Markets Index (-4.2%) had a wide range of results. Traditional top performers Mexico (-1.8%), Poland (-3.3%), and Brazil (-5.8%) were all under pressure. And then there’s China (-10.3%), which has had successive quarterly declines in foreign direct investment, among other problems.

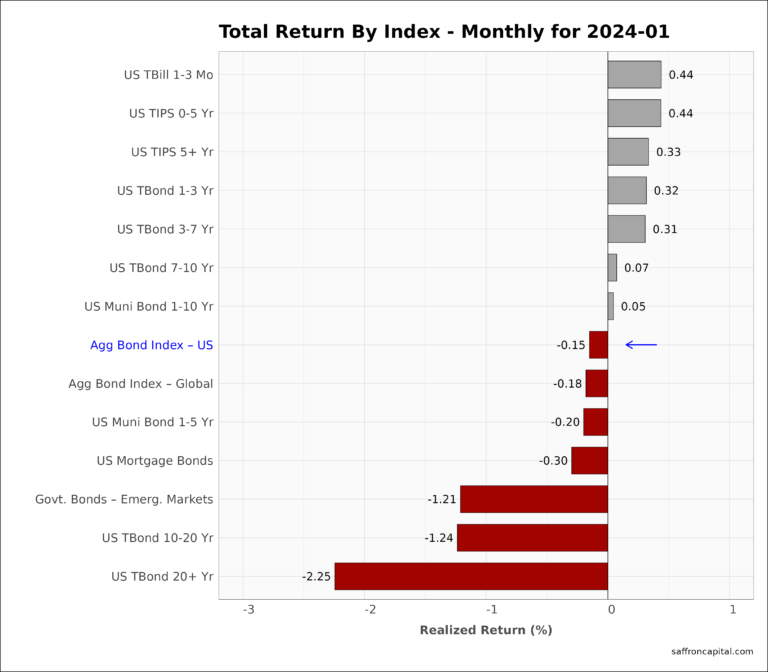

Government Bonds

Returns for the Aggregate US Government Bonds Index (-0.15%) were weak. 1–3-month Treasury Bills (+0.44%) and short-term Treasury Inflation Protected Securities (+0.44%) topped the return list. Weakness was most pronounced among Emerging Market Government Bonds (-1.21%), 10-20 Treasuries (-1.24%) and long duration Treasuries (-2.25%).

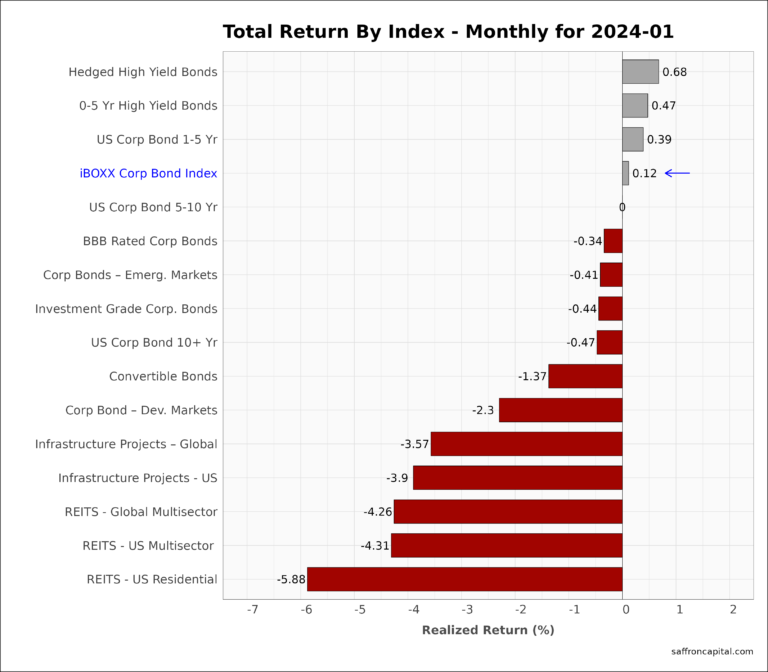

Corporate & Infrastructure Bonds

The iBoxx Corporate Bond Index (+0.12%) beat the Aggregate US Treasury index by 27 basis points January. Top performance was taken by BBB-rated Hedged High Yield Bonds (+0.68%), unhedged High Yield Bonds (+0.47%), and 1-5 Year A-rated Corporate Bonds (+0.39%). Real Estate Investment Trusts (REITS) had notably weak returns as seen by the Global Multisector index (-4.26%), the US Multisector (-4.31%) and the US Residential portfolio (-5.88%).

