April 19, 2022

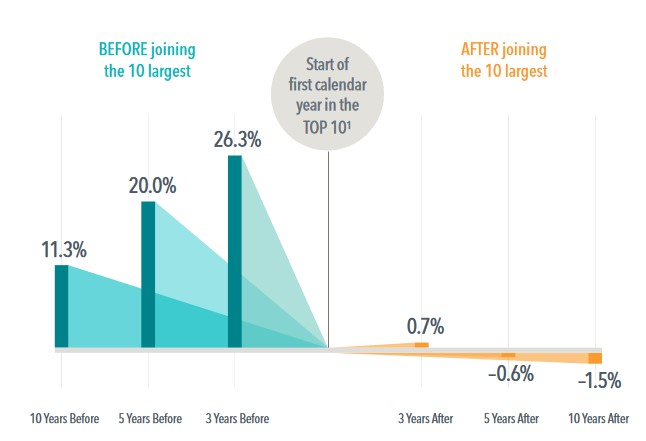

Think Twice Before Chasing the Biggest Large Cap Stocks The return profiles of companies change as they grow to become large cap stocks. This is especially true of the ten largest companies trading on the US stock market. Initially, the returns that pushed them into leadership positions were impressive. But […]