July 14, 2022

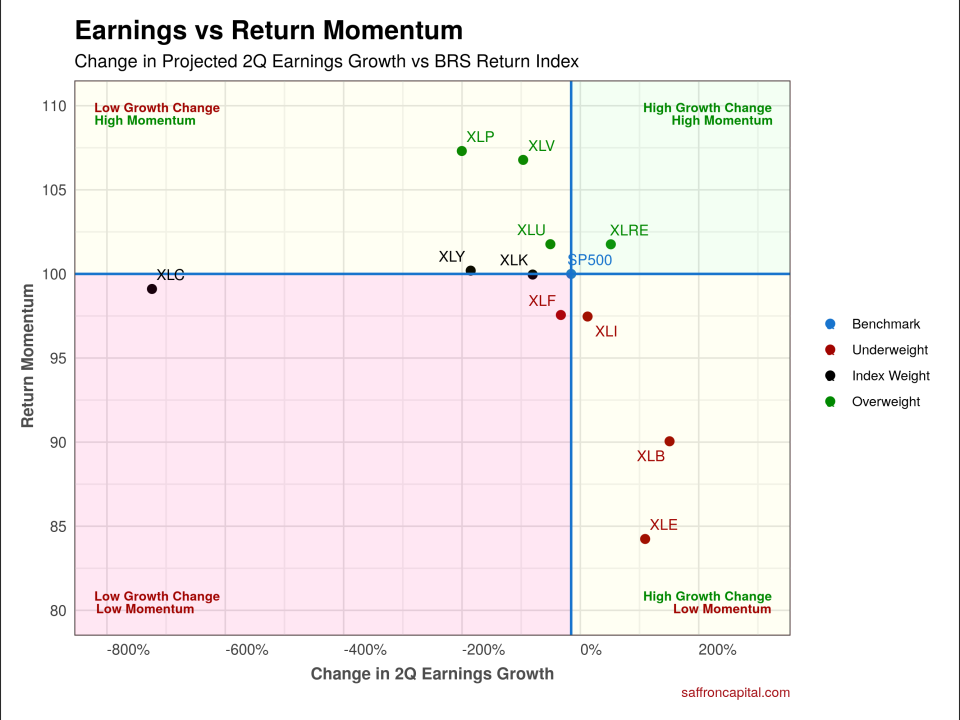

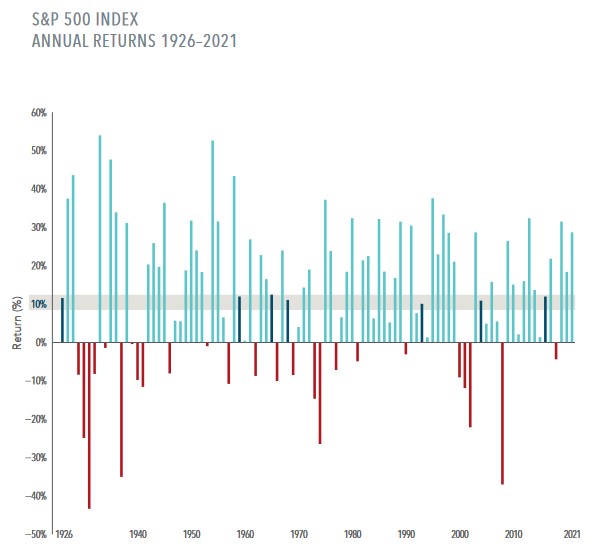

S&P 500 Earnings Update – 2Q.2022 Prelude to Earnings Season The second quarter earnings season ((2Q.2022) has just begun. We share the latest earnings forecasts for the S&P 500 index. Market Context Return Profile Prices and returns for the S&P 500 index are profiled at right. In the second quarter, […]