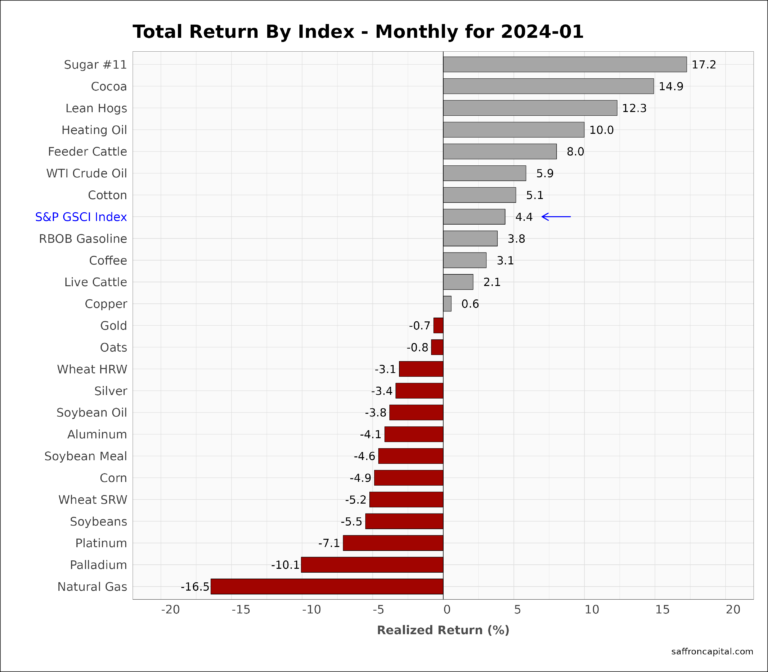

Commodities

Commodities, as measured by S&P GS Commodity Index (+4.4%), outperformed all other asset groups. No surprise, results were highly variable within the group basket. For example, Sugar (+10.1%), Cocoa (+14.9%) and Lean Hogs (+12.3%) lead the group, followed by notable performance from Heating Oil (+10.0%), Crude oil (+5.9%) and Gasoline (+3.8%). Commodities under the most pressure in January included Natural Gas (-16.5%), Palladium (-10.1%) and Platinum (-7.1%).

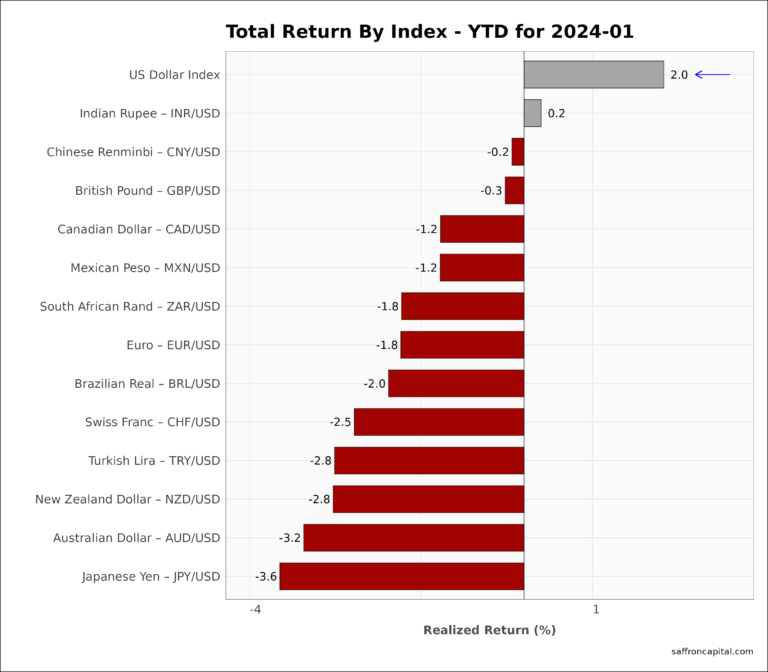

Currencies

Strength in Commodities was notable considering that the US Dollar (+2.0%) increased in January. As a result, all major currency pairs with USD say declines, with the exception of the Indian Rupee (+0.2%). The Japanese Yen (-3.6%) was the hardest hit of the major currencies since the start of the new year.

