Insight Reports

August 28, 2023

Published by Brad Horn on August 28, 2023

Categories

Last week, the IRS announced new changes to the 401k catch-up rule. Previously, the IRS required high-earners to place their catch-up savings in Roth accounts with no immediate tax benefit. The new rule allows savers age 50 and older to make catch-up contributions to pre-tax accounts for two more years. […]

August 14, 2023

Published by Brad Horn on August 14, 2023

Categories

How to Make a Qualified Charitable Distribution from an IRA Introduction to QCDs A qualified charitable distribution (QCD) is an allocation from an individual retirement account (IRA) to a qualifying charity. Internal Revenue Code Section 408(d)(8) contains the guidelines for doing a QCD. This article summarizes the rules in simple […]

August 2, 2023

Published by Brad Horn on August 2, 2023

Categories

Major Asset Classes July 2023 Performance Comparison Introduction July 2023 returns added to gains seen in June, logging the 5th straight month of gains. The S&P 500 index was up +3.1% in July and the NASDAQ 100 index up +3.9%, buoyed by resilient GDP growth and a drop in developed […]

July 23, 2023

Published by Brad Horn on July 23, 2023

Categories

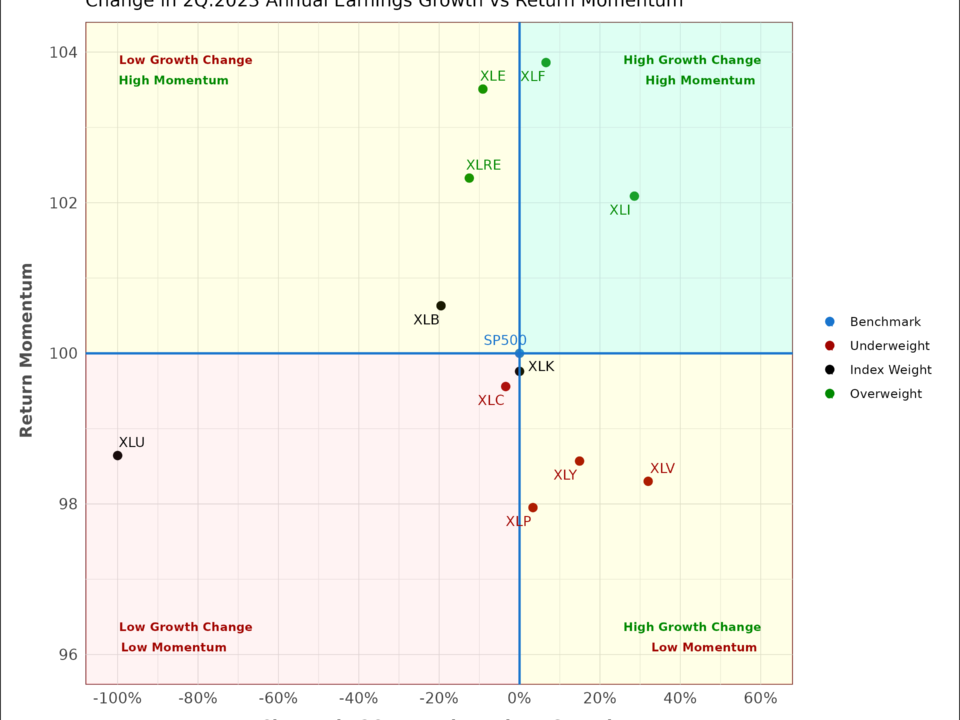

S&P 500 Earnings Update – 2Q.2023 Index Earnings The S&P 500 earnings seasons for 2Q.2023 is well underway. Currently, 91 companies or 18% of the index has now reported actual results. In the upcoming week, a surge of 166 companies will report earnings, taking us to a total of 51% […]

July 9, 2023

Published by Brad Horn on July 9, 2023

Categories

ETF Fund Flows – July 07, 2023 ETF fund flows define the net dollar inflows and outflows for exchange traded funds over predefined periods. Fund flows are useful to identify market trends. The data broadly reveals the rotations investors make as they shift their funds across different assets, market sectors, […]

July 2, 2023

Published by Brad Horn on July 2, 2023

Categories

Major Asset Classes June 2023 Performance Comparison Introduction June 2023 returns came in strong with the S&P 500 index up +6.5% for the month and the NASDAQ 100 index +6.3%. In a sign of strong market internals, the small cap S&P 600 Index broke away from the larger market and […]

June 1, 2023

Published by Brad Horn on June 1, 2023

Categories

Major Asset Classes May 2023 Performance Comparison Introduction May 2023 returns were influenced by a high degree of outlook uncertainty. As a result, returns were lackluster or negative for many assets. For example, a small number of megacaps helped the S&P 500 Index (+0.2%). Across the sectors, Information Technology (+8.9%) […]

May 18, 2023

Published by Brad Horn on May 18, 2023

Categories

ETF Fund Flows – May 17, 2023 ETF fund flows define the net dollar inflows and outflows for exchange traded funds. Fund flows are useful to identify market trends. The data broadly reveals the rotations investors make as they shift their funds across different assets, market sectors, or indexes. The […]

May 1, 2023

Published by Brad Horn on May 1, 2023

Categories

Major Asset Classes April 2023 Performance Comparison Introduction April 2023 market returns were favorable for large cap stocks, but were less rewarding for many other asset classes. For example, total returns for the S&P 500 Index (+1.5%) and international large cap stocks (+2.8%) beat the NASDAQ-100 index (-0.1%) and emerging […]

April 2, 2023

Published by Brad Horn on April 2, 2023

Categories

Major Asset Classes March 2023 Performance Comparison Introduction March 2023 returns capped a quarter of broad gains, but with considerable volatility along the way. Total returns for the S&P 500 Index (3.5%) lagged behind the NASDAQ index (+9.5%), which had its best March since 2010. Thanks to the melt-up in […]