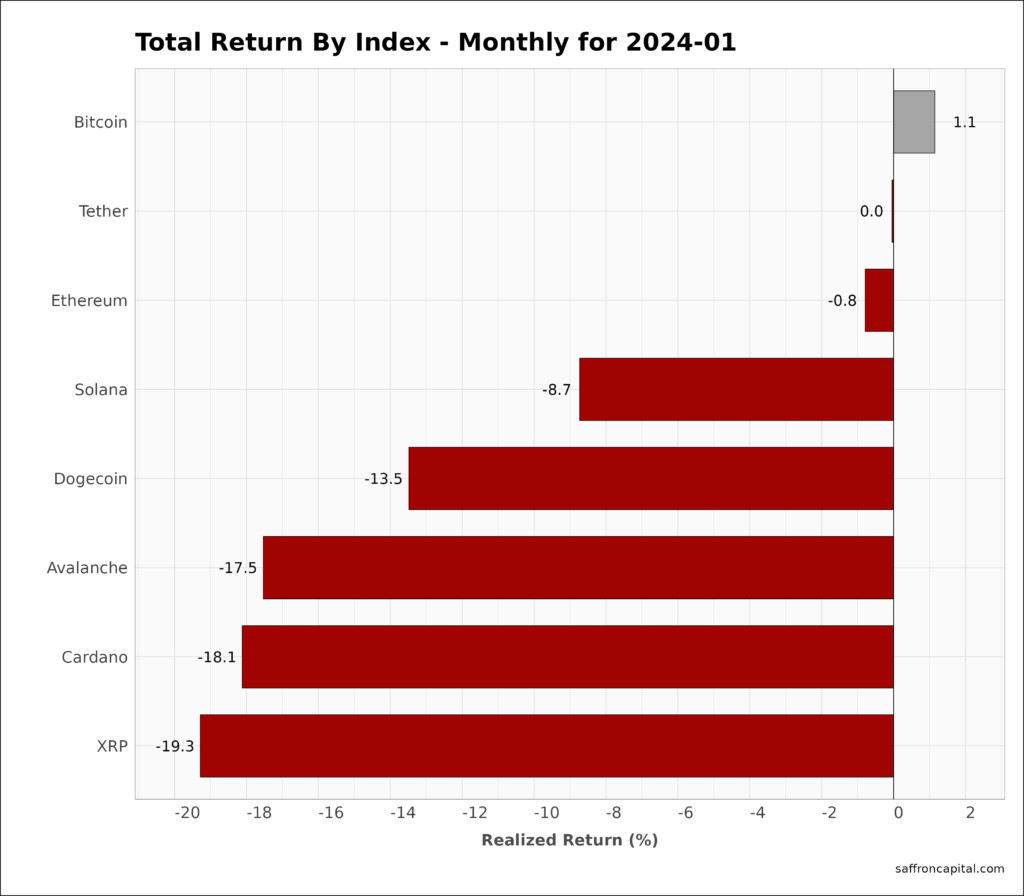

Cryptocurrencies

Cryptocurrencies also came under broad pressure in January. Bitcoin (+1.1%) was the only digital asset to have positive returns. The other crypto assets profiled were selected based on their relative high market capitalizations when compared to the other digital currencies. Tether (0.0%) was unchanged, while significant volatility was evidenced by Dogecoin (-13.5%), Avalanche (-17.5%), Cardano (-18.1%) and XRP (-19.3%). The recent introduction of Bitcoin ETFs is also expected to pressure physical Bitcoin prices. For example, the ETFs have been seen to trade as much as 10% below the physical market. This is a huge discrepancy and an embarrassment for the fund companies like Blackrock that are offering the ETFs. As a result, sophisticated traders will be selling physical Bitcoins, while buying Bitcoin ETFs to lock-in potential gains.

Click to enlarge

Have questions or concerns about the performance of your portfolio? Could you benefit from a custom portfolio formulation that better reflects your goals and risk appetite? Whatever your needs are, we are here to listen and to help with structured capital growth and preservation strategies. To schedule a call with us, please contact us here.